Bitcoin’s (BTC) price closed June at $30,500, bringing its year-to-date (YTD) gains to 85%. After outperforming the S&P 500 by nearly 70%, institutional investors now appear to be taking long positions on BTC. Will Bitcoin make more gains in H2 2023?

After scoring 85% gains in H1, bullish Bitcoin whales now set their sights firmly on the $35,000 milestone. Nevertheless, the social sentiment surrounding BTC is still negative due to the SEC knocking back Nasdaq and Cboe Markets’ Bitcoin ETF applications for ‘incomprehensive‘ documentation

Could these recent market developments catapult BTC toward $35,000 in the coming weeks?

Institutional Investors are Taking Long Positions on Bitcoin

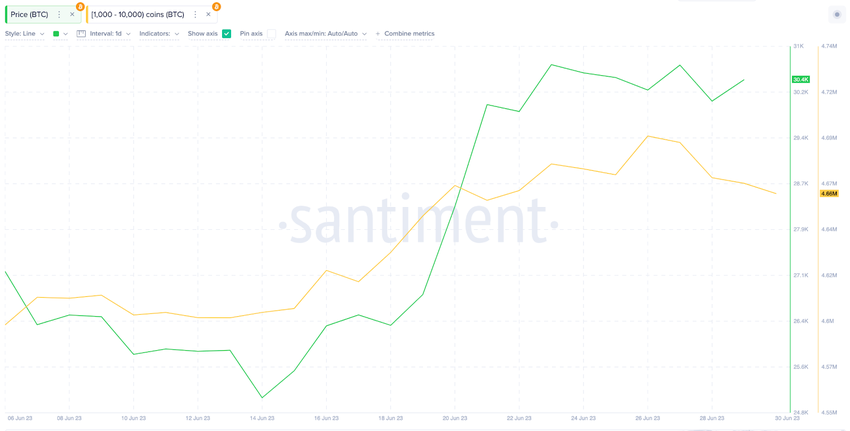

The growing interest in BTC derivatives among institutional investors has begun to evolve in increased demand for Bitcoin. According to on-chain data, a price-savvy cohort of whales holding balances of 1,000 to 10,000 BTC began to buy BTC around June 15.

Interestingly, this coincides with the date Blackrock first announced its Bitcoin ETF filing with the US Security and Exchange Commission (SEC).

Looking at the chart below, the whales gradually made a hefty purchase of 60,000 BTC in the second half of June 2023.

With BTC currently sitting at $30,500, the Whales have invested approximately $1.83 billion since Blackrock filed for a Bitcoin ETF application.

If the SEC approves the applications it received in June, BTC could witness increased whale demand in the coming weeks.

Read More: Best Upcoming Airdrops in 2023

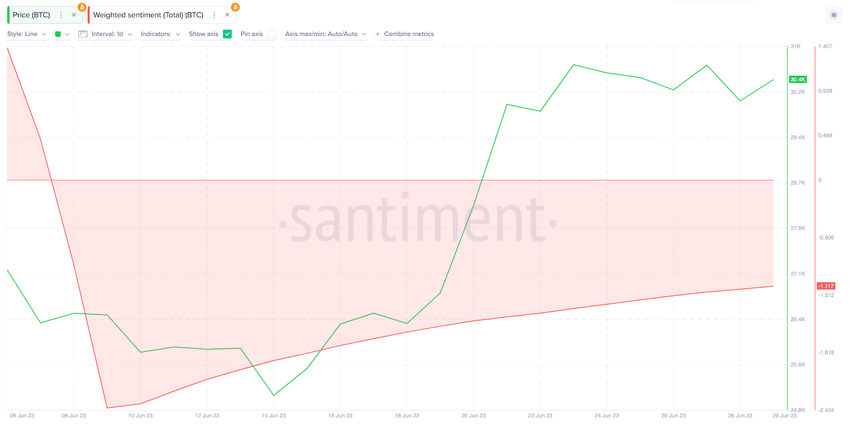

BTC Social Perception Is Still Trending Downward.

The social perception surrounding BTC is still largely negative. The rejection of the Nasdaq and Cboe Markets’ “incomprehensive” Bitcoin ETF applications seems to have raised concerns among investors.

The Santiment chart below shows that BTC Weighted Sentiment still sits at -1 despite recent price gains.

In concise terms, a -1 Weighted Sentiment score means that for every positive opinion about Bitcoin, there are currently more than two negatives. With BTC market sentiment still far from euphoria, there is room for more bullish momentum to build up in the coming days.

Strategic investors looking to enter the market at a low sentiment point could consider this perfect timing to buy BTC.

In summary, the bullish mood among whales and the slightly gloomy market sentiment are critical indicators of more potential gains ahead.

Read More: 9 Best Crypto Demo Accounts For Trading

BTC Price Prediction: All Eyes on $35,000

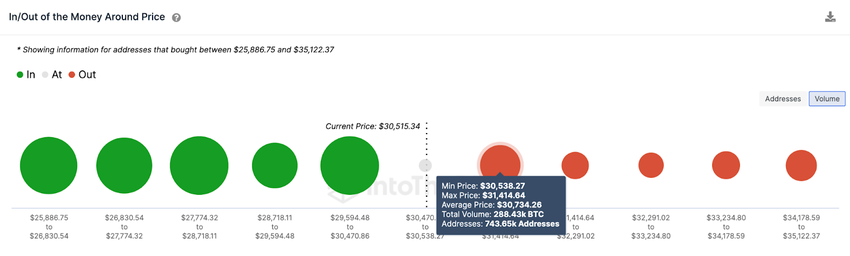

According to the on-chain data analysis provided above, BTC bulls will likely now have their sights set at $35,000. But BTC must first clear the initial resistance around $31,000 to reach that target.

As shown below, a cluster of 744,000 investors that 288,000 BTC at an average price of $30,700 could slow the rally.

But if the bulls scale that resistance zone, BTC could reclaim $35,000 for the first time since May 2022.

Still, with the bears still largely in control of the media narrative, Bitcoin runs a risk of dropping below 28,000 again. However, the 1.55 million investors that bought 772,000 Bitcoin at the average price of $28,100 could prevent the massive drop.

Nevertheless, if the support line fails to hold firm, BTC could retrace toward $27,000 once again.

More From BeInCrypto: 9 Best AI Crypto Trading Bots to Maximize Your Profits