Cardano (ADA) price edged closer to $0.30 as ecosystem participants intensified network activity this week. On-chain indicators provide crucial insights into potential ADA price action for the coming weeks.

From an on-chain perspective, Cardano has made a blistering start to October, with ADA staking hitting a new H2 2023 peak. Here’s how Cardano’s price could react in the coming weeks.

Staking Activity on the Cardano Network Has Hit a 2023 Peak

Cardano’s price hit a 30-day peak of $0.28 on October 2. On-chain data suggest that the significant increase in ADA staking could be a major driver behind the price upswing.

The chart below shows that Cardano Staking has witnessed a noticeable increase from 62.74% to 63.5% between September 27 and October 5.

In nominal terms, Cardano holders have increased the number of ADA coins staked on the network by 0.8% within the first week of October.

This could be the ecosystem responding positively to the Cardano team’s intensifying development activity in recent weeks.

The staking metric evaluates real-time changes in the number of coins investors have locked up in smart contracts to secure the network.

Typically, increased staking impacts the native coin’s price positively, as it means more sophisticated network security and less market supply.

Notably, 63.5% is the highest level of ADA staking activity since June 22, 2023. With more coins temporarily locked out of circulation, ADA price could accelerate above $0.30 if the market sentiment flips bullish.

Cardano Network Demand is On the Rise Amid October Rally

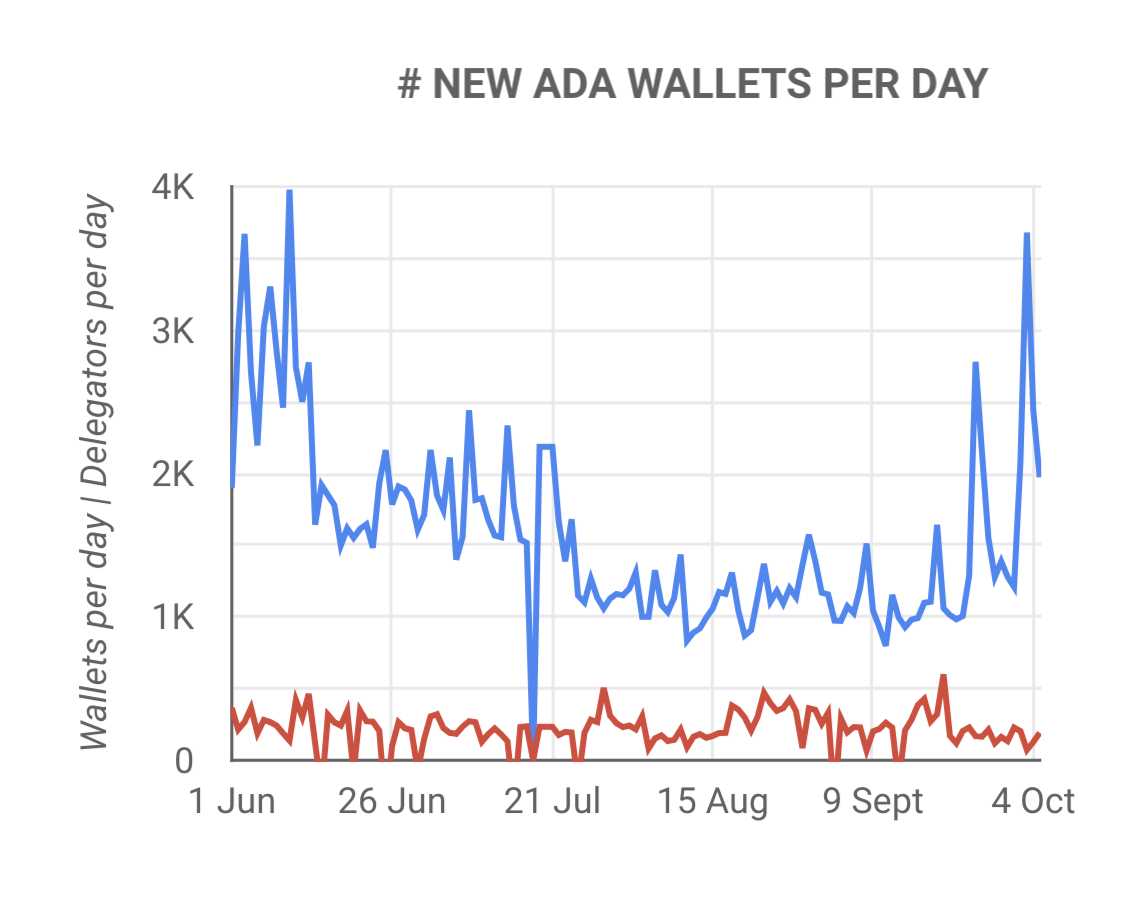

Further confirming the bullish outlook, on-chain data shows that Cardano has witnessed a noticeable increase in network demand. As depicted in the chart below, the Cardano network reached a 4-month peak of 3,860 new wallet addresses created on October 2.

The spate of new joiners entering the Cardano ecosystem has remained consistently high this month, with 11,383 new wallets created over the past week.

By evaluating the number of wallets created daily, investors gain insights into the rate at which the blockchain network attracts new users. As observed above, a sharp increase in new users often leads to fresh market demand for the underlying native coin.

As expected, it has propelled the ADA price above the $0.25 resistance this month. If the Cardano staking activity remains high, the next wave of bullish market demand could see ADA reclaim $0.30.

Read More: Best Upcoming Airdrops in 2023

ADA Price Prediction: Road to $0.35?

From an on-chain perspective, Cardano looks set to reach $0.30 during its next bull rally. The Global In/Out of Money Around Price data, which depicts the entry price distribution of wallets currently holding ADA, also supports that prediction.

It shows that if the Cardano bulls can surmount the initial resistance at $0.29, the ADA price rally could hit $0.35 realistically.

As illustrated below, the 509,000 addresses bought 5.7 billion ADA at a minimum price of $0.29. If they close their positions once Cardano prices edge toward $0.30, it could inadvertently slow the bullish price action.

But if the Cardano staking and network demand intensifies, the ADA price could rally toward the $0.35 range as predicted.

Alternatively, the bears could render the bullish narrative invalid if ADA price reverses below $0.23.

However, the chart depicts that 358,600 addresses purchased 5.2 billion ADA at the maximum price of $0.25. As the largest cluster of Cardano investors that entered below the current prices, $0.25 could form a major support buy-wall.

But, if that vital buy-wall caves, it could trigger a prolonged Cardano price reversal toward $0.23.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.