Axie Infinity (AXS) bulls have fiercely prevented a reversal below the critical $4.50 price support level amid last week’s altcoin market downturn. Whale investors have been spotted buying the dip. Can they trigger a price rebound?

Axie Infinity (AXS) price has consolidated above the $4.50 range over the past week. On-chain data reveals that the increased liquidity from whale transactions has provided the bulls a much-needed lifeline. But can they push for more gains?

AXS Whale Investors Have Provided a Lifeline

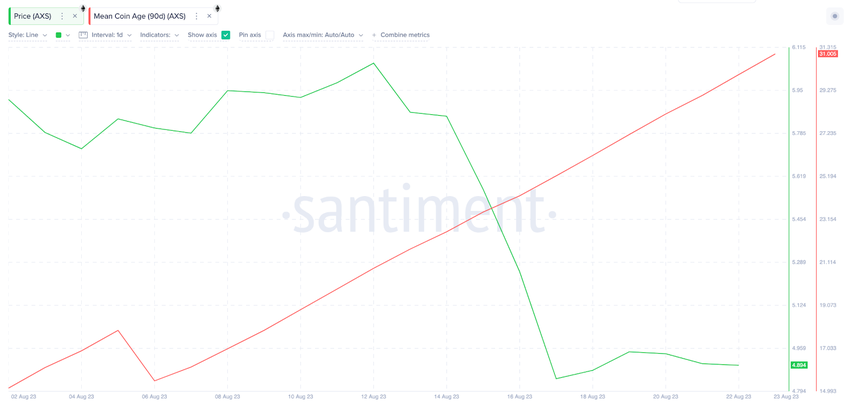

According to on-chain data compiled by Santiment, large institutional investors have helped prop up AXS price over the past week. The chart below shows that after the altcoin markets tumbled on August 17, the whales gradually intensified their trading activity over the last few days.

As shown below, AXS recorded only 1 whale transaction on August 17. But that number grew to 5 on August 21.

Whale Transaction Count tracks whale investors’ trading activity by aggregating the daily transactions exceeding $100,000. Typically, large transactions infuse much-needed liquidity into the market. This helps traders get their orders executed efficiently and at favorable prices.

If the Axie Infinity whales remain active, AXS could continue consolidating above the $4.50 range.

Long-Term Holders are Also Taking a Positive Disposition

Furthermore, according to the Mean Coin Age data presented below, fewer long-term holders have been selling their tokens lately. Following a major blip on August 6, AXS Mean Coin Age has doubled from 15.49 to 31.01 as of August 23.

The Mean Coin Age metric gauges the confidence among long-term investors within an ecosystem. It is derived by computing the average number of days coins in circulation have spent in their current wallet addresses.

When the Mean Coin Age increases during a price downtrend, as seen above, it signals many long-term investors are looking to hold out for a price recovery rather than bail out.

In conclusion, if the altcoin market FUD subsides, the resilience of the whales and long-term holders could trigger a mild-bullish AXS price reaction.

Check Out the Best Upcoming Airdrops in 2023

AXS Price Prediction: The $5 Resistance Could Weaken

While the prevailing crypto altcoin market momentum appears largely bearish, AXS bulls could weaken the $5 resistance in the coming days.

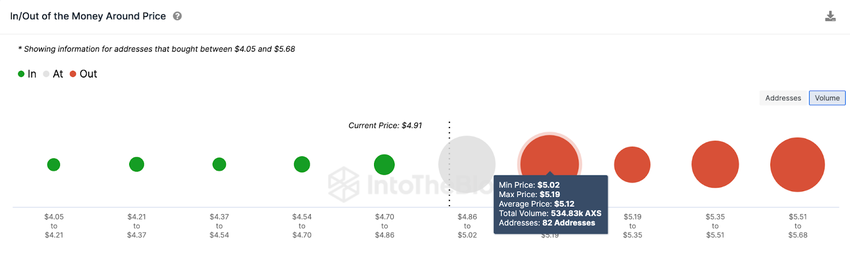

The In/Out of Money Around Price data illustrates the purchase price distribution of current investors within the Axie Infinity ecosystem. It confirms that AXS’s price could react to the whale’s buying pressure with a rebound toward $7.

However, as shown below, 82 addresses had bought 534,830 AXS tokens at an average price of $5.12. They could pose initial resistance if they close their positions.

But if the bull can scale that sell-wall, AXS could proceed on a rally toward $7.

Still, if the bearish momentum grows, Axie Infinity’s price could drop below $4. But, as shown above, 16 holders bought 97,660 AXS at the maximum price of $4.54. They could offer support if the whales keep buying.

But if that support level folds, AXS could retrace below $4.