Hyperliquid offers a TradFi trading experience to on-chain users. On it, you can benefit from low fees, advanced order types, and spot and perpetuals contracts. However, getting started on the platform can feel intimidating for some. This step-by-step guide demonstrates how to trade perpetual futures on the Hyperliquid exchange.

KEY TAKEAWAYS

➤ Hyperliquid offers a TradFi-like trading experience with low fees and advanced order types but requires complex onboarding steps.

➤ The platform allows users to trade spot and perpetual futures contracts, including on a testnet to practice with mock assets.

➤ Hyperliquid’s self-funded model and lucrative airdrop have contributed to its popularity, though users must navigate the inherent risks of trading.

➤ Trading on Hyperliquid involves operational security risks, as its private validator setup enables potential censorship.

How to trade perpetual futures: Step-by-step

To trade perpetuals on Hyperliquid, you will need to:

- Acquire an EVM-compatible wallet or an email.

- Acquire USDC and ETH on Arbitrum.

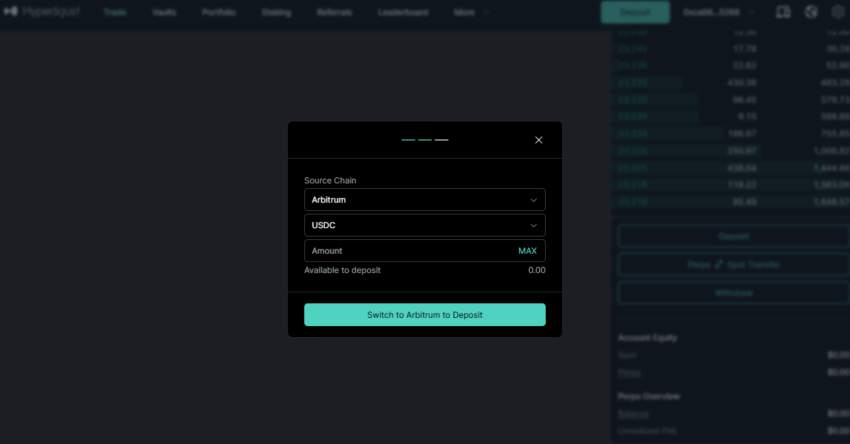

- Bridge USDC and Arbitrum to Hyperliquid.

- Sign in to the Hyperliquid exchange with your wallet or email.

- Deposit USDC into your exchange account.

- Begin trading.

Here’s each step in detail.

Step: 1 Get started with a wallet

You can sign into Hyperliquid using an email or wallet. For this guide, we will use the MetaMask wallet. For a more detailed guide on how to set up a wallet, check out our complete guide on using MetaMask.

