Polygon (MATIC) price hit a weekly low of $0.70 on Wednesday, November 22, as the crypto markets reacted to the regulatory controversy surrounding Binance. On-chain analytics identify the critical bullish indicators that could shape MATIC’s next price move.

MATIC price hit a 5-month peak of $0.98 on November 14, but despite steady demand, the bears capitalized on the leadership upheaval at Binance to force a correction this week. As the market regains momentum, here’s how MATIC’s price could react.

Ecosystem Updates and Partnerships Have Attracted Investor Interest

The Polygon network has attracted significant investor interest this month due to network improvements and strategic partnerships. Despite the Fear, Uncertainty, and Doubt (FUD) that gripped the crypto market amid Binance’s leadership shuffle, demand for MATIC remains steady.

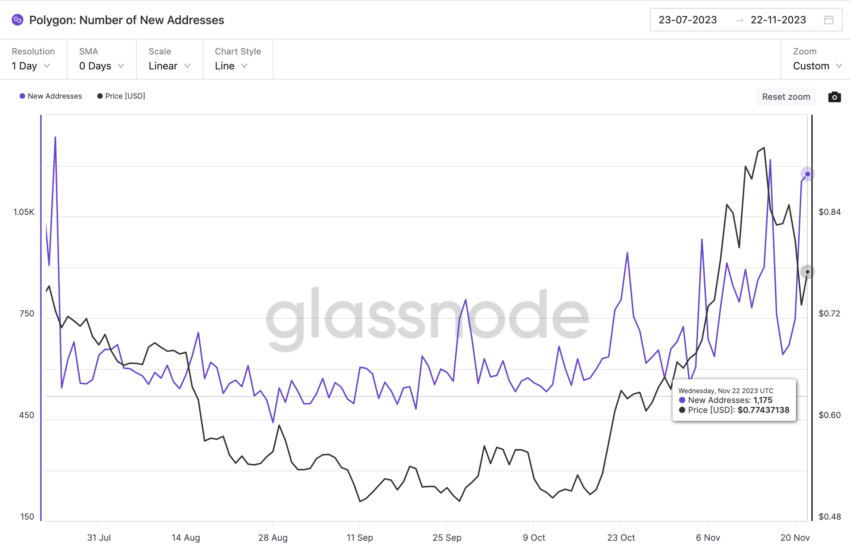

On November 22, the number of new MATIC wallets created daily reached 1,175 addresses. That figure is just 42 shy of the four-month high of 1,217 New Addresses recorded on November 16, according to Glassnode’s on-chain chart below.

Read more: 7 Must-Have Cryptocurrencies for Your Portfolio Before the Next Bull Run

The new addresses metric tracks how a blockchain network attracts new users. By summing up the daily number of new MATIC wallets created, it estimates the increase or decrease in demand for products and services hosted on the Polygon network. An increase in new wallets logically means that users are creating new accounts and, likely, bringing in fresh capital.

The chart above clearly illustrates that Polygon’s recent partnership announcements and network updates surrounding the POL token migration have generated widespread investor interest. As these new wallets begin to carry out transactions, it could put upward pressure on the MATIC price.

Read more: How To Buy Polygon (MATIC) and Everything You Need To Know

Demand For MATIC Has Exceeded Selling Pressure Despite Market FUD

In further confirmation that Polgyon’s recent network growth is bullish, on-chain data reveals that the spate of buying momentum appears to be rising quickly relative to selling pressure.

