Open up the keg of powder, it’s time to lock and load. It’s alt season. In July, I predicted a bump of BTC followed by an open alt season. I was right. A perfect storm is bringing back memories of December 2017, and this time big money is looking to exit the U.S. dollar.

Duck Season? Rabbit Season? No, Alt Season.

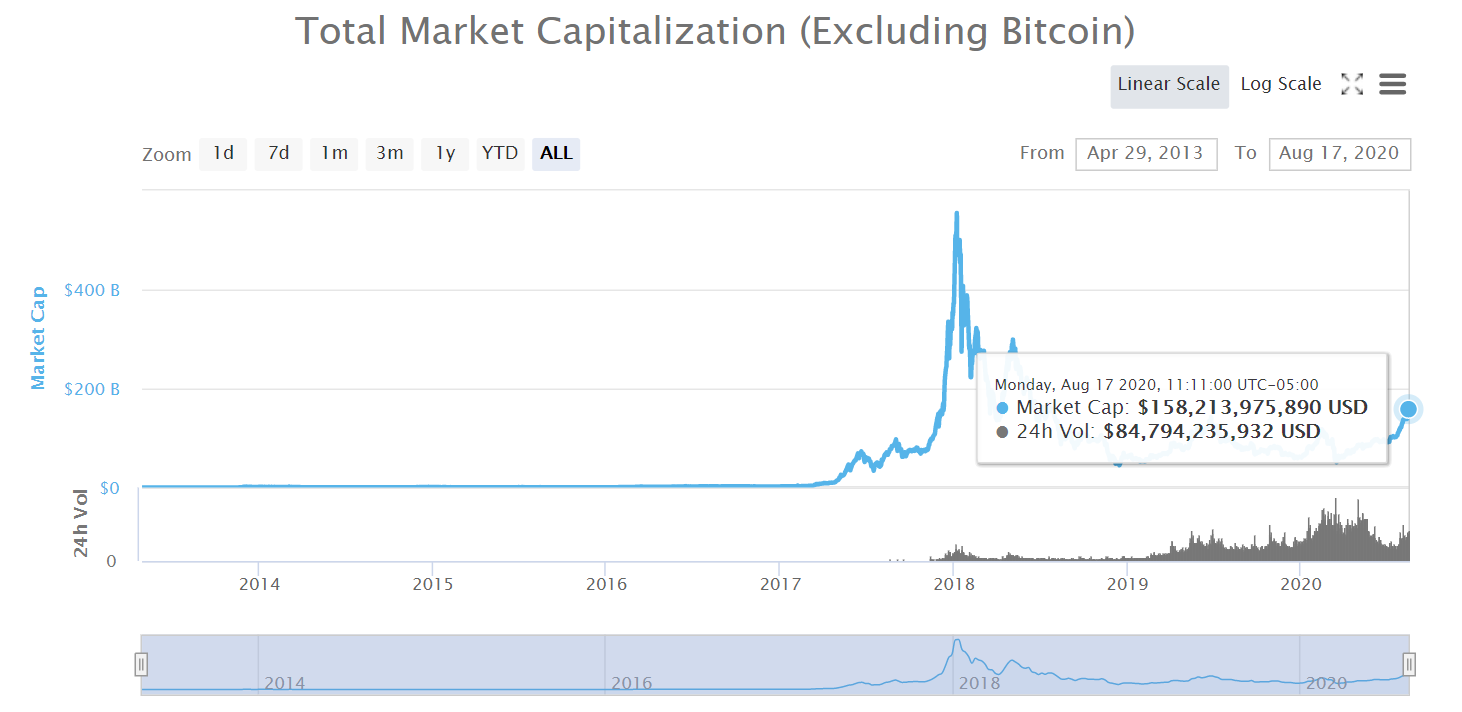

It’s official. Alt season is here, and non-bitcoin cryptos are doing what they do best: pump. Total crypto markets have seen a surge from $165 billion in March to almost $400 billion today.

But this market is for the altcoins, which are nearing $160 billion of value. In other words, what in March was the total crypto market cap is now the entire altcoin market cap.

