Friday is Bitcoin options contracts expiry day, and a sizable stack is about to expire. Crypto markets have turned bearish again, retreating as the week comes to a close, but will the options make an impact?

On September 22, around 22,000 Bitcoin options contracts will expire with a notional value of $590 million. Furthermore, it is a smaller expiry event than in previous weeks, with a huge chuck expiring next Friday.

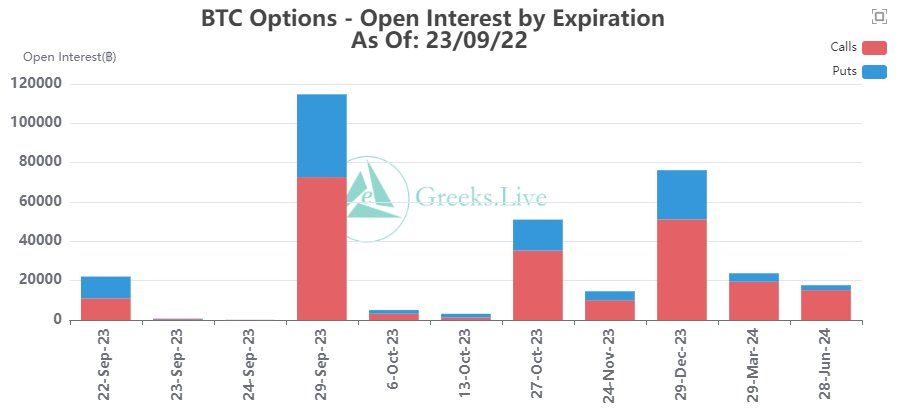

Bitcoin Options Expiry

The max pain point of today’s batch of expiring Bitcoin options contracts is $26,500, which is not far off current spot prices of $26,660.

Max pain is the price level with the most open contracts and at which most losses will be made when they expire.

The put/call ratio for the contracts is 1, which means longs and shorts are evenly matched.

GreeksLive noted that the percentage of put positions has increased significantly this week. There are more investors actively buying puts in the face of significantly worse market liquidity recently, it added before noting:

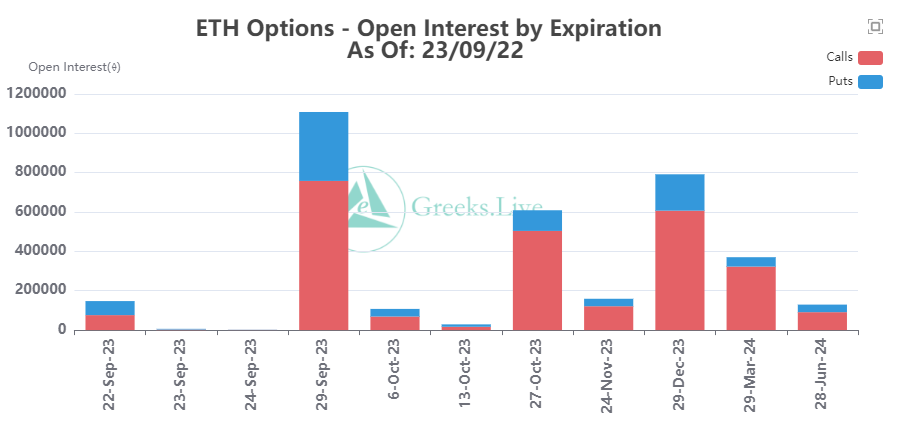

“BTC’s recent trend has been significantly stronger than ETH, and BTC IV is also higher than ETH at full term, which makes ETH’s monthly Put a more worthwhile investment on balance.”

Bitcoin has moved more over the past week, reaching its highest price of the month on Monday at $27,400. Comparatively, Ethereum has remained stagnant.

Implied volatility (IV) is a measure of expected future volatility derived from the expiring derivatives contracts.

Ethereum Contracts Coming to a Close

Around 147,000 Ethereum options contracts are also set to expire today. These have a notional value of $230 million and a max pain point of $1,600.

The put/call ratio for these is 0.94, which is also pretty evenly distributed between long and short contract sellers.

Bitcoin is currently down 2.6% from its Monday high, dipping to $26,664 at the time of writing. Moreover, today’s expiring BTC options will unlikely impact markets very much.

BTC is hovering just above support at $26,500, but further declines could result in a loss of the $26,000 price level again.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.