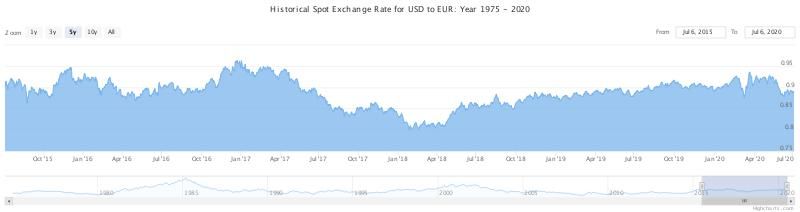

The euro is one of the world’s most renowned and stable fiat currencies, competing only with the US dollar if at all.

In 2020, France and other EU countries are preparing to take the union’s dominance one step further by introducing a CBDC version of the euro.

Used by 19 different countries in the Eurozone, the euro is incredibly resistant to geopolitical issues at a macro level. Instead, its value is often tied to the strength of the entire European economy and the debt levels of individual countries.

In turbulent times, investors flock to the U.S. dollar instead of the euro due to the greenback’s perceived stability.

France’s First Foray Into Digital Currency Technology

In April, the Bank of France invited applications from all over Europe for central bank-issued crypto solutions. While these projects would not be used for real-world CBDC implementations, the central bank said that it was looking to better understand the risks and opportunities associated with the underlying technology. In its follow up document, the bank explained that it was looking for innovative solutions that tackled common challenges related to security and performance, regardless of the underlying technology. Ultimately, this meant it gave applicants the flexibility to work outside the constraints of blockchain technology. Since then, the French central bank has already conducted tests on blockchain-based CBDC implementations. In May 2020, it partnered with French investment bank Société Générale (SocGen) for a limited trial involving the issuance of security tokens. As part of the experiment, Societe Generale issued bonds to the tune of €40 million. The payment was settled in ‘digital euro form’ (i.e. CBDC), issued by the Bank of France. SocGen said that the collaboration highlighted the feasibility of using blockchain-based assets for wholesale, inter-bank settlements. With the inclusion of smart contracts, the cost and time savings could motivate financial institutions to adopt the technology in the near future. The test also presents a key distinction between the CBDCs proposed by France and other countries. While most state-backed digital currencies are meant for use by individual citizens, France has mostly focused on wholesale use. In other words, the country wants to bring tokens to banks and financial institutions before it considers rolling out a retail-based solution. No other public tests have been conducted yet, and the Bank of France is expected to shortlist as many as ten applicants by July 10, 2020. The selection will largely be based on the ‘innovative’ merit of each application.CBDC Efforts Elsewhere in the EU

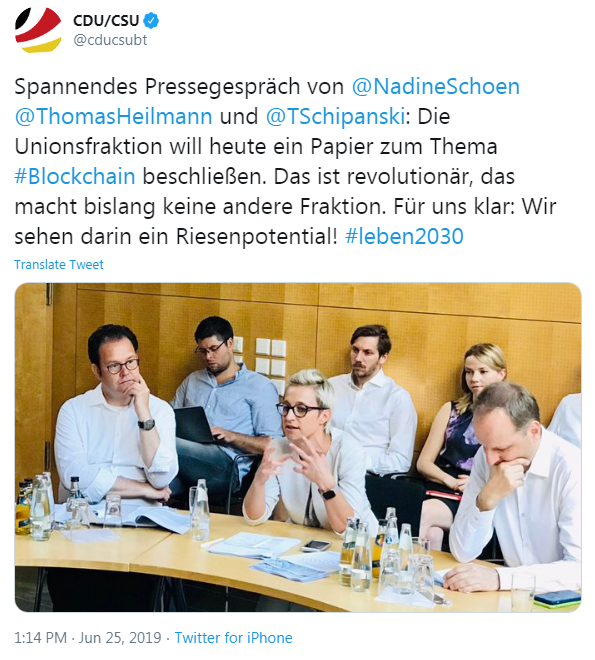

Interestingly, France is not the only country in the European Union, advocating for a Central Bank Digital Currency. The Netherlands, Germany, and Sweden are among the few member nations that have spoken favorably about state-backed digital currencies of late.

“make it accessible to a global infrastructure.”The Union went on to explain that the central bank-issued token would not replace existing fiat currency. This would prevent the institution of a parallel economy and allow authorities to monitor each unit of the currency. Furthermore, they could freeze e-Euro tokens involved in any criminal activity and confiscate them if necessary. It also pitched the e-Euro as a disruptor in the cross-border payment ecosystem. Decentralized cryptocurrencies already settle international transactions in a timely and cost-efficient manner, particularly when compared with traditional alternatives such as SWIFT.

