USDC Driving Liquidity

Recent research by Messari’s Jack Purdy (@jpurd17) has revealed that the Coinbase and Circle USD Coin (USDC) is largely responsible for this increase.He added that $400 million in USDC has been added by Maker governance in order to restore the Dai dollar peg as its demand has increased in recent months. With new yield farms appearing and a surge in interest for non-fungible tokens, Dai has been the stablecoin of choice for many. The Dai Savings Rate is still zero, so most of it is being used as collateral in higher-yielding liquidity pools. Purdy added that this increased demand has led to debt outstanding increasing from $200 million to over $900 million in the past few months. The Dai supply currently stands at around $900 million, an increase of over 1,000% over the past six months. The researcher concluded that Maker could regain lost ground over newer DeFi platforms as interest rates rise. The latest announcement from Maker is the addition of Chainlink, Loopring, and Compound tokens for use as collateral in its vaults:While new governance tokens and sky-high APYs stealing all the attention during the latest DeFi Summer

— Jack Purdy (@jpurd17) September 30, 2020

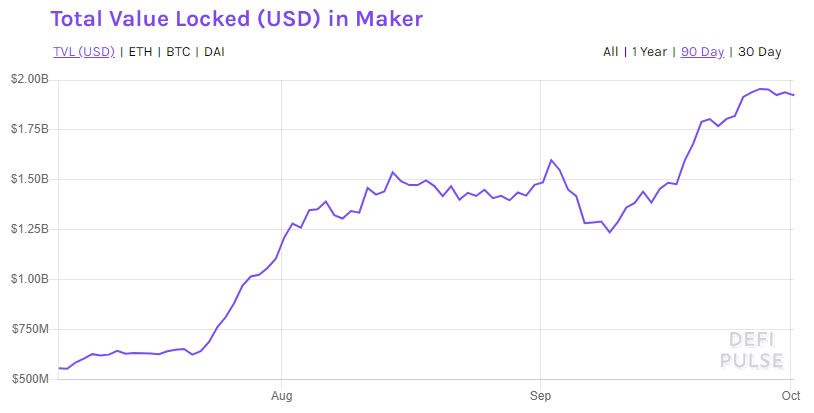

Maker has quietly grown to almost $2 billion in value locked pic.twitter.com/DId9JP443X

Loopring ($LRC) @loopringorg

— Sky (@SkyEcosystem) September 30, 2020

Compound ($COMP) @compoundfinance

and Chainlink ($LINK) @chainlink are now available to use as collateral in Maker Vaults. pic.twitter.com/V8mmJiXwLS

MKR Climbs 17%

Maker’s native token, MKR, has also been progressing in terms of price action recently. MKR has added 17% on the week in a move from just over $500 to the current price of $590.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.