Bitcoin (BTC) fundamentals across a range of metrics are currently at their highest levels and could signal long-term bullish prospects for BTC.

Since the last halving in 2016, on-chain benchmarks like retail purchase, address owners, hash rate, and transaction volume have grown by leaps and bounds. Bitcoin’s third halving which is less than 12 hours away is expected to trigger another phase of massive growth not only in fundamentals but in the BTC spot price as well.

Bitcoin Fundamentals Reaching New Heights

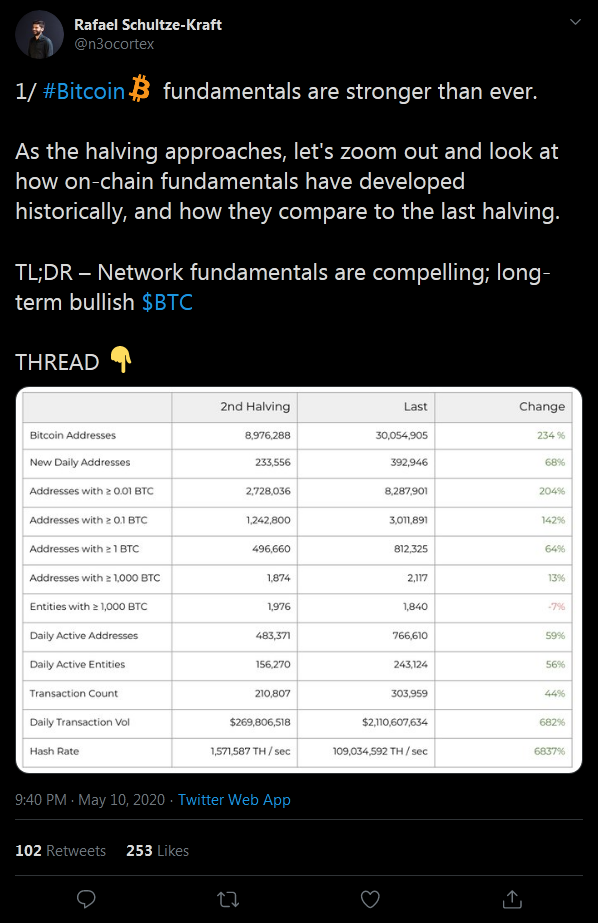

Tweeting on May 10, 2020, Rafael Schultze-Kraft (@n3ocortex), the CTO and co-founder of the crypto analytics platform Glassnode, highlighted the improvement in Bitcoin fundamentals since the 2016 halving.

Source: Twitter

As previously reported by BeInCrypto, Bitcoin fundamentals have been strengthening even during periods of flash crashes and sustained price downtrends. Apart from isolated hash rate crashes, the computing power expended to secure the network has continued to grow.

Indeed, Bitcoin’s hash rate is more than 680% higher than it was at the 2016 halving. Within that period, the network survived a few bouts of hash rate slips, one of which was due to the 2018 Bitcoin Cash (BCH) and Bitcoin SV (BSV) fork kerfuffle.

