Friday is Bitcoin options expiry day, and a massive tranche of contracts is set to go today. Crypto markets are enjoying a rare day in the green, but will the big expiry have an impact?

On September 29, around 118,000 Bitcoin options contracts will expire with a notional value of a whopping $3.2 billion. The end-of-the-month expiry is usually a big one, and September will dwarf previous weeks’ expiry events.

Big Bitcoin Options Expiry

The max pain point for today’s big batch of expiring Bitcoin options contracts is $26,500. This is now lower than the spot BTC price, which topped $27,000 a few hours ago.

The price level with the most open contracts is max pain, and it’s also the level where most losses occur when the contracts expire.

The put/call ratio is 0.58, meaning almost two-thirds of today’s expiring contracts are calls (longs).

Greeks Live noted that this is a quarterly delivery, adding this year’s Q3 is as flat as in previous years. Moreover, the third quarter is generally the least active period, and “Put’s position share is significantly lower compared to weekly deliveries.”

“Liquidity has continued to deteriorate of late, with large position shifting being the main trading driver this week. With delivery just around the corner, IV continues its downward trend.”

IV is implied volatility which measures expected future volatility derived from the expiring derivatives contracts. The downtrend indicates that the market consolidation and low volumes will likely continue for a while.

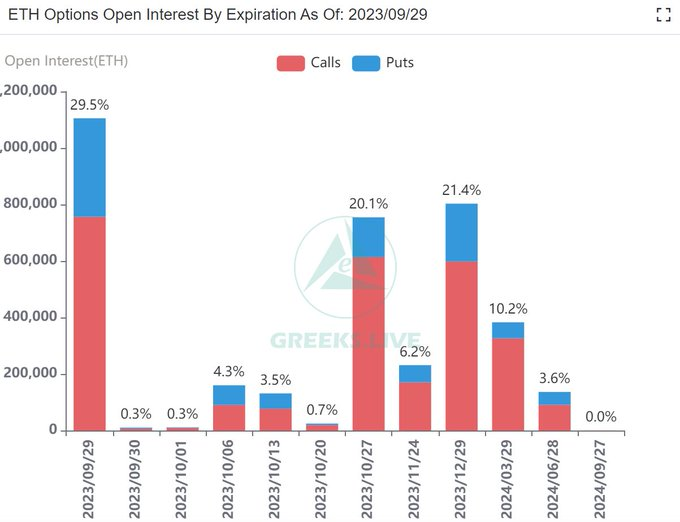

Big Day For ETH Contracts

In addition to Bitcoin options, today also marks the expiration of 1.1 million Ethereum contracts.

These have a notional value of $1.8 billion and a max pain point of $1,650 which is exactly where ETH is trading at the time of writing. The put/call ratio for the Ethereum contracts is 0.46.

Crypto markets are experiencing a rare day in the green, with the total cap climbing 2% on the day to reach $1.11 trillion.

BTC topped $27,000 in late trading on Thursday but has already cooled and dropped back to $26,958.

Meanwhile, Ethereum gained 2.8% on the day to reach $1,651. ETH momentum may have been driven by the premise of the first futures ETFs being launched in the US next week.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.