Last week, Ape Coin (APE) price managed to rebound above $2 after dropping to a new all-time low of 1.82 on July 13. But a decline in Ape Coin user acquisition rate threatens to deflate the bullish momentum.

The altcoin market rally, fuelled by Ripple’s victory against the SEC, helped propel Ape Coin above the $2 resistance level. The in-depth on-chain analysis highlights critical risk factors that could hamper APE’s price recovery mission.

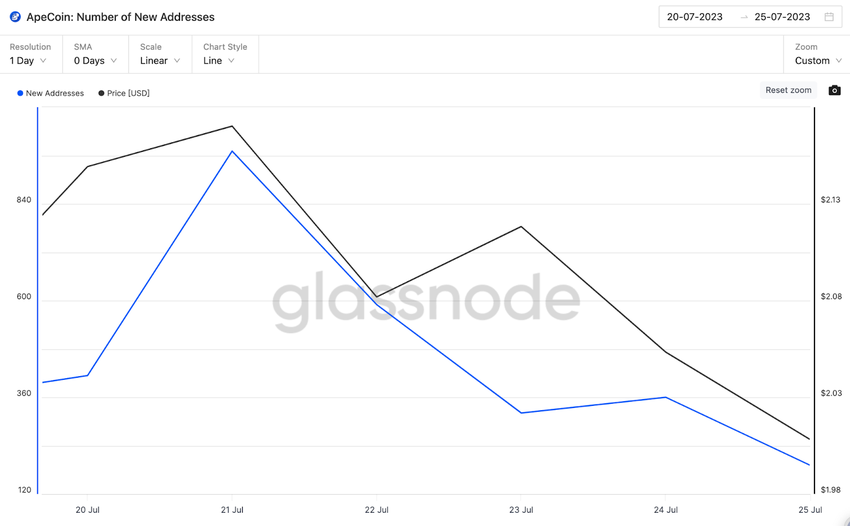

Ape Coin User Acquisition Rate Has Dropped to a 3-Month Low

While APE price has increased marginally, the decline in the Bored Ape Yacht Club (BAYC) native token user acquisition rate is now raising concerns.

Glassnode said Ape Coin registered only 190 new wallet addresses on July 25. This is its lowest user acquisition rate since May 29, when it recorded 176 new wallet addresses.

The new Addresses metric roughly estimates the number of new users joining a blockchain network daily. If it drops drastically, it stunts the network growth, and ultimately, the underlying token could struggle to find new demand.

Notably, Ape Coin is committed to a monthly token emission of about $30 million until February 2026. Hence, the inability to attract new demand to absorb that inflationary pressure could negatively impact Ape Coin price momentum.

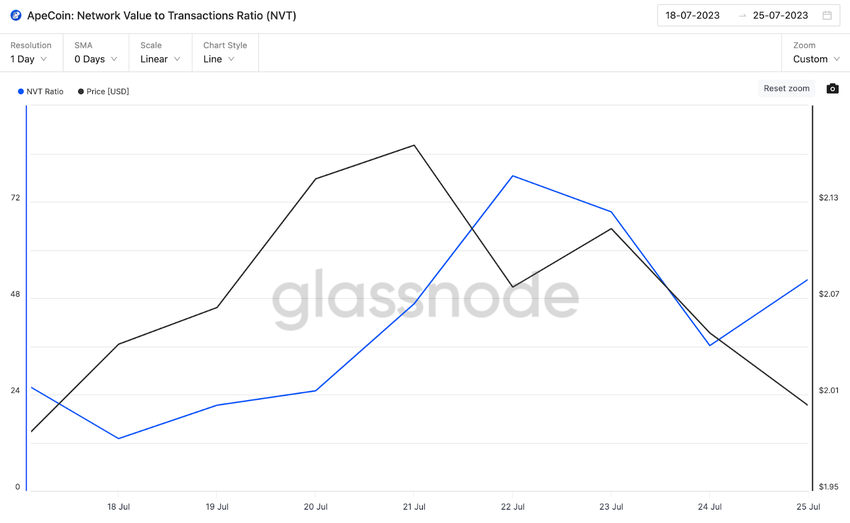

After Recent Upswing, APE Now Appears Overbought

In confirmation of the bearish outlook, the Network Value to Transaction Volume (NVT) ratio hints that Ape Coin is now approaching the overbought zone. Between July 18 and July 26, it has risen by 300% from 13.03 to 52.72.

The NVT ratio measures the growth in market capitalization against the network’s underlying transactional activity.

When it rises, it suggests that recent price growth is majorly fuelled by price speculators and existing holders covering their positions rather than real growth in transactional activity.

This confirms that unless Ape Coin can attract strong demand and increased user participation, it could take on a bearish momentum in the coming weeks.

Read More: 11 Best Crypto Portfolio Trackers in 2023

APE Price Prediction: A New All-Time Low Beckons

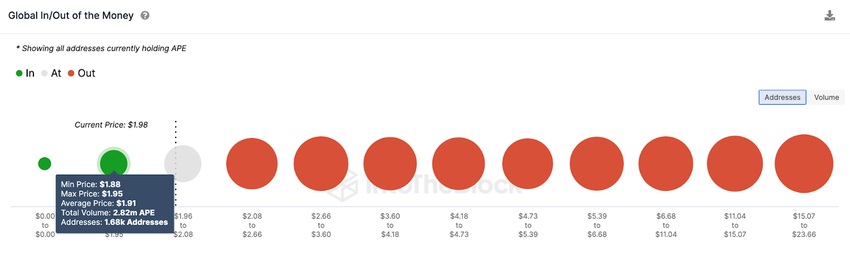

The on-chain indicators analyzed above illustrate that Ape Coin price momentum could soon turn bearish again. However, the 1,680 wallets that bought 2.8 million APE tokens for an average price of $1.90 could offer initial support.

But if that support buy-wall caves, APE could drop to a new all-time low of $1.50.

Still, the bulls could stage an unlikely comeback if the recent Ape Coin price momentum pushes it above $2.50. But as seen above, 11,530 investors that bought 81.3 million APE tokens at the average price of $2.20 could slow the rally.

Nevertheless, APE could reclaim $3 if that resistance level gives way.