Blockchaincenter.net has set up a page with an index meant to determine when alt season is happening. Today is alt season. And it has a 90/100 rating.

While institutions keep adding bitcoin to their treasuries, it also means that smaller traders have some powder in the keg. A few things have happened since the 2017/2018 bull run to make this alt season epic.

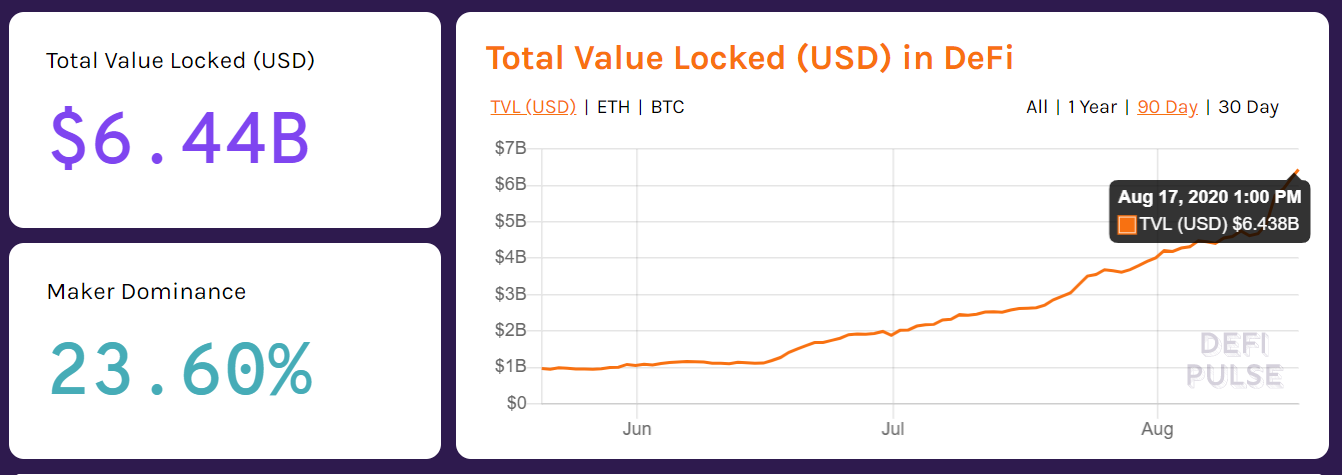

The DeFi craze, with promises of freedom from banks, has made headlines as $6 billion is now locked up. What’s more, decentralized exchanges, namely Uniswap, has allowed almost any coin to be listed without having to pay exchange listing fees.

If you can write a smart contract, you can sell a coin. Uniswap has added a nice dose of the Wild West back into the mix.

https://twitter.com/Uniswapgems/status/1295347304803835909?s=20

The result? A whole swathe of people are hunting for so-called Uniswap Gems. That, in turn, has set the ETH price, and its corresponding transaction fees, through the roof.

In addition, the crypto world’s newfound love of yield farming is pouring money into the market. Chainlink and other oracle tokens have quintupled and more, in just a few months.

Cause Célèbre

Justified or not, money is now in alts. On the other hand, the macro perspective still looks good. People are distrustful of the bubbling stock markets. The U.S. Federal Reserve jammed liquidity into the markets by printing more cash. Institutional investors are finally looking beyond the dollar to store their wealth.

