Cardano (ADA) price continues languishing below the $0.25 territory, as the global crypto markets gained $6 billion this week. On-chain analysis examines vital metrics that could potentially double ADA prices.

Cardano price remains sticky, while other prominent mega-cap assets like Bitcoin (BTC) and Solana (SOL) have posted double-digit weekly gains. What vital on-chain metrics can trigger an ADA price breakout?

Cardano Whales Acquire 120M ADA in October, But There’s a 520M Deficit

Cardano’s price hit a yearly peak of $0.46 on April 15, 2023, as the crypto markets reacted positively to Ethereum’s successful Shanghai network upgrade.

Events that unfolded in the subsequent weeks show that Cardano whales (wallets with a 1 million ADA minimum balance) capitalized on the price rally to take profits.

Between April 19 and May 20, the whales rapidly sold off 1.98 billion ADA coins. As depicted in the Santiment chart below, that month-long selling frenzy triggered a 24% price decline from $0.46 to $0.35.

More recently, the Cardano whales have acquired 120 million ADA coins (~$30 million) between October 1 and October 20. This has brought their balances to 21.36 billion ADA, the highest since the sell-off that ensued after hitting the 2023 price peak.

The $30 million buying wave in October is a giant stride for the bulls. But notably, when Cardano’s price hit the yearly peak of $0.46 on April 15, the whales held a cumulative balance of 21.88 billion ADA.

Hence, this implies they still have a deficit of 520 million ADA coins to cover to double Cardano’s price from $0.24 and claim a new yearly peak.

A Significant Increase in Network Participation Rate Could Also Propel Price

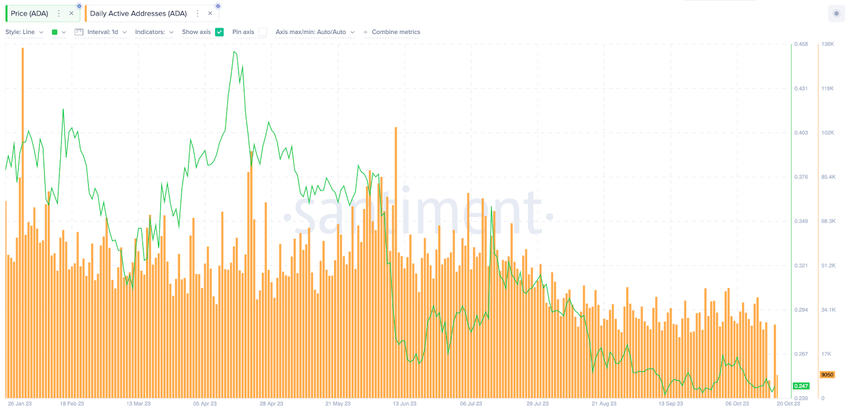

The daily network participation rate is another vital on-chain metric that has powered previous ADA price rallies. According to Santiment, ADA first crossed the $0.40 mark in 2023, just days after Daily Active Addresses hit a yearly peak of 135,400 on February 1.

Albeit at varying levels, subsequent ADA price bounces in April and July 2023 were also preceded by steady and significant spikes in network participation that took Cardano above 70,000 Daily Active Addresses.

Meanwhile, Cardano network participation has been in decline in recent weeks. Having failed to hit the 40,000 mark in two weeks, Cardano recorded just 28,538 Active Addresses on October 19.

Daily Active Addresses is a standard metric for measuring a blockchain’s network participation rate. Essentially, a decline in Daily Active Addresses means that fewer users are interacting with products built on the Cardano network.

And with ADA native coin being and utilizing less in daily transactions, it quite explains why the recent price performance has been below the broader industry trends.

In summary, the historical on-chain data trends analyzed above show that Cardano’s price could double if it consistently surpasses 70,000 DAA and the whales re-up their holdings by another 520 million ADA coins.

ADA Price Prediction: Road to $0.50

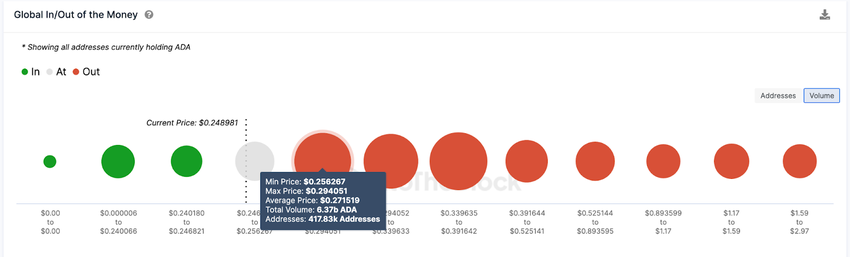

From an on-chain perspective, a significant increase in whale holdings and network participation rate could double Cardano prices. The Global In/Out of Money data depicting current Cardano holders’ entry price distribution highlights key resistance and support levels.

It shows that ADA’s initial resistance around the $0.27 territory is quite significant. As illustrated below, the 417,830 wallets bought 6.4 billion ADA at an average price of $0.27.

If they book early profits, they will likely trigger a premature ADA price pullback. But if the whales intensify their ongoing buying trend, a decisive breakout from $0.27 could send Cardano’s price closer to $0.50.

Still, the bears could invalidate this bullish prediction if ADA price reverses below $0.20. However, the chart depicts that 158,580 addresses purchased 1.49 billion ADA coins at the maximum price of $0.24.

To avoid historical losses, they will likely HODL in hopes of a quick rebound.

But if that vital support buy-wall cannot stand, it could catalyze a prolonged Cardano price reversal toward $0.20.

Read More: 6 Best Copy Trading Platforms in 2023