In promising news for the crypto community, the recent wave of digital asset selloffs is approaching its conclusion, according to JPMorgan research.

“The recent selloff in crypto markets is likely near an end, with long-position liquidations “largely behind us,” the report states.

Bitcoin Futures Interest, a Key Indicator

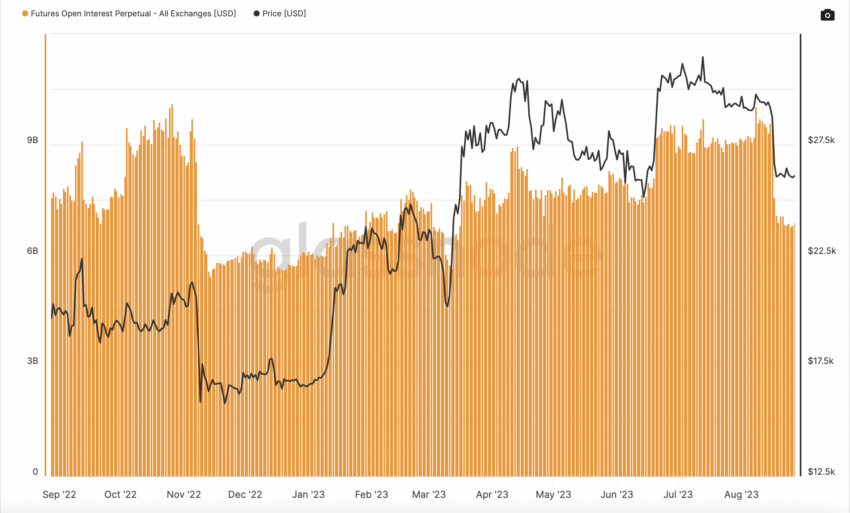

A recent report that cites JPMorgan Research points out that there has been an increase in Bitcoin futures trading activity. It suggests that the uptick in activity might signal market stabilization following a period of recent selloffs.

Bitcoin Futures are essentially contracts to buy or sell crypto Bitcoin at a set price on a specific future date and are traded on the Chicago Mercantile Exchange (CME).

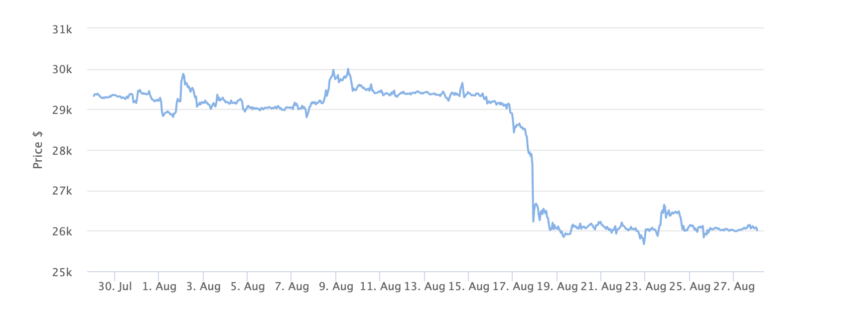

The report states that there is a decline in the “number of unsettled and active future contracts trading on exchanges.” This decline in open interest suggests a growing interest in acquiring Bitcoin and hints that the recent selloff trend might be coming to an end.

Open interest refers to the total value of active long and short-term futures contracts. It is a way of measuring market activity by assessing the capital invested in the futures market, as CME explains:

“As open interest increases, more money is moving into the futures contract and as open interest declines money is moving out of the futures contract.”

JPMorgan View on Bitcoin ETFs

JPMorgan analyst Nikolaos Panigirtzoglou believes this indicates there could be a reversal in the market shortly:

“As a result, we see limited downside for crypto markets over the near term.”

When the reversal trend might start is uncertain. However, the report noted the slowing down of price decline. It pointed to Bitcoin being down “0.2% at around $25,980 as of 11:30 a.m. in New York on Friday.”

To learn more about where to buy Bitcoin, read BeInCrypto’s guide: 4 Best Crypto Brokers for Buying and Selling Bitcoin in 2023

Recently, JPMorgan released a report suggesting that Bitcoin exchange-traded funds (ETF) will not significantly impact Bitcoin’s price.

Panigirtzoglou pointed out that while the product is already available in Europe and Canada, it has not captured significant investor interest.

However, the product is currently pending approval in the United States. The Securities and Exchange Commission (SEC) has not yet made a decision, and recent delays might result in the decision being postponed to 2024.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.