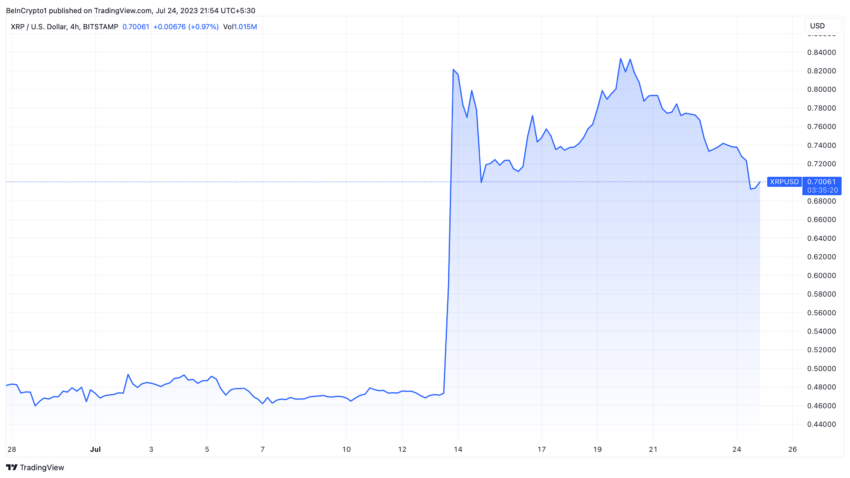

The United States Securities and Exchange Commission’s (SEC) defeat in the Ripple case, where US District Judge Analisa Torres ruled in favor of the firm’s XRP sales, has sparked intense debate.

As the dust settles, a pressing question emerges: does the SEC’s appeal against the XRP ruling genuinely have a chance of success?

The SEC’s Warning Against Ripple’s Ruling

The SEC’s dissatisfaction was evident when it suggested that Judge Torres’s ruling against them was erroneous. Torres’s decision stood in Ripple’s favor, indicating that a substantial portion of its XRP sales did not transgress investor-protection statutes.

“It may certainly be the case that many programmatic buyers purchased XRP with an expectation of profit, but they did not derive that expectation from Ripple’s efforts. None of the programmatic buyers were aware that they were buying XRP from Ripple,” Torres said.

This ruling has stirred the waters. Other defendants, such as Do Kwon of Terraform Labs, are trying to utilize the judgment to counter his SEC charges.

The core of the SEC’s discontent seems to stem from what it interprets as “baseless requirements” introduced by Judge Torres to the test of classifying an asset as a security.

Torres’s perspective suggests Ripple’s sales to institutional investors mandated SEC oversight. In contrast, its sales to individual investors via crypto exchanges did not.

The SEC responded that reconciling this reasoning with foundational securities laws is an uphill task.

“Contrary to [Terraform Labs’] assertions, much of the Ripple ruling supports the SEC’s claims in this case and rejects arguments [Terraform Labs] have raised here. However, with respect to the Programmatic and other sales, the SEC respectfully avers that Ripple conflicts with and adds baseless requirements to Howey and its progeny. Respectfully, those portions of Ripple were wrongly decided, and this Court should not follow them,” the SEC said.

It Will Take Years for the SEC to Succeed

John Deaton, founder of Crypto Law, warns against perceiving the SEC’s appeal as an impediment to Ripple’s recent courtroom triumph. He believes it would be a drawn-out affair even if an appeal materializes. Perhaps, it could span years before the 2nd Circuit issues a decision.

Until then, Torres’ decision reigns supreme.

“Even if the 2nd Circuit said Torres was wrong regarding her application of the 3rd Howey factor, that doesn’t mean the SEC wins on Programmatic sales. All that happens is that Torres then applies the other two factors and could likely still rule the same exact way,” Deaton said.

Deaton points out that Torres’s judgment centered on the intricacies of the Howey Test, the established benchmark to determine the existence of an investment contract during an asset’s sale. She ruled that many XRP purchasers might have anticipated profit, but Ripple’s actions did not shape these expectations.

Read more: Why the Crypto Market Future Lies on US Judge Analisa Torres

Challenging Torres’s application of the Howey Test would necessitate the SEC to venture into murkier waters, focusing on facets like the “investment of money” and the existence of a “common enterprise.”

Ripple Still Has to Respond to Other Charges

Ripple’s courtroom battles might be reaching their crescendo, but its implications resonate throughout the crypto market. This case is particularly pivotal, marking the first instance where a US judge favored a crypto firm, delineating certain XRP sales from US securities legislation.

While Ripple might celebrate a victory, the story is not completely rosy. The company still breached the law by directly selling XRP to savvy investors, suggesting a future filled with intricate legal hurdles.

For more information about XRP’s price prediction, please click here!

Ripple’s CEO, Brad Garlinghouse, has already been vociferous about the SEC’s overreach. He indicated the agency wrongfully designated itself as the cryptocurrency regulatory authority.

Still, the outcome of this appeal could largely chart the course of the crypto industry, both in the US and globally.

Trusted

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.