The Bitcoin (BTC) price reached a high of $53,015 on February 20 but has corrected since.

Bitcoin trades in the upper portion of a short-term corrective pattern. Can it break out, or has the price reached a local top?

Bitcoin Shows Weakness

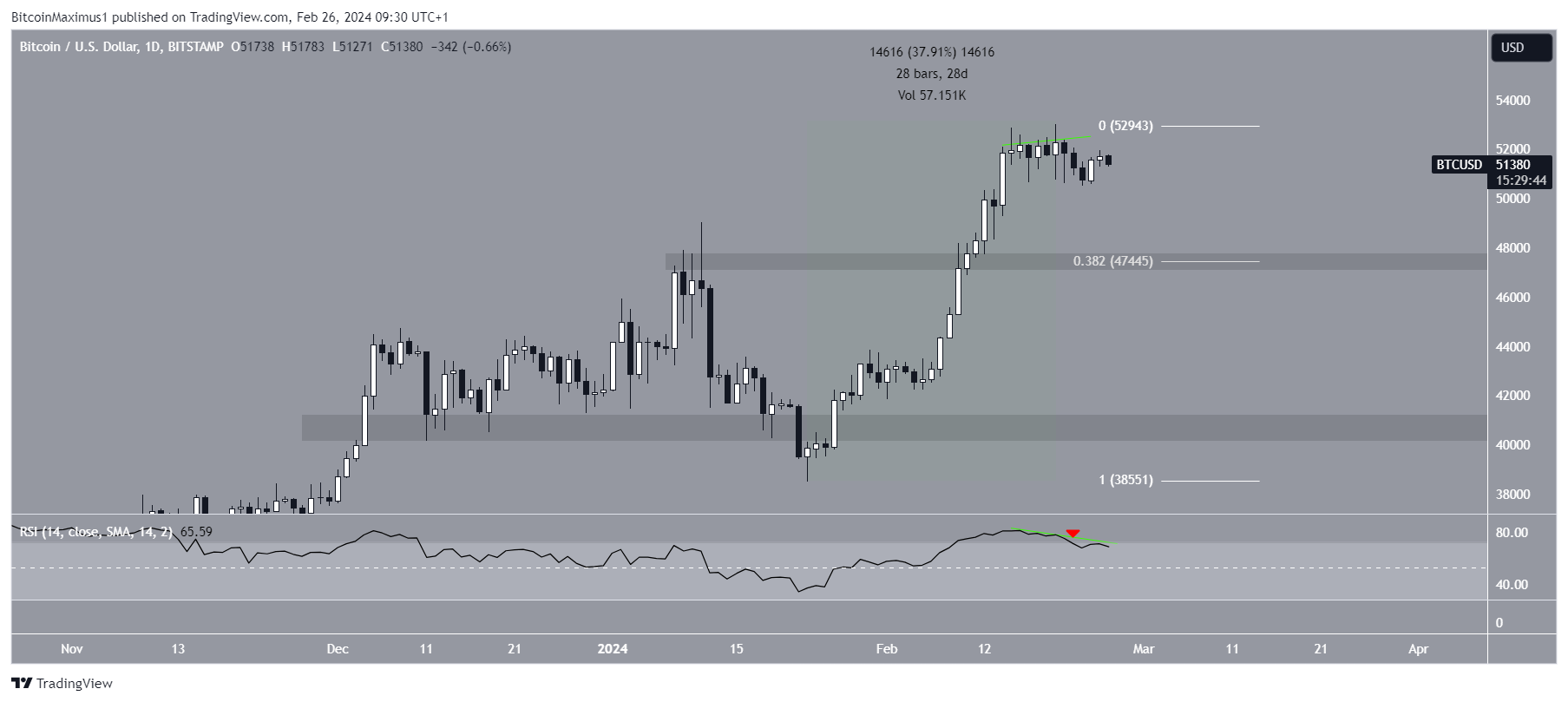

The technical analysis of the daily time frame shows the BTC price has moved upwards since January 23. In 28 days, it increased by 40%, leading to a high of $53,015 on February 20. This was the highest Bitcoin price since 2021.

While the BTC price has fallen slightly since it still trades above $51,000. However, due to the rapid ascent, there is no horizontal support below the current price.

While the price action is positive, the daily Relative Strength Index (RSI) provides bearish signs. Market traders use the RSI as a momentum indicator to identify overbought or oversold conditions and to decide whether to accumulate or sell an asset.

Read More: Where To Trade Bitcoin Futures

Readings above 50 and an upward trend indicate that bulls still have an advantage, whereas readings below 50 suggest the opposite. The daily RSI generated a bearish divergence (green) and fell below 70 this week (red icon).

What Are Analysts Saying?

Cryptocurrency traders and analysts on X positively view the future BTC trend.

CryptoMichNL suggests the BTC price will top close to $58,000 before halving, and a significant correction will follow afterward.

“I’m unaware whether we will get this correction on #Bitcoin in the short term. I think that this rally is going to peak between $54-58K and provide a substantial correction to $40-42K after the halving has taken place”. He stated.

Mesawine1 suggests the BTC price is completing a short-term correction, after which a significant upward movement will transpire. While dave the wave is bullish, he believes that BTC will underperform altcoins in the short- and medium-term.

Read More: Who Owns the Most Bitcoin in 2024?

BTC Price Prediction: Is the Trend Still Bullish?

The shorter-term six-hour time frame gives a more bullish reading than the daily one. This is because of the positive price action. Since the February high, Bitcoin’s price has decreased inside a descending parallel channel. These channels usually contain corrective movements. As a result, a breakout from it will be the most likely scenario.

Additionally, the BTC price has traded in a range between $51,300 – $52,400 during this period. Each time it deviated below the range low (green icons), it bounced at the channel’s support trend line and reclaimed the range. BTC currently trades in the channel’s upper portion. If BTC breaks out, it can increase by 6% to the next resistance at $54,300.

Despite this bullish BTC price prediction, a breakdown from the channel can cause an 8% drop to the horizontal and Fib support at $47,400.

Read More: What is a Bitcoin ETF?

For BeInCrypto‘s latest crypto market analysis, click here.