ApeCoin (APE) price hit $1.9 on Wednesday. The recent slump means that the APE token is now 92% below its all-time high price of $23.70, achieved in May 2022. Will it trigger a panic sell-off and push the ApeCoin price toward zero?

Bored Ape Yacht Club (BAYC) investors groan as ApeCoin (APE) price dropped to a new all-time low of $1.9 on Wednesday. Critical on-chain data suggest that whale investors could inflict further losses in the coming weeks.

Community Growth Has Not Impacted Price Positively

In contrast to the current price downtrend, the ApeCoin community has attracted many new joiners over the past month. On-chain data compiled by Santiment shows that 528 new ApeCoin wallet addresses were created on July 11.

This represents a massive 160% growth when compared to the 204 addresses recorded on June 1.

Network Growth tracks the number of new wallet addresses created on a blockchain network. This estimates the rate at which new users are joining the ecosystem.

The chart above illustrates that while ApeCoin Network Growth has increased by 160% over the past month, it has not impacted price positively. In fact, the ApeCoin price dropped by 38% during that period.

This bearish trend suggests that new joiners have hesitated to hold ApeCoin and deploy it for economic transactions.

Growing Pessimism Among the Whales Could Push ApeCoin Toward Zero

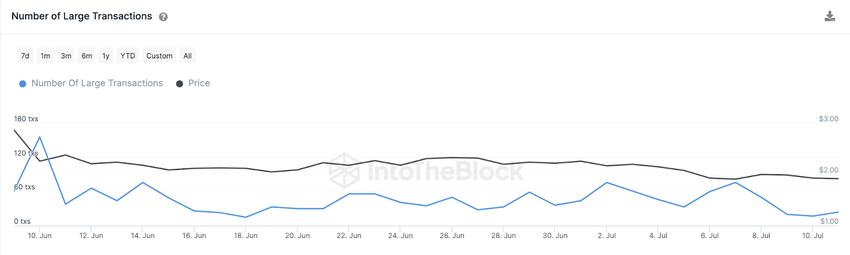

Furthermore, ApeCoin whale investors have started growing increasingly pessimistic. The IntoTheBlock chart below shows that the whales conducted 156 transactions on June 10. And by July 11, that figure has gradually dwindled to just 24 large transactions.

The Large Transactions metric summarizes the daily number of transactions exceeding $100,000. When it declines over an extended period, it indicates a general pessimistic disposition among whale investors.

In summary, the extensive bearish sentiment surrounding the ecosystem could push ApeCoin toward Zero in the coming weeks.

Read More: Best Upcoming Airdrops in 2023

APE Price Prediction: Potential Lifeline at $1?

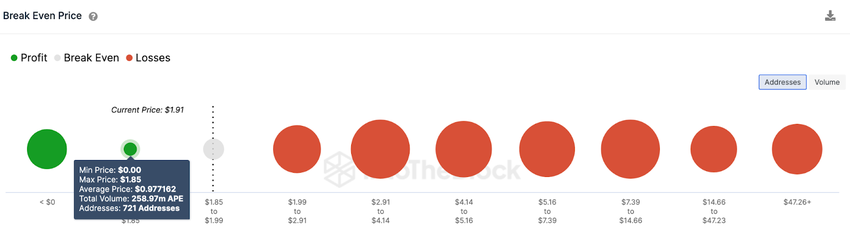

The factors analyzed above indicate that ApeCoin could fall closer to zero. But first, the $1 support level could potentially offer one last lifeline.

At that zone, 721 investors that bought 260 million APE tokens at an average price of $0.97 could offer support.

If that last line of defense fails, it will likely spark a panic sell-off, and ApeCoin could edge closer toward zero.

Yet, the bulls could attempt to stage a recovery mission if the APE token price rises above $2.50. However, it would be an uphill task to beat the resistance posed by 12,000 investors that bought ApeCoin at the average price of $2.40.

Nevertheless, ApeCoin could avoid reaching zero if that resistance caves and the price rebounds to reclaim $3.

More From BeInCrypto: 9 Best AI Crypto Trading Bots to Maximize Your Profits