Amid a recent court ruling mandating the SEC to re-evaluate Grayscale’s Bitcoin ETF proposal, global crypto influencers are actively speculating about the probability of approval and its potential impact on Bitcoin’s price.

As several influencers declare it a game-changer, others indicate a near future with a six-figure Bitcoin price.

Grayscale Bitcoin ETF: Price, Timeline and Uncertainties

Crypto influencers worldwide are predicting what the future holds for Bitcoin after the court ordered that the United States Securities and Exchange Commission’s (SEC) decision to deny Grayscale Investments’ Bitcoin ETF product was not valid and must be reassessed.

Following the August 29 court ruling, several crypto influencers made posts on X (formerly known as Twitter).

Miles Deutscher told his 356,000 followers that it was a game-changer. “This changes everything. Time to pay attention again,” Deutscher states.

Deutscher predicts that this now means the odds of other Bitcoin spot approvals have “significantly increased.”

To learn more about how to buy Bitcoin, read BeInCrypto’s guide: 4 Best Crypto Brokers for Buying and Selling Bitcoin in 2023

Ivan on Tech declared to his 400,000 followers he is confident the product will be approved and hints towards a six-figure Bitcoin price in the near future:

“Grayscale crushes SEC. ETF Inevitable. Bitcoin $100,000 LFG,” he remarks.

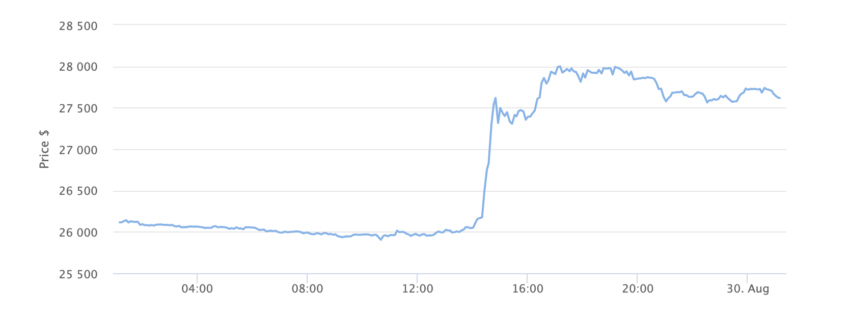

Following the ruling, Bitcoin experienced a price gain of roughly 7.2%, reaching a peak of $28,000. As of the time of writing, Bitcoin’s current price is $27,592.

Host of the Bankless Show, Ryan Sean Adams, described the recent ruling as “huge news.” He even believes it could be as early as this year that it sees approval. “Resume the bull,” he states.

This leads to speculation about the future of Ark Invest’s Bitcoin ETF product. The SEC has repeatedly postponed providing an outcome. Recent reports suggest that the SEC could potentially extend that deadline until January 2024.

Recently, Cathie Wood, the CEO of Ark Invest, speculated that if the SEC were to approve Bitcoin ETFs, it would do so in a single decision. “I think if the SEC is going to approve a Bitcoin ETF, it will approve more than one at once,” she declares.

Potential Alternative Objections

However, Bloomberg’s James Seyffart outlines two ways that the SEC can still stop Bitcoin ETFs from listing.

In a post to his 32,000 followers, he states that the SEC would have to “revoke the listing of Bitcoin Futures ETFs.”

He explains that the most recent filing states that the SEC “can’t argue about manipulation of markets while allowing Bitcoin Futures ETFs.”

However, he considers this scenario to be unlikely. He believes it’s more probable that the SEC might raise new reasons for denial that haven’t been presented before:

“I have been saying for months it could have to do with Custody or settlement of Bitcoin which is not something that futures ETFs have to worry about. SEC has made a lot of noise around custodians.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.