Crypto bears and short speculators have been liquidated en-masse today as altcoins go on a tear following Ripple’s victory against the SEC. Several altcoins enjoyed double-digit gains, but markets remain range-bound in the longer-term timeframe.

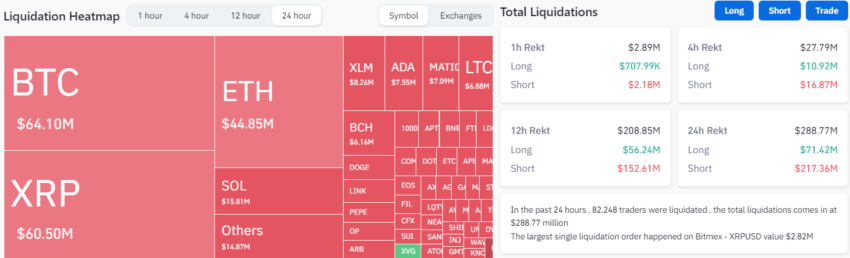

Crypto liquidations have approached $300 million over the past 24 hours, according to Coinglass data. It likely comes as no surprise that the majority of them were short positions.

Crypto Liquidations Surge

At the time of writing, there were $288.7 million in crypto liquidations over the past 24 hours. Short speculators and bears have been hammered by the crypto rally that was catalyzed by Ripple’s partial triumph against the SEC.

Three-quarters of the crypto liquidations were short positions accounting for $215 million, according to Coinglass. Moreover, more than 80,000 traders were liquidated in total, it reported.

The largest liquidations were those with short positions on Bitcoin (BTC), Ripple (XRP), and Solana (SOL).

XRP prices skyrocketed more than 80% after the news broke of Ripple’s partial victory. The coin has been legally declared not a security for secondary transactions, dealing a blow to Gary Gensler and the SEC.

At the time of writing, XRP was trading at $0.80, its highest price since April 2022. However, despite this monumental pump, the cross-border payments coin was still down more than 76% from its 2018 all-time high of $3.40.

Other crypto assets that the SEC has alleged are securities that are performing well during the Friday morning Asian trading session.

Ethereum (ETH) notched up 8% to top the psychological $2,000 barrier for the first time in three months. However, Bitcoin (BTC) only managed 3.5%, returning to the resistance zone at just over $31,000.

Double Digit Gains For ‘Non-Securities’

Big winners from the news include Cardano (ADA), another token deemed a security by the regulator. ADA has spiked to $0.365 in a 27% move that has returned it to a level not seen since late April.

Another alleged security, Solana (SOL), cranked 34% to touch $30 briefly before a slight retreat. However, SOL is still not back to the levels it traded at before the collapse of FTX in early November.

Polygon’s MATIC token, another alleged security, made 18% to hit $0.848 at the time of writing.

However, zooming out shows that crypto markets remain rangebound as they have been since mid-March.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.