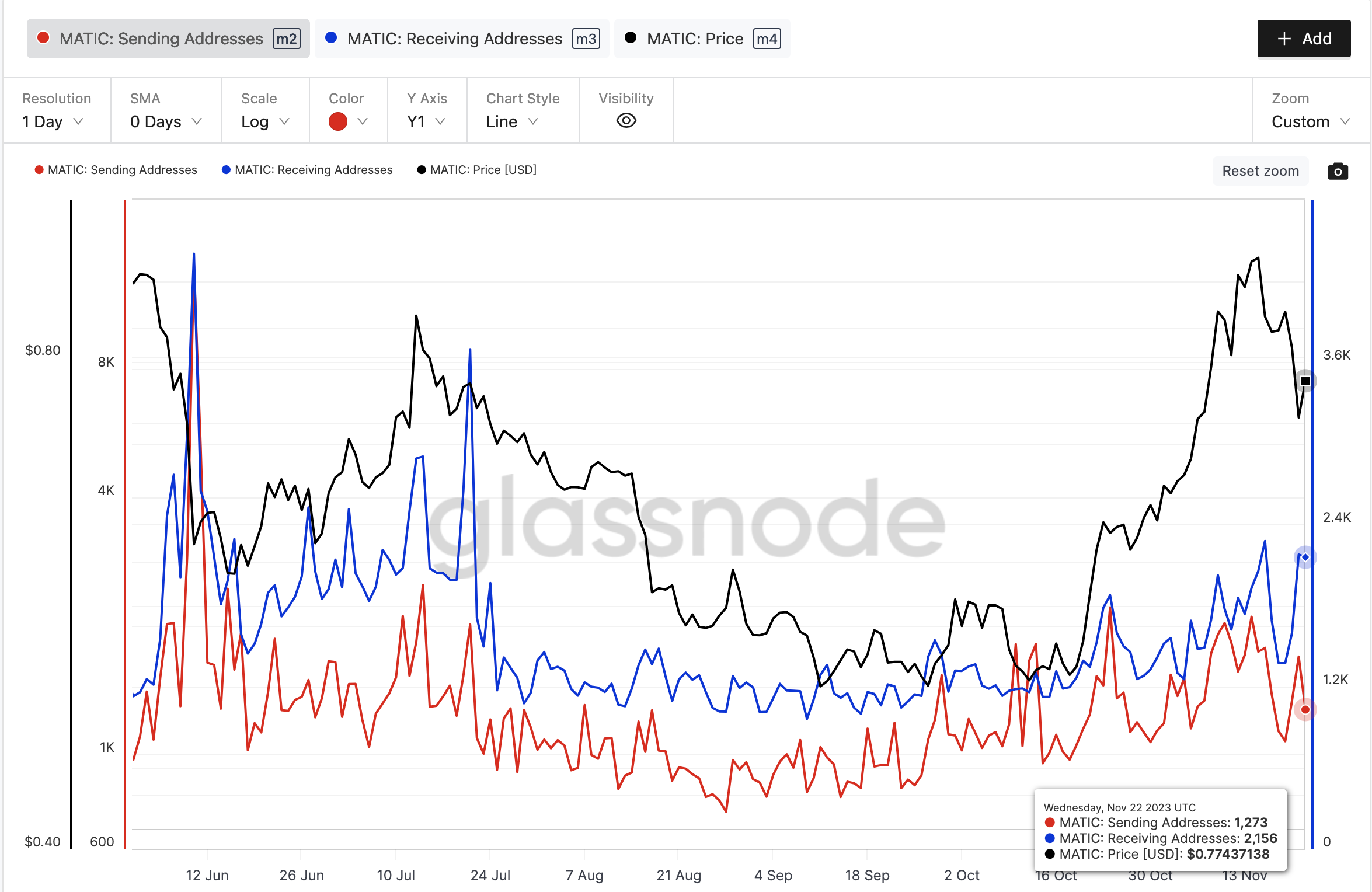

Despite a 36% retracement from last week’s top of $0.98, market demand for the MATIC token continues to mount. The Glassnode chart below affirms that the number of MATIC buyers (receiving Addresses) still firmly exceeds sellers (sending addresses).

This week, the latest reading shows that MATIC receiving addresses (buyers) increased from 1,595 wallets to 2,156 wallets between November 20 and November 22. Meanwhile, sending addresses (sellers) have dropped marginally from 1,335 to 1,273 wallets.

This implies a positive divergence between the number of sellers and buyers on the Polygon network, which could evolve into bullish momentum.

Put, the receiving addresses metric estimates the number of unique wallets purchasing the underlying token. Conversely, the sending addresses metric represents the number of existing holders who are actively transferring or selling off their holdings.

