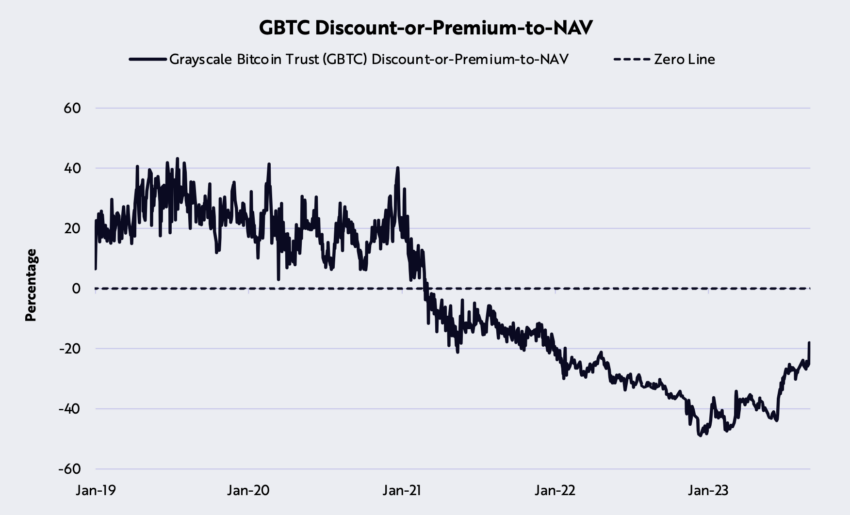

Ark Invest highlighted positive market trends in Grayscale Bitcoin Trust (GBTC), indicating increasing confidence in its potential transition to a spot Bitcoin exchange-traded fund (ETF).

These findings arrive amidst widespread speculation within the industry following the recent favorable ruling in favor of Grayscale against the US Securities and Exchange Commission (SEC).

Ark Invest Suggests Positive Outlook For Bitcoin ETFs

Ark Invest’s latest report attributes the rising price of GBTC to positive market sentiment following Grayscale’s recent court victory.

On August 29, the US Court of Appeals ruled that the SEC must review and reconsider the terms of its rejection of Grayscale Bitcoin Trust’s (GBTC’s) application to convert into a spot Bitcoin ETF.

On that same day, Ark Invest noticed a favorable change in market activity. It explained that GBTC’s discount to net asset value showed signs of narrowing.

“That day, GBTC’s discount- to-NAV increased from -24% to -18%, suggesting market optimism that the odds of a Bitcoin spot ETF in the short term have increased.”

It further noted that GBTC’s price “closed August at a discount-to-NAV of -20.6%.”

The ruling generated a strong sense of confidence throughout the industry. Furthermore, two senior analysts at Bloomberg expressed their surprise at the judge’s “unanimous and decisive” ruling.

Eric Balchunas posted his and fellow Bloomberg analyst James Seyffart’s predictions on X (formerly Twitter) shortly after the ruling:

“[James Seyffart] and I are upping our odds to 75% of spot Bitcoin ETFs launching this [year].”

Ark Invest’s Analysis of the Bitcoin Futures Market

The report also discussed recent Bitcoin Futures market activity.

It pointed out resemblances in the Bitcoin Futures market to a period shortly after Bitcoin reached its all-time high in November 2021. “Futures open interest collapsed at a rate not seen since December 2021,” it stated.

To learn more about where to buy Bitcoin, read BeInCrypto’s guide: 4 Best Crypto Brokers for Buying and Selling Bitcoin in 2023

Ark Invest reported that on August 17, Bitcoin futures liquidated by 21.7%. The investment firm believes “the price correction was a cathartic sentiment correction.”

This follows Glassnode’s recent report of decreasing volumes and reduced activity in the futures market.

Furthermore, Glassnode pointed out that the average daily trading volume for Ethereum futures dropped last week, reaching $8.3 billion per day.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.