Arkham Intelligence, a blockchain intelligence firm, has reportedly identified Grayscale Bitcoin Trust’s holdings on the blockchain, asserting that it is distributed across a substantial number of wallets.

The firm further reports that it ranks as the world’s second-largest Bitcoin holder, with a total of over $16 billion.

Grayscale Bitcoin Trust’s Staggering Total Value

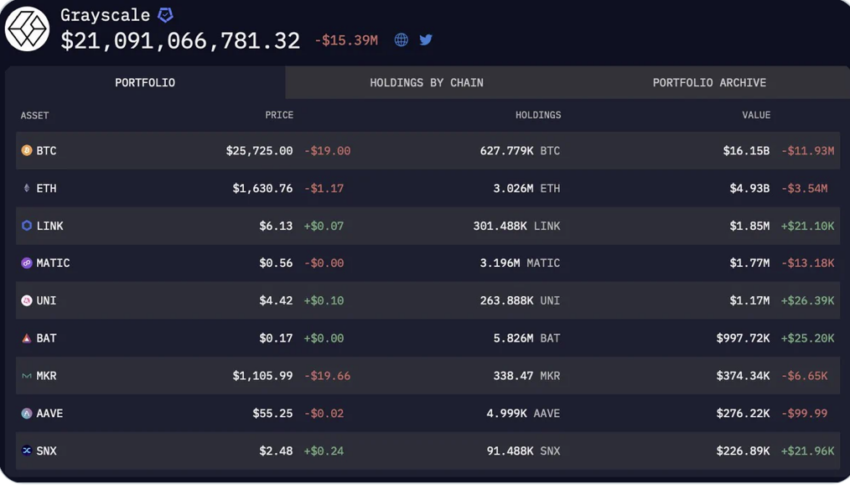

In a recent X (formerly Twitter) post, Arkham Intelligence discloses that Grayscale Bitcoin Trust (GBTC) holdings are distributed across over 1,750 wallets. The research firm further reports that Grayscale has a total Bitcoin quantity of 627,779.

It further explains that each wallet holds “no more than 1,000 BTC.”

This signifies that none of the wallets holds a value exceeding $257.7 million. At the time of publication, Bitcoin’s price is $25,779.

Within the same portfolio, it also holds several other cryptocurrencies, such as Ethereum ($4.93 billion) and Chainlink ($1.85 million).

Arkham asserts that Grayscale has not identified the wallet on its own. “Though Grayscale publicly reports balances, they have refused to identify the on-chain addresses of the trust,” it notes.

To learn more about Bitcoin, read BeInCrypto’s guide: What Is Bitcoin? A Guide to the Original Cryptocurrency

Grayscale’s Battle With The SEC

This development also coincides with Grayscale’s proactive push to secure approval for the conversion of the GBTC into a Bitcoin exchange-traded fund (ETF).

Recently, the US Court of Appeals sided with Grayscale in a legal battle against the United States Securities and Exchange Commission (SEC). The judge affirmed that the SEC had erred in rejecting its conversion application.

Grayscale wasted no time in requesting a meeting with the SEC to bring the matter to a close.

On September 6, Grayscale’s legal team dispatched a letter to the SEC, requesting a meeting to expedite the approval process. The letter stated,

“We would appreciate the opportunity to meet with the staff of the Securities and Exchange Commission as soon as practical.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.