The Avalanche (AVAX) price has fallen since reaching a 2023 high of nearly $50 on December 24.

The decrease peaked on January 8, and the AVAX price has moved upward since then.

Avalanche Falls Before Reaching $50

The AVAX price has increased swiftly since September 2023. In 90 days, the price increased by nearly 500%, culminating with a new yearly high of $49.95 on December 24.

The AVAX price fall caused a breakdown from an ascending wedge and led to a low of $31.20 on January 8, 2024. AVAX created a bullish candlestick the same day (green icon), and it has increased since.

The weekly RSI is undetermined. When evaluating market conditions, traders use the RSI as a momentum indicator to determine whether a market is overbought or oversold and whether to accumulate or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls still have an advantage, but if the reading is below 50, the opposite is true. After falling below 50 (red circle), the indicator attempts to move above the level again.

Read More: How to Buy Avalanche (AVAX)?

What Do Analysts Say?

Cryptocurrency traders and analysts on X have a bullish view of the future trend.

Mars_DeFI is extremely bullish on the future of AVAX for fundamental and technical reasons. He tweeted:

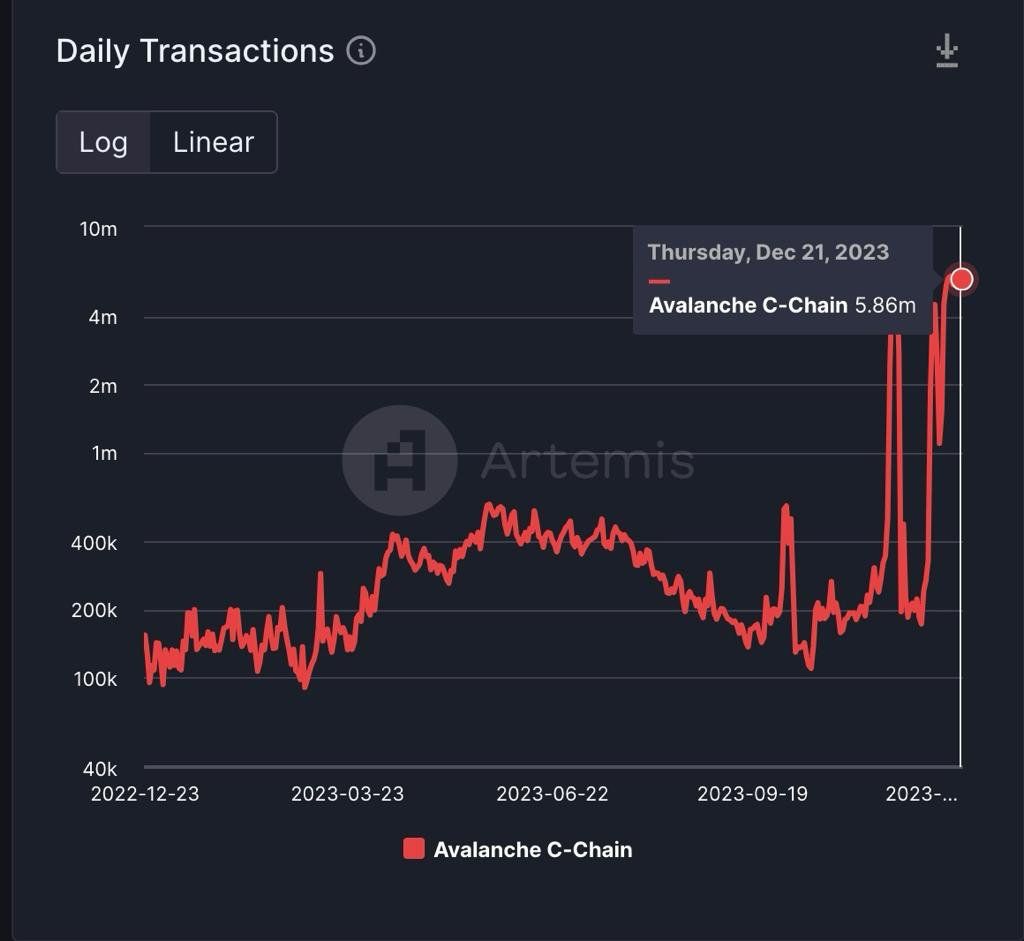

Take a look at the one-year comparison between December 2022 and 2023.

Daily active addresses: 41.01k vs 82.48k (that’s a 2x increase)

Daily transactions: 154.15k vs a staggering 5.86m

Total value locked (TVL): 787.77m, which plummeted to as low as 478.19m in September 2023, but has now rebounded to 980.77m.

A meager 13.46m vs an impressive 193.77m, marking a significant upgrade.

