The current phase of the crypto market cycle is a choppy period within an extremely tight trading range. However, the patterns have been seen in previous market cycles and were followed by larger breakouts.

On July 17, on-chain analytics provider Glassnode reported on the current low-volume state of the crypto market.

Slow Accumulation Crypto Market Cycle Continues

Glassnode noted that several metrics “indicate a slow and steady capital inflow.” It added that many of them “resemble the choppy market conditions seen in the 2016 and 2019-20 periods.”

Bitcoin prices briefly tapped a new 2023 high of $31,700 late last week in the wake of the Ripple result. However, this level proved to be too strong a resistance to overcome for the third time this year.

“The market remains extremely quiet,” the report noted, adding that the Bollinger Bands are now separated by a price range of just 4.2%.

Similar market chop in previous years, such as 2016 and 2019, showed very similar patterns to the present. Both instances preceded large bull markets, which were initiated in the following years of 2017 and 2020.

Read More: Best Crypto Sign-Up Bonuses in 2023

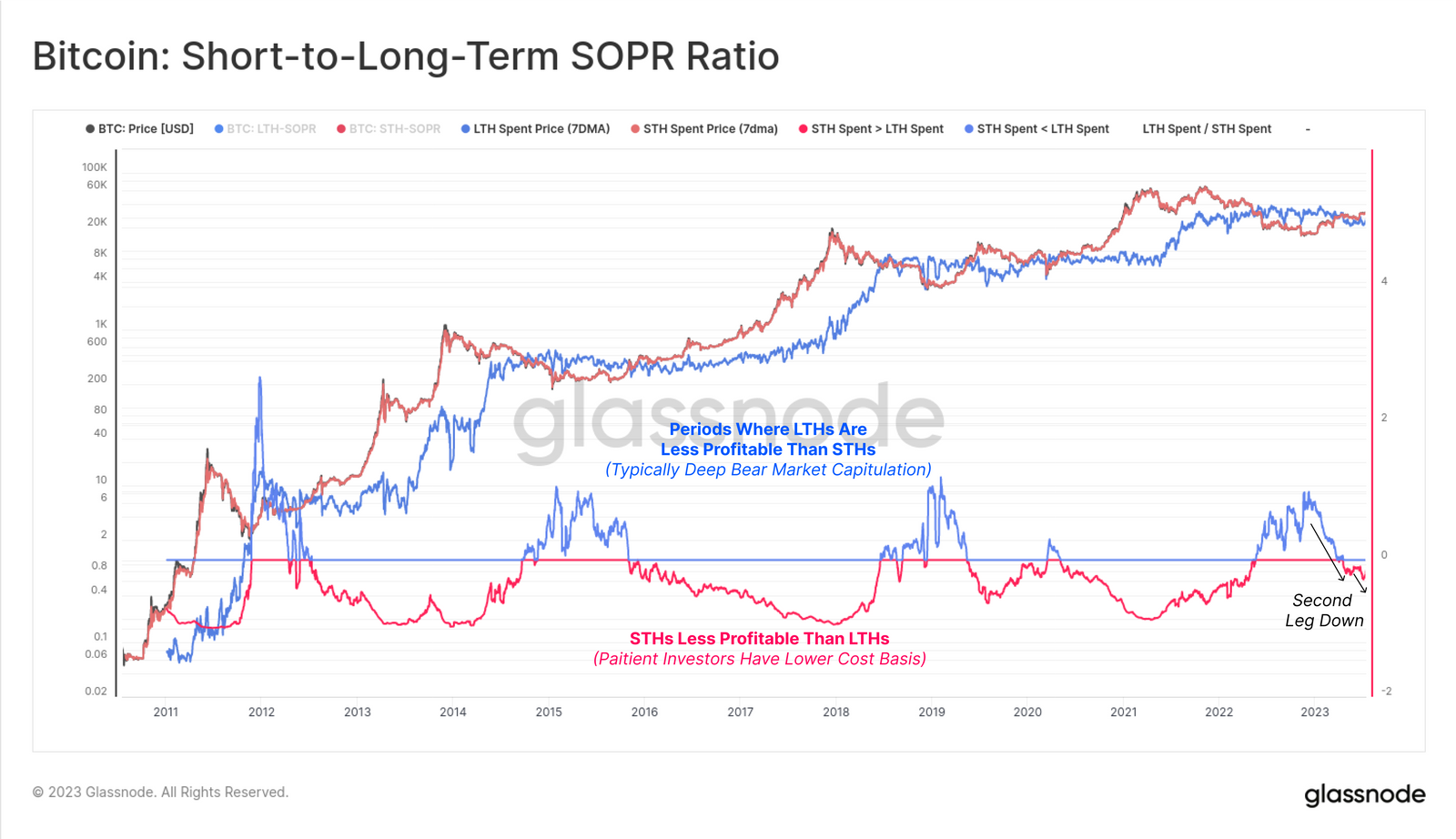

The patterns are evident in the Bitcoin short-to-long-term SOPR ratio chart. The metric helps identify large-scale shifts in long and short-term holder behavior.

