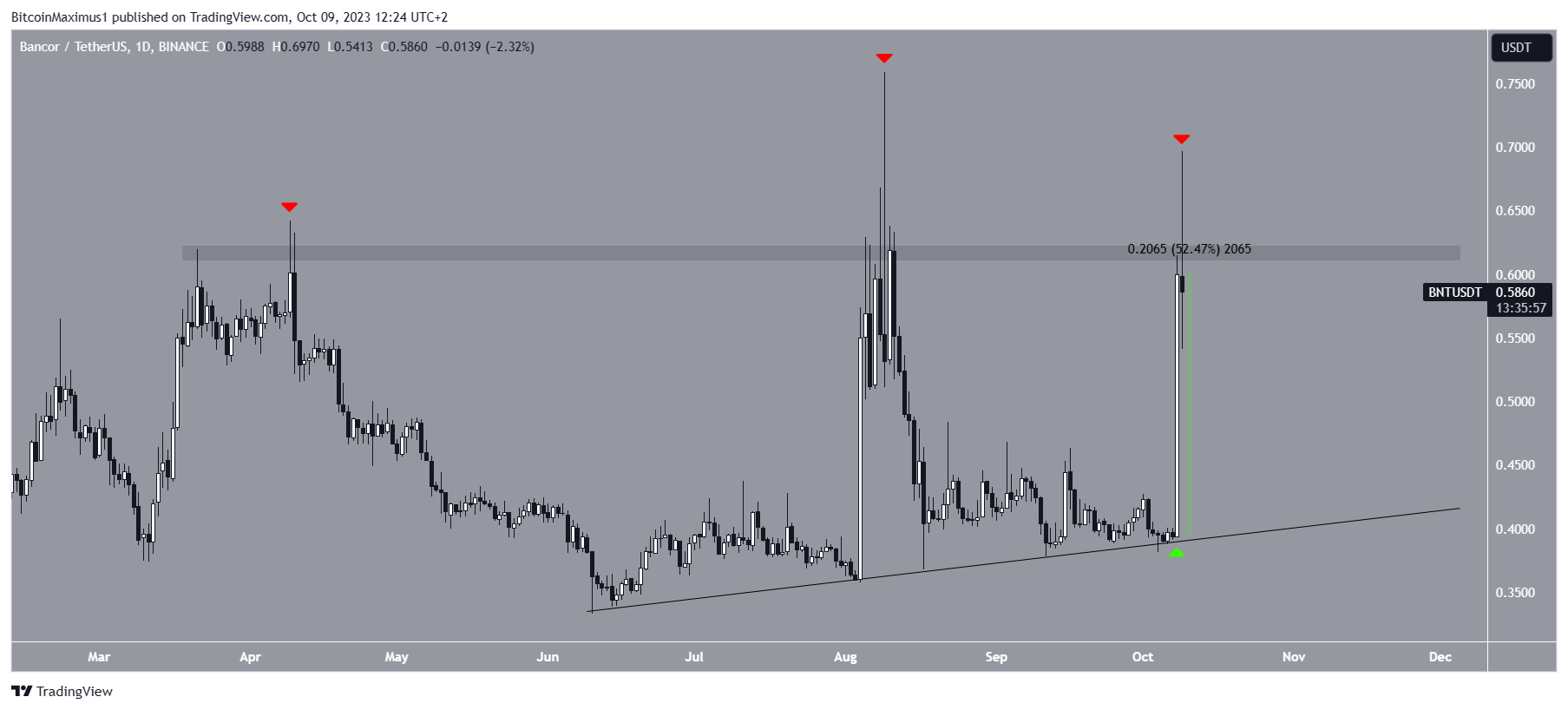

The Bancor (BNT) price increased by 70% over the weekend but could not sustain its increase today.

BNT has fallen below the $0.62 horizontal resistance area, which has been in place since March.

Bancor Reaches Long-Term Resistance

The daily timeframe technical analysis shows that the BNT price has traded below the $0.62 horizontal resistance area since March 2023. The area has been validated numerous times (red icons), more recently being touched today.

While the altcoin moved above the area several times, it has failed to reach a daily close, creating long upper wicks instead.

These wicks are bearish signs, showing considerable selling pressure, which prevent the Bancor price from confirming its breakout above $0.62.

Since June, the Bancor price has also increased alongside an ascending support line. BNT bounced at the line on October 8, increasing by 52%.

The increase amounted to more than 70% at one point, but those above long upper wick negated a part of the upward movement.

The BNT price now trades below the $0.62 area again.

The daily trading volume has also spiked considerably during these two highs, on August 9 and October 8.

The October 8 increase was especially important since 797 BNT addresses were active, the most active in nearly two years. Additionally, 157 new BNT addresses were created on the same day.

Another interesting development is that a wallet that is suspected to be of the Upbit exchange has accumulated 4.71 million BNT tokens over the past 11 hours. This is 3.3% of the total supply.

BNT Price Prediction: Is This Just the Beginning?

The weekly timeframe technical analysis suggests that the increase could be the beginning of a long-term bullish trend reversal.

The main reason for this is that the BNT price broke out from a 940-day descending resistance trendline last week. Breakouts from such long-term trendlines often lead to significant increases. The breakout took BNT inside the $0.60 resistance area.

Read More: 9 Best Crypto Demo Accounts For Trading

Another reason for the bullish outlook comes from the RSI. Market traders use the RSI as a momentum indicator to identify overbought or oversold conditions and to decide whether to accumulate or sell an asset.

Readings above 50 and an upward trend indicate that bulls still have an advantage, whereas readings below 50 suggest the opposite.

The indicator is above 50 and increasing, both pointing to a bullish Bancor price trend.

Moreover, the RSI generated a bullish divergence between July and December 2022. A bullish divergence occurs when a momentum increase follows a price decrease. It often leads to significant upward movements.

If BNT breaks out above $0.62, it can increase by 400% and reach the next resistance at $3.20.

Despite this bullish BNT price prediction, failure to close above the $0.62 area can lead to a 40% drop to the descending resistance trendline at $0.40.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.