$11.9 vs $46.1, with holders now enjoying profits. With more than 4m $avax tokens recently burned keeping and more updates to keep the token supply deflationary , we should expect the token to quickly reclaim ATH and even surpass it in the bullrun.

Umutak47 noted a breakout from a descending resistance trend line, which could lead to more upside. Finally, MisterCh0c said that the AVAX increase was so obvious that even notoriously bearish trader Capo managed to predict it.

Read More: What is Avalanche (AVAX)?

AVAX Price Prediction: Signs of a Local Top in Place?

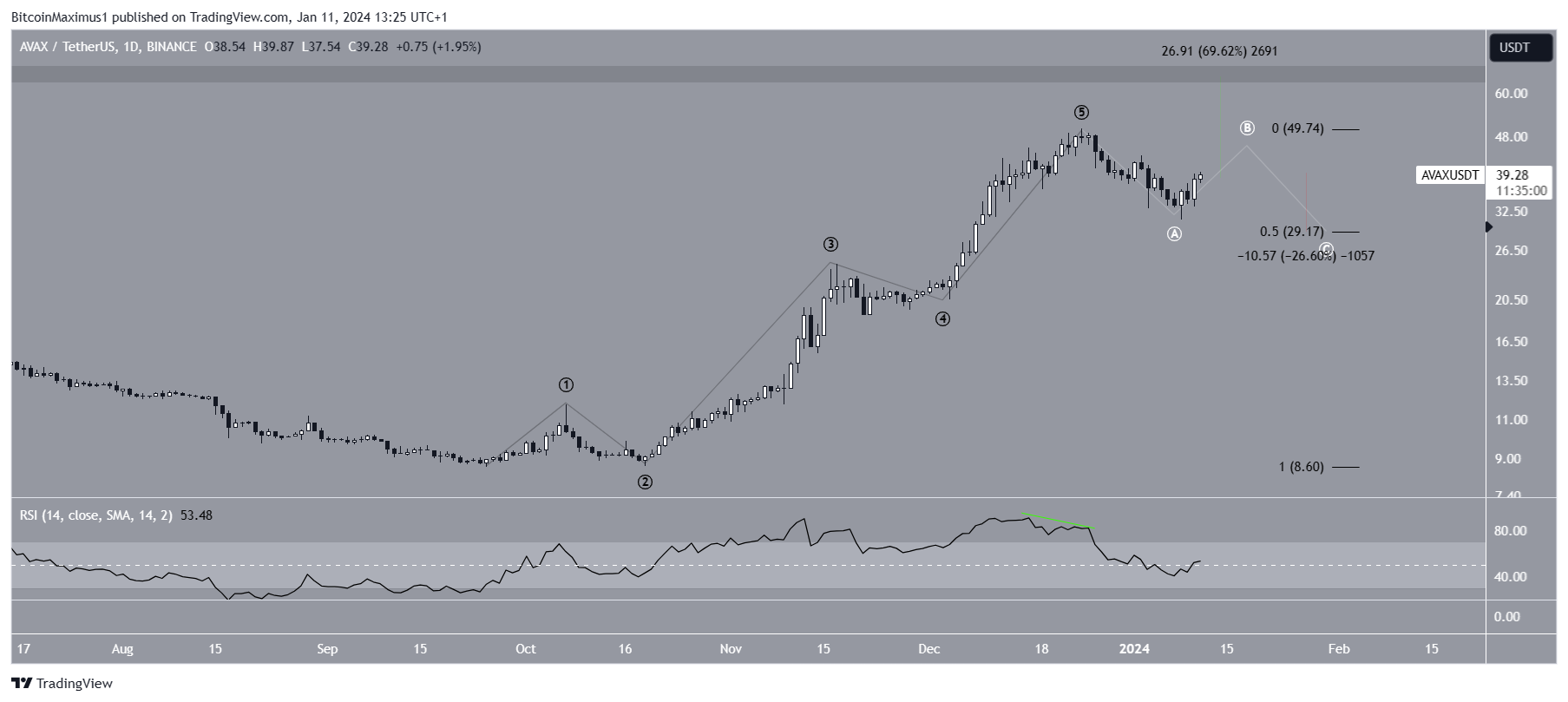

A closer look at the daily time frame readings suggests that the AVAX price may have reached a local top. This is because of the wave count.

The most likely wave count suggests AVAX has completed a five-wave upward movement. This is supported by the bearish divergence in the daily RSI during the top (green).

If the count is correct, AVAX has begun an A-B-C corrective structure (white) and is in the B wave. If so, it will increase toward $45, complete the B wave, and then fall by 25% to finish wave C at the 0.5 Fib retracement support level at $29.

Despite this bearish AVAX price prediction, increasing above $50 (red line) will mean the correction is complete. Then, AVAX can increase by another 70% and reach the next resistance at $66.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.