Consequently, the Spent Output Profit Ratio has entered its second leg down, reflecting the reversal in investor behavior.

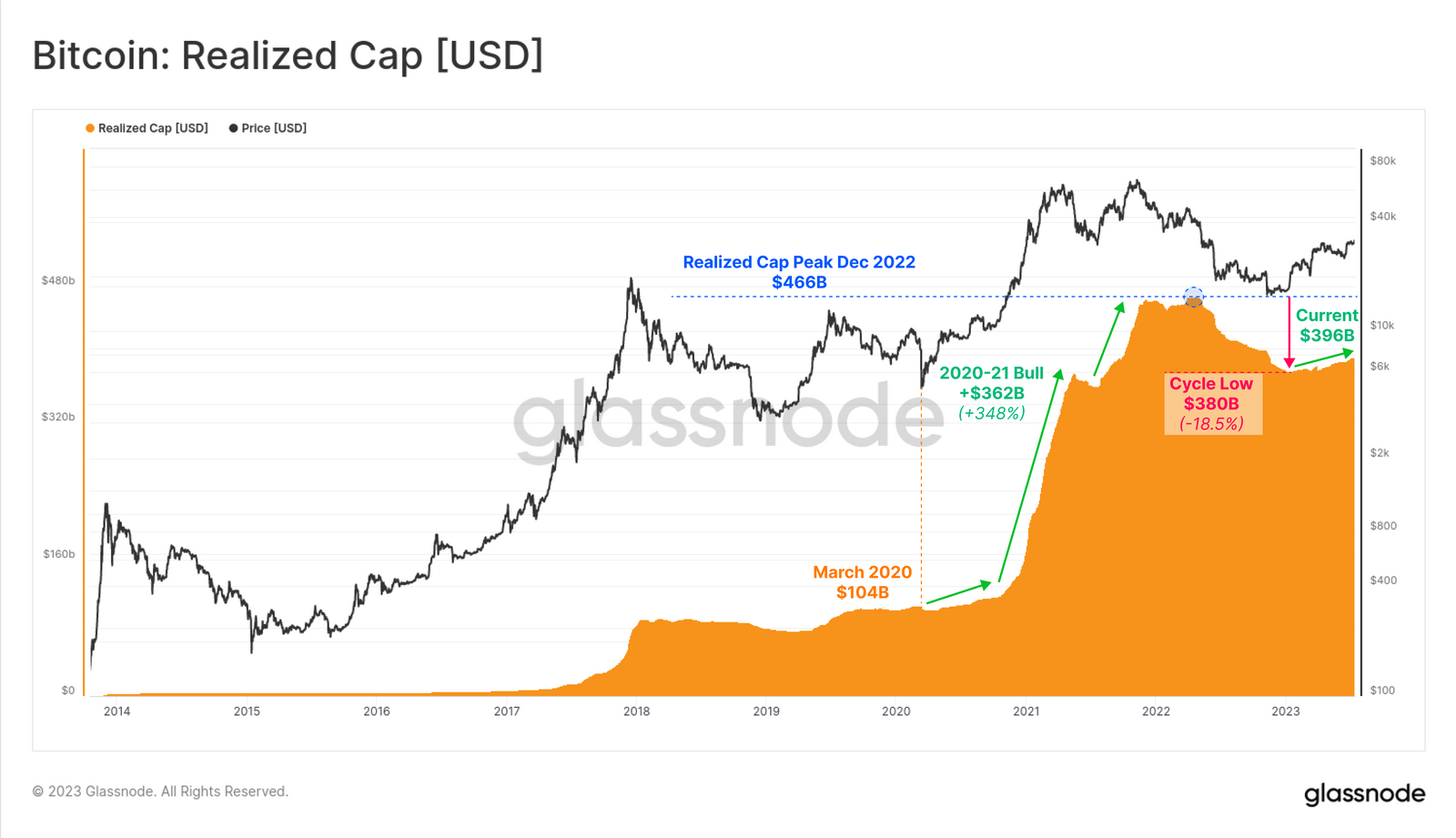

On the upside, “capital is still flowing into digital assets at a steady and modest rate,” the report noted. The “Realized Cap” or “on-chain Market Cap” is just under $400 billion and has been slowly climbing this year.

Glassnode explained:

“As the realized cap climbs, it signals that coins are changing hands at higher prices on net, suggesting a modest uptick in new demand inflow this year.”

The report concluded that on a broader scale, “investors appear remarkably unwilling to let go of their supply.”

Crypto Market Outlook

The total market cap has declined by 0.6% on the day to $1.24 trillion at the time of writing.

It has hovered around this level for the past couple of months, aside from the brief spike late last week following the Ripple lawsuit result.

BTC had dropped 0.8% on the day and was trading at $30,073 following a brief dip to $29,800 during late trading yesterday.

ETH was moving in its shadow as usual, dropping 1.4% on the day to $1,905, while most altcoin losses were deeper.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.