Source: Twitter

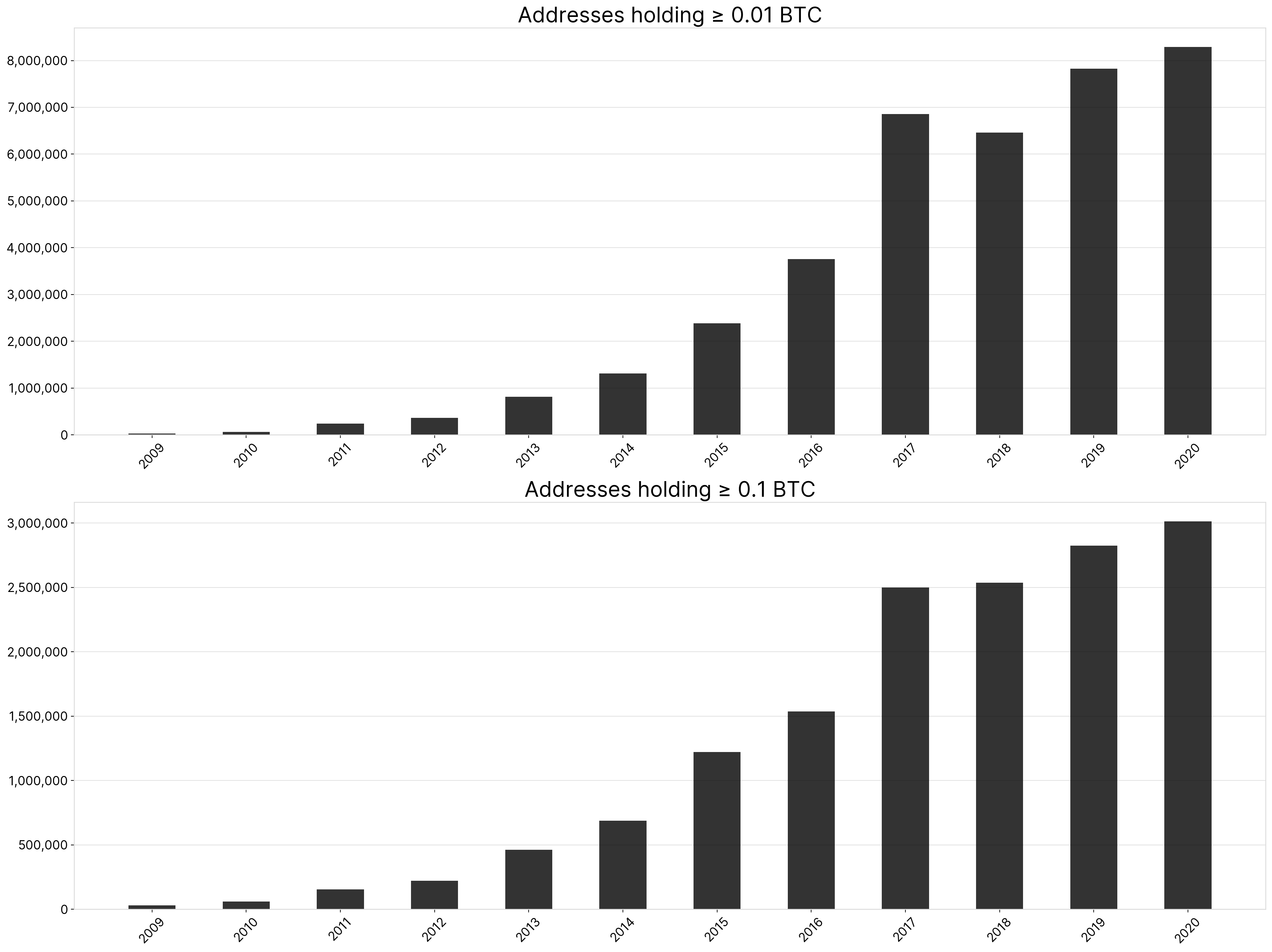

On the ownership side of things, there is also a significant increase across both retail and ‘big-money’ participation. The number of Bitcoin addresses with 0.01 BTC and 0.1 BTC continues to increase daily. Retail Bitcoin owners are reportedly ‘stacking sats’ by any means necessary, some even spending their $1,200 stimulus checks in the U.S.

Likewise, ‘wholecoiners’ — addresses with at least 1 BTC — and whale wallets that hold above 1,000 BTC are also more in number now than four years ago.

Third Halving Milestone

The constantly improving Bitcoin fundamentals are thought to be indicators of long-term bullish conditions for BTC, irrespective of any short-term price struggles. Indeed, following the year-long bear market of 2018, Fundstrat’s Tom Lee remarked at the start of 2019 that these improving fundamentals had become tailwinds for Bitcoin.

With the halving merely hours away, the expectation is that the accompanying supply shock occasioned by the inflation drop will propel BTC to a new all-time high price.

Since the 2016 halving, Bitcoin has also undergone some significant protocol upgrades, including SegWit adoption which has helped to eliminate high fees during surges in transaction volume.

Bitcoin’s third halving is happening at a pivotal moment, as the global economy suffers from the shutdowns caused by the COVID-19 pandemic. Fears of a recession as bad as the late 1920s and early 1930s remain palpable.

While mainstream finance flounders upon the back of issues like currency devaluations, inflation, infinite quantitative easing (QE) and supply chain destabilization, etc., Bitcoin appears primed for increased adoption and a strengthening of its haven asset narrative.

Be sure to check out BeInCrypto’s in-depth video guide on everything you need to know about Bitcoin’s upcoming halving: