GMX, Arbitrum and Avalanche’s largest decentralized perpetual exchange (DEX), has voted to include Chainlink’s low-latency oracles in its imminent GMX V2 upgrade, which could be bullish for LINK.

The new partnership will bring real-world financial data to GMX V2’s perpetuals, swaps, and liquidity.

GMX Will Test Drive Chainlink’s New Network

The decentralized exchange’s core contributors are testing Chainklink’s new oracle network on Arbitrum’s testnet.

“GMX contributors have been working with Chainlink Labs since last year on the specifications of these new oracles, and we’re excited to contribute to establishing a long-term self-sustainable oracle network,” said GMX core development contributor X.

Arbitrum’s largest project GMX is a decentralized spot and perpetual contract exchange offering cheap swaps. A perpetual contract is a derivative instrument similar to a futures contract, except that it has no expiry date. Liquidity providers earn fees through market making, swaps, and leveraged trading.

Oracles connect smart contracts on blockchains to necessary outside data. Chainlink’s low latency oracle network provides GMX with low-latency access to the data from derivatives exchanges through pull requests.

Data from these pull requests are cryptographically signed and verified on-chain. Chainlink rewards node operators with LINK tokens for merging and formatting data from multiple trusted sources. Chainlink service providers will receive 1.2% of GMX V2’s trading fees.

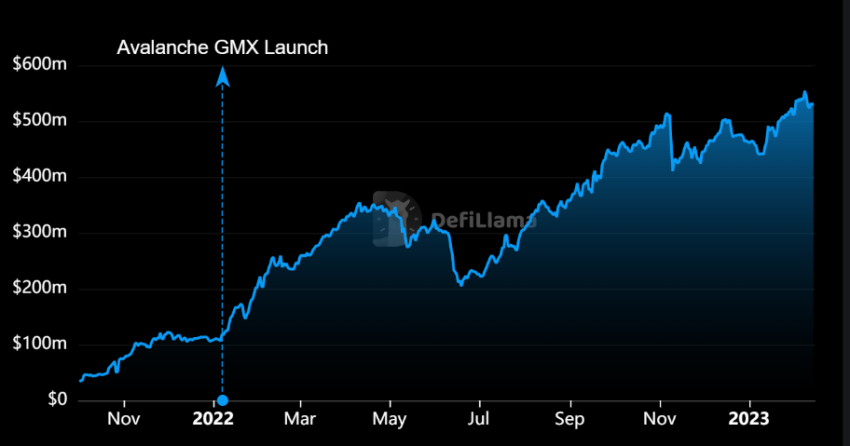

According to DefiLlama, GMX accounts for about $564 million of the $2.14 billion locked on the Ethereum L2 Arbitrum. Decentralized exchange Uniswap V3 comes in second with a TVL of $279 million.

Oracles Crucial to Leveraged Trading

Perpetual contracts markets use oracle price feeds to, among other things, enable the winding down of leveraged positions when a trader’s margin falls below a minimum level. Turbos Finance, a decentralized perpetual contract exchange on the Sui network, gets price feeds through Chainlink rival SupraOracles. SupraOracles supports 64 networks.

Decentralized lending applications use oracles to determine whether a user’s loan collateral falls below the protocol’s minimum percentage. Virtual automated market makers, a type of decentralized exchange, need oracles to keep the prices of leveraged virtual assets close to their real-world counterparts.

Other notable oracle providers include Solana-based Switchboard and Band Protocol on the BNB Chain. A slice of the betting market uses UMA, an Optimistic oracle network available on Ethereum and Polygon.

LINK on a Downward Trajectory, Price Could Fall Below $7

The LINK price has fallen since its yearly high of $8.80 on April 18. During the drop, it failed to bounce at the previous resistance area of $8. This is a bearish sign since the area was expected to provide support. Now, the previous breakout is considered a deviation.

If the downward movement continues, LINK could fall to the next closest support area at $6.50. However, if the price regains momentum, a retest of the $8 area could occur. The area could provide resistance once more.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.