Bitcoin setting a new all-time above $20,000 has seen about 74,000 traders with short positions liquidated across the crypto market.

One BitMEX trader even saw a $10 million loss on the crypto derivatives platform BitMEX as Bitcoin added $3,000 to its price in a single day.

Bitcoin Shorts in the Red as Price Moons

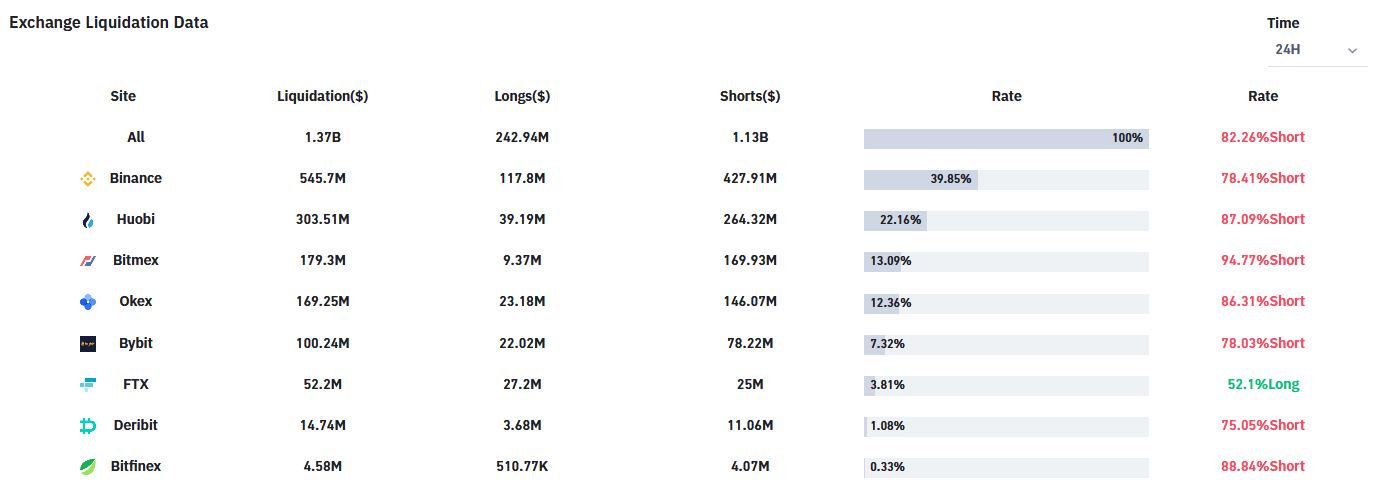

According to data from bybt, total crypto derivative liquidations over the last 24 hours stand at over $1 billion with about 98.1% of this amount coming from short positions.

Bitcoin’s march above the $20,000 milestone triggered a wipeout of traders with short bets expecting a possible pullback.

Indeed, before setting a new high, Bitcoin has seen successive rejections at the $19,450 price level. This price action likely led short sellers to expect a downtrend, interpreting the failed attempts to cross $19,500 as a lack of support at that price level.

Binance accounted for the largest proportion of these liquidations with $427.91 million in shorts underwater. In total, short positions on BTC worth about $865 million suffered liquidations amid BTC’s advances.

Open Interest and Options Volume Set New Records

The market sentiment currently appears overwhelming bullish with open interest (OI) currently at an ATH of about $8.1 billion. OKEx and Binance account for the two highest BTC futures OI with $1.47 billion and $1.40 billion respectively, according to data from Skew.

As of press time, Bitcoin is up 20% over the last 24 hours as it continues to set new all-time highs.

However, a record OI at a time of extreme bullishness might point to a trend reversal at least in the short term with BTC seeing a possible pullback amid profit-taking in the spot market.

Figures from Skew also show Bitcoin options trading volume reached a new landmark, crossing the $1 billion milestone for the first time on Dec. 16. BTC options giant Deribit accounted for the majority of this achievement, contributing $879 billion in trading volume.

In all, the crypto space saw one of its best days from a price action perspective on Dec. 16. The total crypto market capitalization is currently above $650 billion, a 12% increase over the last 24 hours.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.