Like many other Layer-1 tokens, Cardano (ADA) price scored sizable gains on Monday as bullish sentiment returned to the crypto markets. On-chain data analysis examines if the ADA bulls have enough in the tank to propel ADA out of its month-long consolidation phase below the $0.30 territory.

Cardano (ADA) price his $0.26 on Tuesday, bringing its weekly gains to 12%. On-chain and derivative markets data provide vital insights into whether the ongoing crypto rally can propel ADA out of its current consolidation phase.

Despite 12% Price Gains, Cardano Speculative Traders Remain Unconvinced

Over the past week, Cardano’s price has gained 12%, moving from $0.24 on September 12 to $0.26 on September 19. But during that speculative traders have been pulling out their capital from ADA Futures markets.

According to crypto derivatives market data platform Coinglass, ADA Open Interest has declined by $5.6 million since the price rally began on September 12.

Open interest represents the total value of outstanding derivatives contracts for a specific asset at any given time. It provides insights into the underlying asset’s market participation level and investor interest.

Typically, a decline in Open Interest during a price rally suggests that holders of existing long positions are taking profits and closing out their positions.

Also, the dearth of fresh capital inflows could mean that investors do not anticipate the ongoing price swings will be large enough for them to book significant profits.

Hence, this divergence between Cardano price and Open Interest suggests that speculative traders expect the consolidation phase to linger.

Spot Traders are Looking to Buy, But Sellers are Holding Out for Higher Prices

Cardano has attracted significant demand as the bullish headwinds swept across the crypto markets this week. However, traders seem to wait for prices to increase significantly before selling.

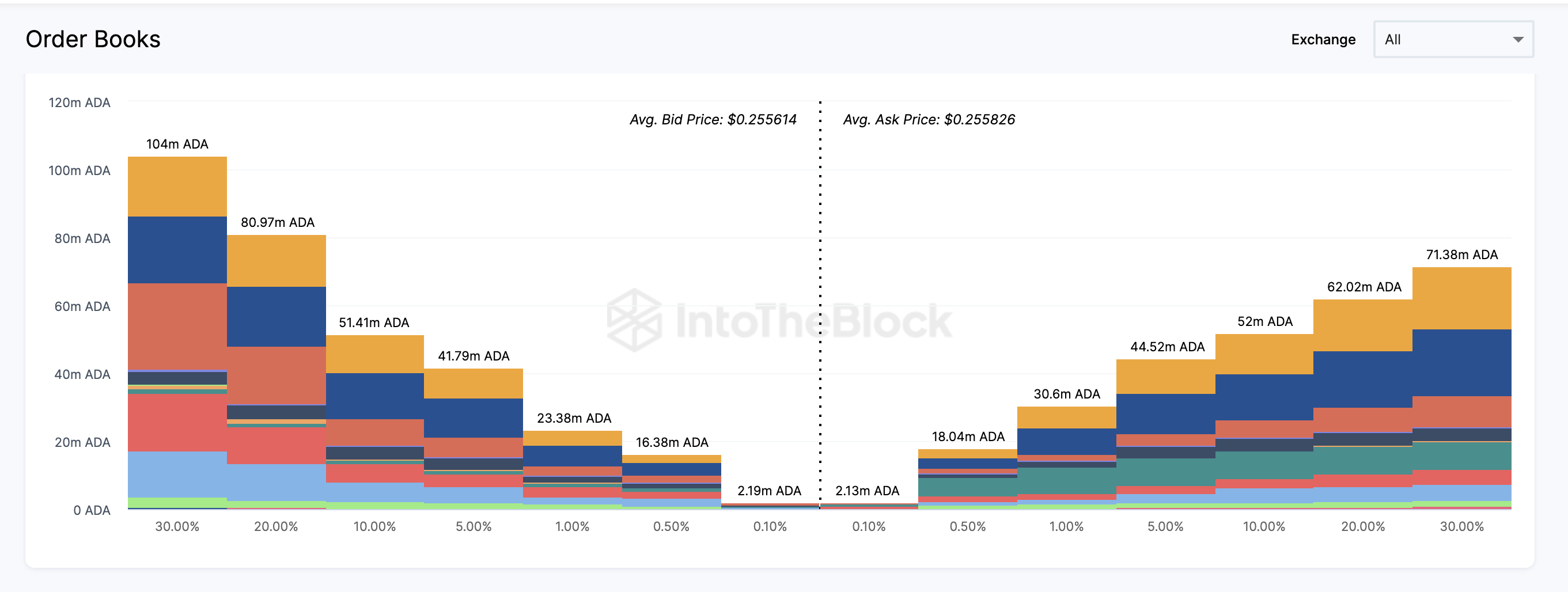

According to aggregated data from the Order Books of crypto exchanges, including Binance, Kucoin, and Coinbase, ADA buy orders have now exceeded sell orders.

As depicted below, the bulls have placed orders to buy 320.12 million ADA coins, which is considerably higher than the 280.3 million ADA coins currently up for sale.

While the bulls firmly control the market, the sellers appear to be holding out for higher prices. The chart below illustrates that 185 million ADA, or 67% of the existing sell orders, are mounted at prices $0.29 and above.

The Exchange Order Books chart depicts the aggregate volume of active buy/sell orders Cardano holders placed across recognized crypto exchanges. With an excess market demand of nearly 40 million ADA, Cardano bulls currently have the upper hand. However, it remains to be seen if they would be willing to raise their offers to meet the sellers’ asking prices in the coming days.

If that does not happen, ADA price will likely continue its consolidation phase rather than break out of the $0.30 territory in the coming weeks.

ADA Price Prediction: Consolidation around $0.25 Before Breakout

From the key indicators analyzed above, the current spot market demand levels mean Cardano’s price will likely remain above the $0.25 range in the coming days. However, the bulls will face significant difficulty reclaiming the $0.30 territory.

The In/Out of Money Around Price data, which outlines the purchase price distribution of the current Cardano holders, vividly validates this prediction.

It highlights that 40.92 million addresses had purchased 1.9 billion ADA coins at the average price of $0.28. That resistance level could prove daunting unless the buyers raise their stakes significantly.

But if the bulls can push past that sell wall, ADA price could make another attempt at reclaiming $0.30 for the first time since August 1.

But in the unlikely event that the market FUD intensifies, the Cardano bears could potentially force a major downswing toward $0.20

Although 27,030 addresses had bought 198.6 million ADA at the minimum price of $0.24. And if they chose to HODL, Cardano’s price could consolidate above that zone as predicted.

But if that support level allows, the ADA price could begin to edge closer to $0.20.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.