Logically, it is a bullish divergence when the number of wallets buying MATIC (receiving addresses) increase coincides with a decline in the number of sellers (sending addresses). This appears to have played a pivotal role in MATIC’s 7% price rebound from the weekly low of $0.73 recorded on November 21 to $0.78 at press time on November 23.

If this unique alignment persists, MATIC’s price bulls could regain control to force a $0.90 retest in the days ahead.

MATIC Price Prediction: Road to Reclaim $1?

From an on-chain standpoint, the rising network demand is a major factor driving the buying momentum within MATIC markets this week. With these vital metrics still trending bullish, it puts MATIC’s price in a prime position for another leg-up.

Read more: 14 Best Polygon (MATIC) Wallets in 2023

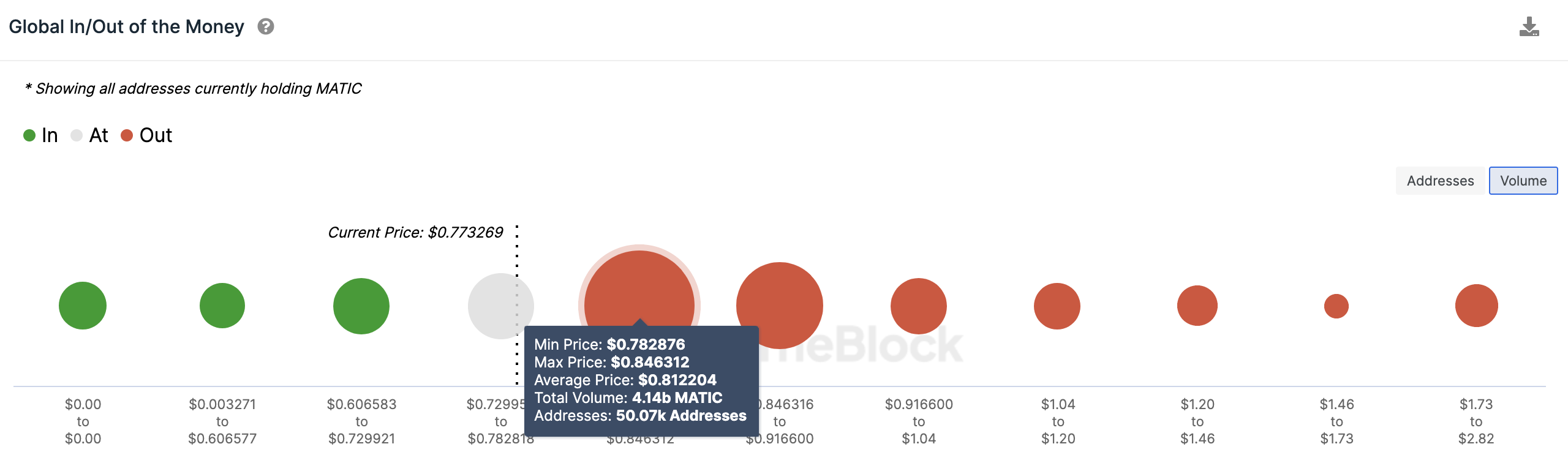

The Global In/Out of the Money (GIOM) data, which groups the current MATIC holders according to their entry prices, also supports this short-term bullish forecast.

However, it shows that the bulls must first scale the initial resistance at $0.80 for the bulls to be confident of a $1 retest. As shown below, 50,007 addresses had bought 4.14 billion MATIC at an average price of $0.81. If those holders exit early, they could effectively derail the MATIC price rally.

But if the bulls can scale that resistance sell-wall, the MATIC price rally could head toward $1 as predicted.

Still, the bears could negate that bullish price forecast if the MATIC price dips below $0.65. But, as observed earlier this week, the support buy-wall at $0.68 could prove daunting. At that zone, 46,310 MATIC addresses that bought 598.5 million MATIC at the average price of $0.68 could mount a strong support zone. If those investors look to HODL and cover their positions, Polygon will likely avoid a significant price reversal.

Looking For a New Exchange? These Are the Best Crypto Sign-Up Bonuses in 2023

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.