The current altcoin season appears to be gaining momentum. Bitcoin Dominance (BTC) has just dropped below 50% and ETH has hit 0.05 BTC — the pair’s highest price in over 2.5 years. Many altcoins are seeing tremendous gains and some are even surpassing their historic all-time highs.

This is favored by Bitcoin price action, which has been ranging between $50,000 and $60,000 for the past two months. In the short term, we can likely still expect some sideways consolidation before BTC’s next big move up or down. If this range price action continues, then we could expect even greater momentum for the ongoing altcoin season.

BTCD drops below 50%

The Bitcoin Dominance (BTCD) rate dropped below 50% on April 30. This level has not been recorded since July 2018.

The historical significance of this level is great as it has repeatedly served as both a support and resistance level. In addition, this it’s also a psychological area, suggesting that Bitcoin no longer holds a majority of the cryptocurrency market.

On the weekly chart, we see a systematic decline in the BTCD since the beginning of 2021, when the indicator reached a local peak of 73.5%. A long-term double-peak pattern was then created, and its consequences have manifested in a drastic decline in Bitcoin Dominance.

It’s worth noting that a drop below the 50% line is also the loss of an important 0.618 Fib retracement level of the entire long-term upward movement. If this area is not regained, the closest support areas are only in the range of 36%-40%.

Technical indicators on the weekly time frame are bearish. RSI is at its lowest level since May 2017, around 20. MACD is generating lower bars of bearish momentum, and the stochastic oscillator is at the extreme bearish territory around 4.5.

We get similar readings on a daily time frame, although here we find the first signs of a bullish divergence. They may signal an incoming bounce, but still need confirmation. The overall trend remains clearly bearish.

ETH hits 0.05 BTC

Another important indicator of the ongoing altcoin season is the price action of Ethereum (ETH), which hits new all-time highs in relation to the USD for the fifth consecutive week. At press time, the price of ETH is $2,770.

However, it’s the price action against BTC that is decisive for the strength of altcoins. In the analysis of the ETH/BTC chart conducted 3 weeks ago, when ETH was valued at 0.035 BTC, BeInCrypto wrote:

“If the move continues ETH could potentially increase by another 40% to the 0.05 BTC area.”

In fact, the expected move took place and ETH hit the value of 0.05 BTC. Moreover, the largest altcoin has already broken above the top line of the parallel channel, where a reaction was expected.

If the growth dynamics are maintained, 0.54 BTC will be another important area of resistance. This level has not been recorded since August 2018, but is historically significant. This is because it’s served as resistance/support many times in the past (orange circles).

How long will altcoin season last?