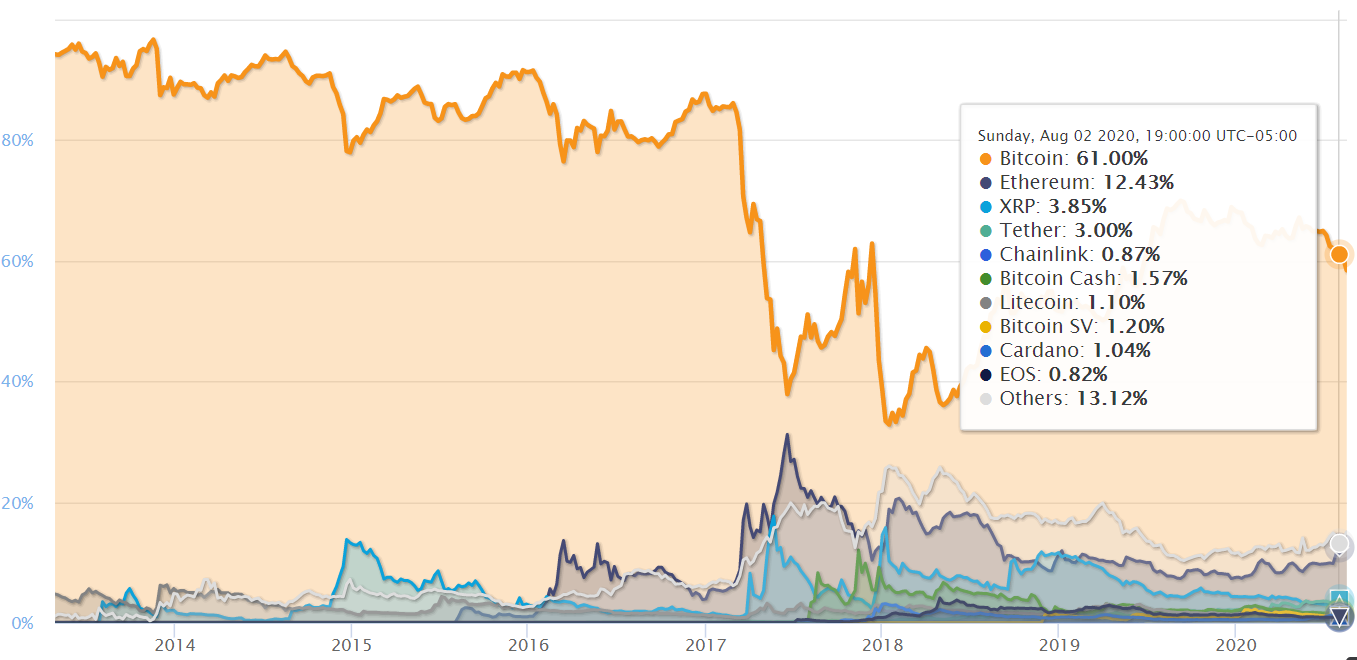

Perhaps the most significant indicator is Bitcoin dominance, which dropped below 60% this week. BTC dominance has not seen these levels in a year. The last major dips in BTC dominance happened with the outperforming run-up in altcoins.

With all the crazy gains of tiny cap coins, some bigger ones have yet to really take off. Litecoin (LTC) and Ripple (XRP) have had traders screaming for weeks for a breakout. They are slowly rising, but nothing on the scale of Chainlink.

Some active crypto traders have boasted they are basically getting free money, everything is pumping so hard. The front pages of CoinMarketCap and Coingecko are bright green.

https://twitter.com/Crypto_Bitlord/status/1287450380490563585?s=20

But it’s important to remember what goes up often must come down.

Careful What You Wish For

Some small-cap altcoins have seen great excitement, especially if the word ‘DeFi’ is attached. Some coins like LID and CNS promise insane daily dividends but are not transparent about who’s in their team.

Others like SUKU offer a special blockchain-driven standard seal of approval, but the technology doesn’t stand out from other supply-chain authenticator coins.

The fact is that many of these projects will fail, just like so many ICOs did in 2017 and 2018. Others might even do what they do well. But some have no revenue outside of seed capital and coin price. Some are just unlucky.

If you're losing money in this market you should probably reevaluate

— Empty (@Fullbeerbottle) August 17, 2020

It is exciting. And with that excitement comes crazy money. Making it and losing it. The total crypto market cap is still half of the last peak, and even ETH is still 70% from its all-time high. There is definitely room for growth and higher long-term support.

Exuberance is great, but this market is not regulated. 10x’ing your money is one thing. Selling it before it crashes is another. Hopefully, the attention this brings will take crypto closer to adoption.

Disclaimer: The opinions in this article do not necessarily reflect the views of beincrypto.com.