The EUROchain Experiment and Controversy

Where EUROchain Fell Short

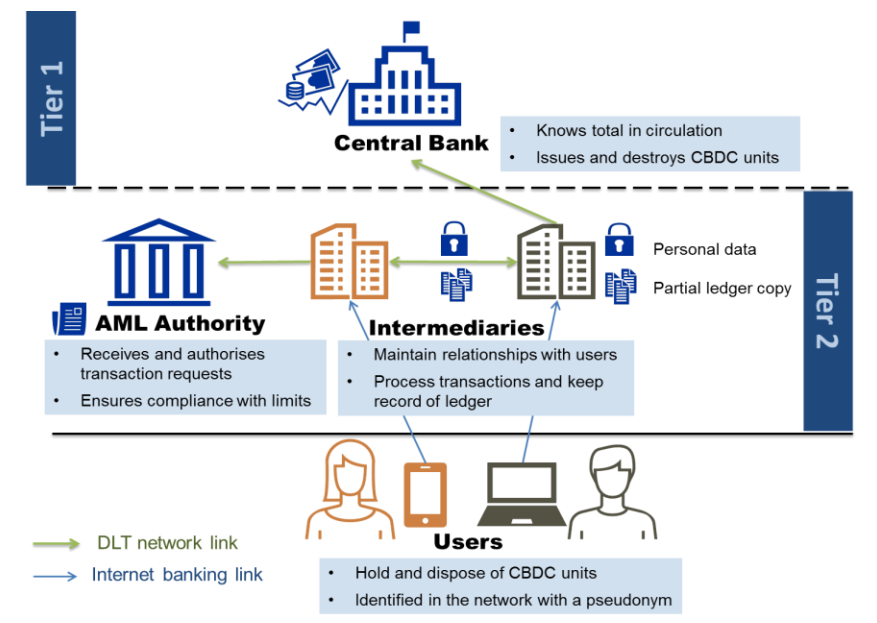

EUROchain critics quickly pointed out that the blockchain and resulting tokens would be highly centralized, neutralizing most of the advantages afforded by the technology. Under the research assumptions, the ECB would be the sole controller of EUROchain. It could dictate its own terms on issuance, supply, and even wallet generation. This leaves no scope for peer-to-peer transactions, requiring all funds to go through a trusted intermediary such as a bank. Furthermore, the system borrows heavily from Bitcoin’s UTXO model, which is not capable of providing complete anonymity.

Why European Central Banks Are Pushing for a CBDC

Ever since Facebook announced its Libra project, governments around the world have started to pay more attention to the cryptocurrency ecosystem. Over the years, Facebook has garnered its fair share of criticism. This ranges from regulatory pushback to breaches of privacy and lapses in security. Now that the social media giant has entered the financial domain, many nations realize the need for a competing solution. Federal Reserve Chairman Jerome Powell has warned that Libra could lead to global financial instability. To that end, governments are stepping up their efforts to design and launch their own CBDCs before the private sector takes control of the market. The European market is no different. Most countries are accelerating their research into CBDCs. In 2019, Governor of the French Central Bank, François Villeroy de Galhau, spoke about this issue at length. He explained:“The creation of a central bank digital currency … is neither a precondition for nor a guarantee of more efficient payments. However, we as central banks must and want to take up this call for innovation at a time when private initiatives – especially payments between financial players – and technologies are accelerating, and public and political demand is increasing. Other countries have paved the way; it is now up to us to play our part, both ambitiously and methodically.”

Digital Currencies in a Cashless World

Private tokens are not the only threat governments have to contend with. Worldwide, physical cash is rapidly going out of fashion. While banknotes are currently still legal tender, companies like PayPal in the West and WeChat in the East are becoming commonplace. This is especially true in certain countries like China and Sweden, where the overwhelming majority of transactions are cashless. In fact, cash usage has declined so significantly that the Chinese central bank had to warn businesses against refusing cash payments. For central banks, a completely cashless society could lead to a public losing faith in its financial institutions. If money becomes synonymous with names such as Libra, PayPal, and Stripe, the central bank’s perceived importance diminishes. With its members dead-set on making CBDCs a reality, it’s likely that the European Union will come up with a ‘digital euro’ solution sooner rather than later. However, given the euro’s renown and credibility, the ECB must tread carefully. Any missteps could negatively affect its prized fiat currency. Do you think European central banks will adequately address the complex issues surrounding future CBDC design?Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rahul Nambiampurath

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

READ FULL BIO

Sponsored

Sponsored