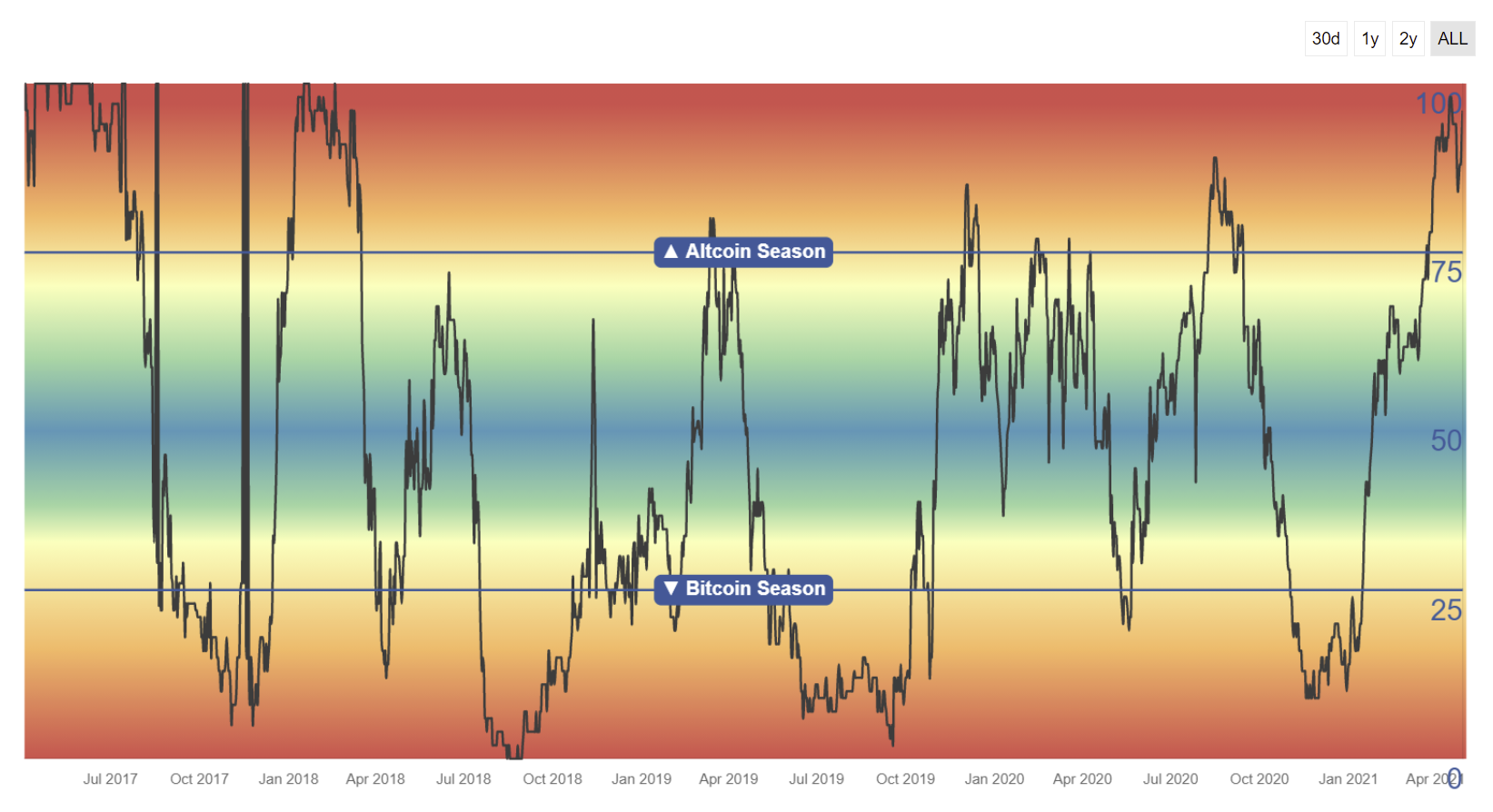

The altcoin season indicator on the Blockchain Center analytics service has been in the red range for several weeks, well above the 75-line. It currently records the value of 96, which was last seen in March 2018.

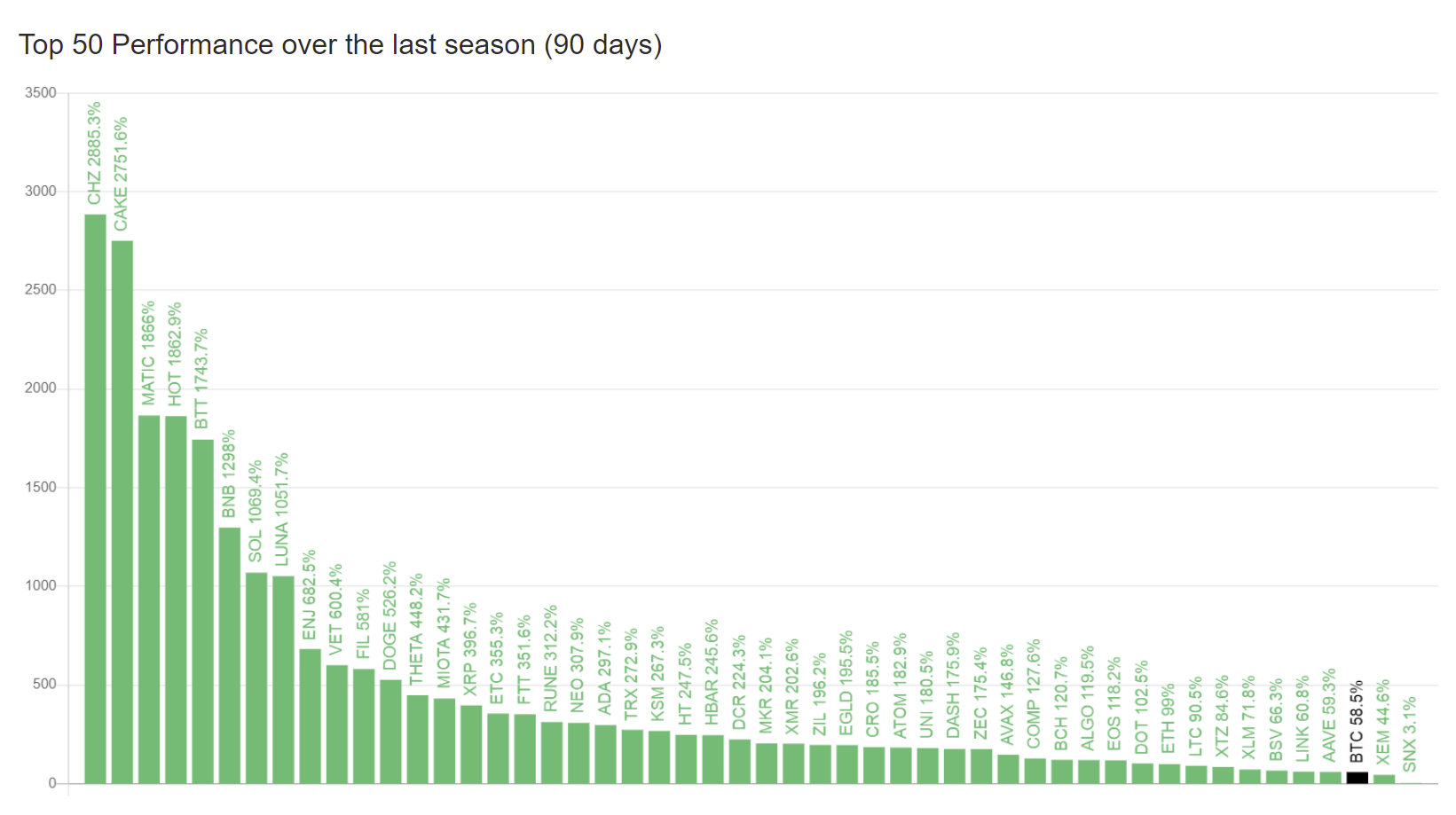

Among the largest winnings in the last 90 days, the service lists: CHZ (2,885%), CAKE (2,751%), MATIC (1,886%), HOT (1,862%) and BTT (1,743%). However, the vast majority of large altcoins are way ahead of BTC in terms of increases.

Cryptocurrency analyst @CryptoCapo_ posted a BTCD chart on Twitter, where he discusses the importance of the 50% level for the further development of the altcoin season. In his opinion, a break below means a continuation, while a bounce could signal an altcoin market “pause.”

His comments are in line with our analysis. They confirm the weakness and the continuation of the downward trend for BTCD. This strengthens the possibility of further continuation of the altcoin season.

Therefore, it seems that holding the psychological level of 50% is crucial for determining the further fate of altcoins in relation to Bitcoin price action. The most likely scenario assumes further consolidation and compression of the BTC price, which could result in a deeper drop in BTCD.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.