Bitcoin (BTC) price broke above $29,000 on Wednesday morning. Institutional investors front-running Blackrock’s Bitcoin ETF approval appear to be driving the ongoing rally. Will BTC skyrocket in the same trajectory as GOLD did when the first Gold ETF launched in 2004?

An Exchange-Traded Fund (ETF) is a financial product that tracks the price of an asset and allows investors to gain exposure to it without directly holding custody of it.

Subject to approval, Blackrock’s Bitcoin ETF will allow BTC to be indirectly traded on traditional stock exchanges, similar to shares and index funds. This is poised to open Bitcoin and the cryptocurrency industry to a broader market.

Here are some critical statistical metrics that signal how the Bitcoin ETF could push BTC prices above $40,000 in the near future.

- The total market capitalization of the U.S. stock market is worth $40.5 trillion.

- This US stock market is 3,600% larger than the current global crypto market capitalization (TOTALCAP).

- The price of Gold was $700 when SPDR Gold Shares launched the first Gold ETF ($GLD) in November 2004.

- By August 2011, the price of Gold had skyrocketed 250% to reach a new all-time high of $2,450.

The chart above shows the price of Gold was $699 when $GLD first launched in 2004. Within 5 years, Gold reached a new all-time high of $2,450.

Going by recent dramatic changes in on-chain data, institutional investors already anticipate that Blackrock’s Bitcoin ETF will have a similar impact on BTC price.

More From BeInCrypto: 9 Best AI Crypto Trading Bots to Maximize Your Profits

Institutional Investors Have Started Betting Big on Bitcoin

On-chain data shows that institutional investors have started taking bullish positions on BTC since Blackrock’s ETF application hit the newswires.

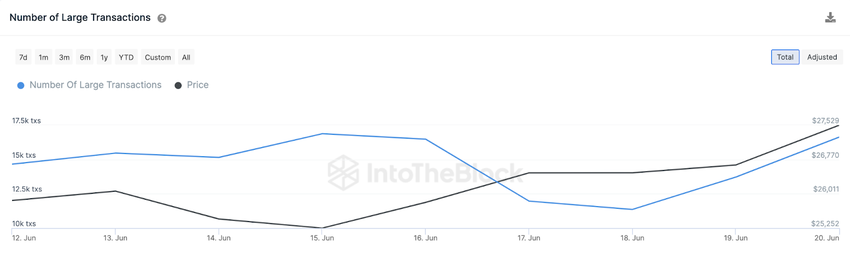

Specifically, IntoTheBlock’s data reveals that Whale Investors have been increasing their trading activity for 3 consecutive days. Between June 17 and the close of June 20, BTC Large Transactions grew from 11,360 to 16,360. This represents a whopping 47% rise in just three trading days.

Large Transactions tracks the trading activity of institutional investors and high-net-worth individuals by summing the daily number of confirmed transactions that exceed $100,000.

The chart above indicates that Blackrock’s recent ETF application may have played a pivotal role in boosting institutional investors’ confidence in BTC.

Regulatory authorities’ potential approval of a Bitcoin ETF is a significant step toward mainstream acceptance and legitimacy of Bitcoin as an asset class.

If things go as planned, Bitcoin holders can expect BTC to reclaim the $40,000 milestone in the near future.

More From BeInCrypto: Crypto signals: What Are They and How to Use Them

BTC Price Prediction: Blackrock ETF Approval Could Push Bitcoin to $33,000.

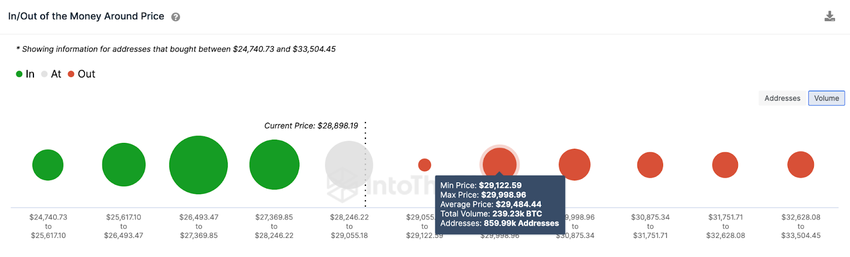

IntoTheBlock’s IOMAP data shows that BTC’s price has established stable support above $27,000. As long as BTC stays above the $26,400 – $27,400 range, it has a good chance of reaching a new 2023 peak.

But first, BTC must first clear the initial resistance at $29,500. Here, 860,000 addresses bought over 239,000 BTC for an average price of $29,484.

If BTC can scale that zone, it will face much less resistance to $33,000.

Still, the BTC could enter another bearish trend if Bitcoin abruptly drops below $26,000. But as identified above, BTC will have the solid support of around $26,400.

At that zone, 2.38 million addresses bought over 1.14 million BTC at a minimum price of $26,493. But if that support fails, BTC could retrace below $25,000 again.