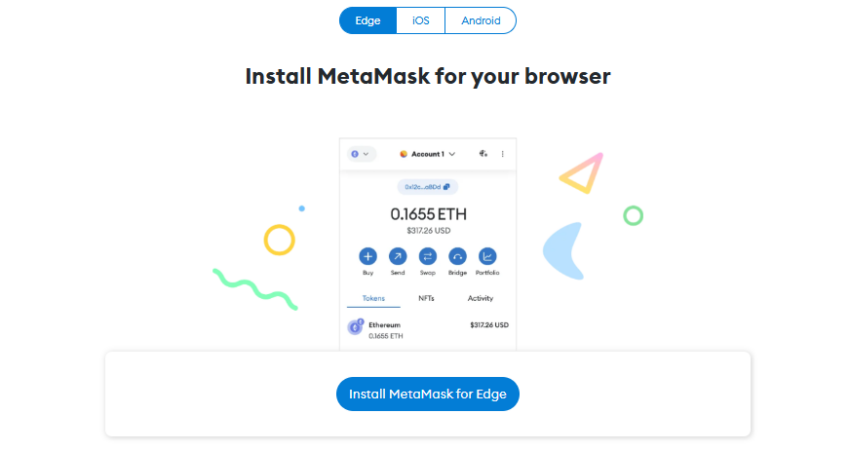

1. Download a wallet: Download the MetaMask wallet. It is available on most Chromium-based browsers, Android, and iOS.

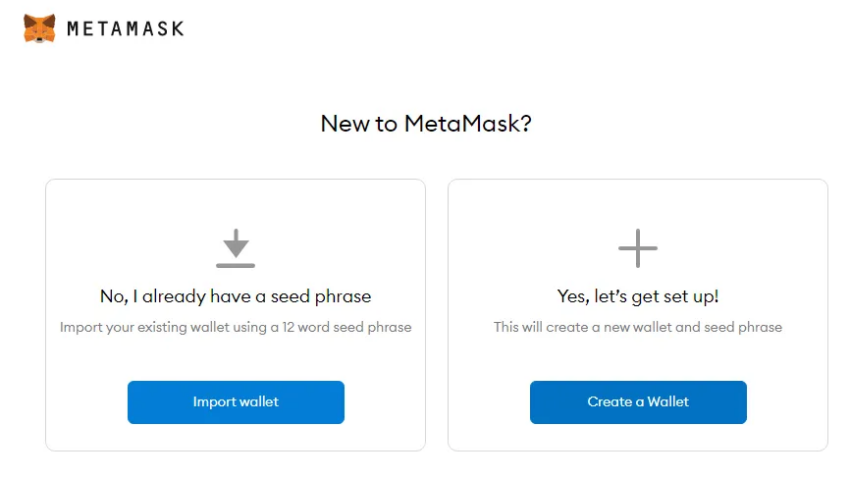

2. Create a new wallet: You can either import an existing wallet or create a brand-new wallet.

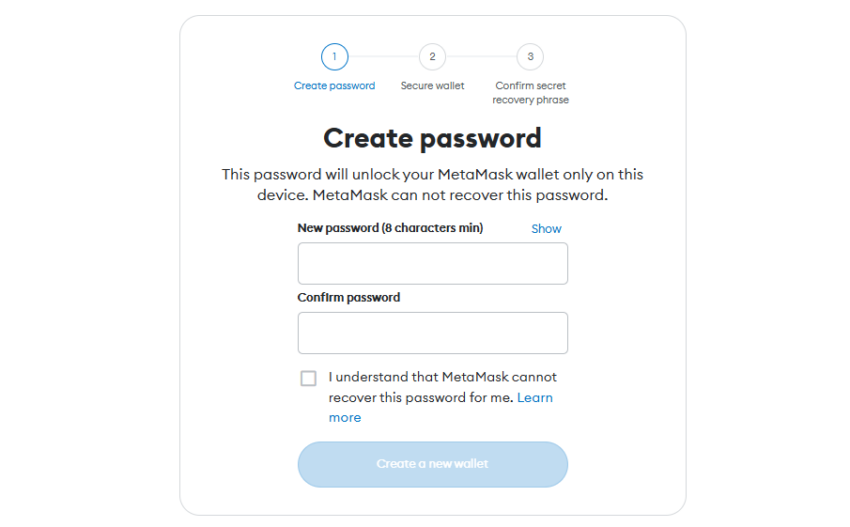

3. Secure your wallet: Create a strong password to secure your MetaMask wallet. It must be at least eight characters. Use symbols and special characters for added security. You will also need to record your seed phrase and store your private key in a safe place.

You should never share your password, seed phrase, or private keys. It is also not good operational security to store your seed phrase or private keys in any cloud accounts.

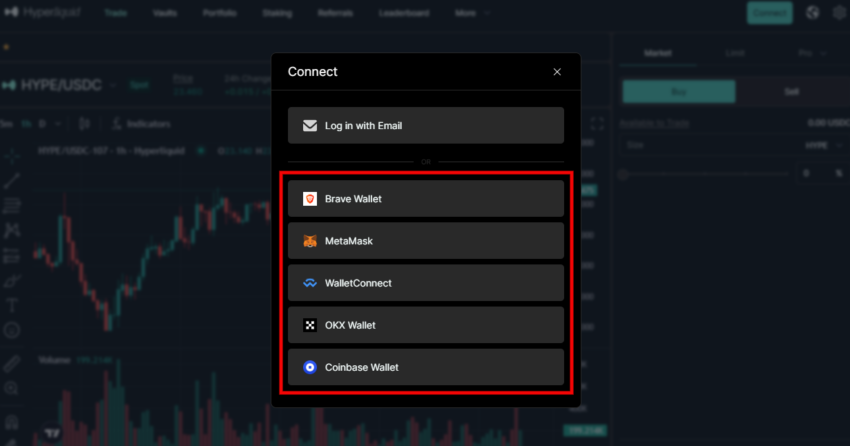

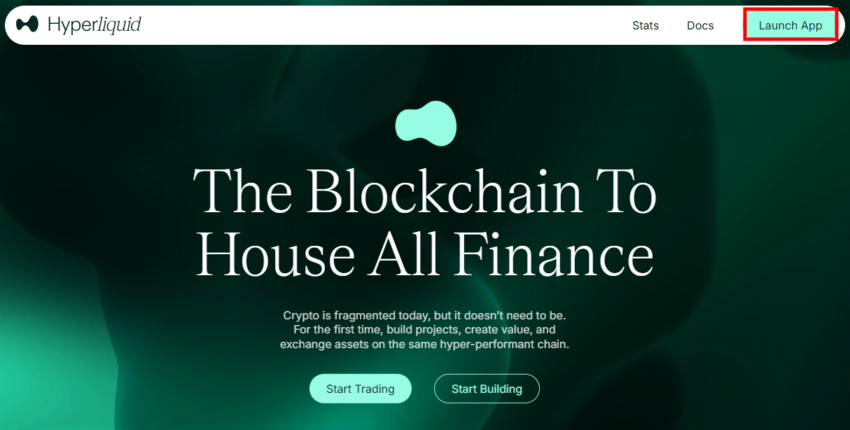

4. Connect your wallet: Navigate to the Hyperliquid website and launch the app. Observe the list of supported wallets, then select the appropriate one to sign in.

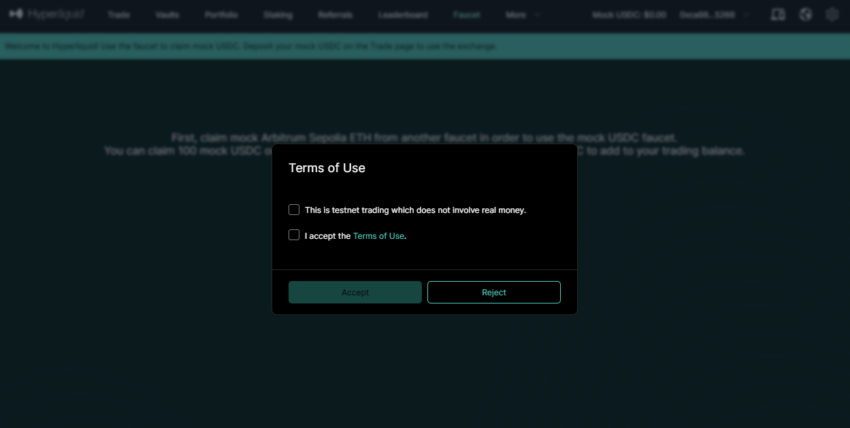

5. Accept the Terms of Use: Please read and accept the Terms of Use to continue if you agree with the conditions.

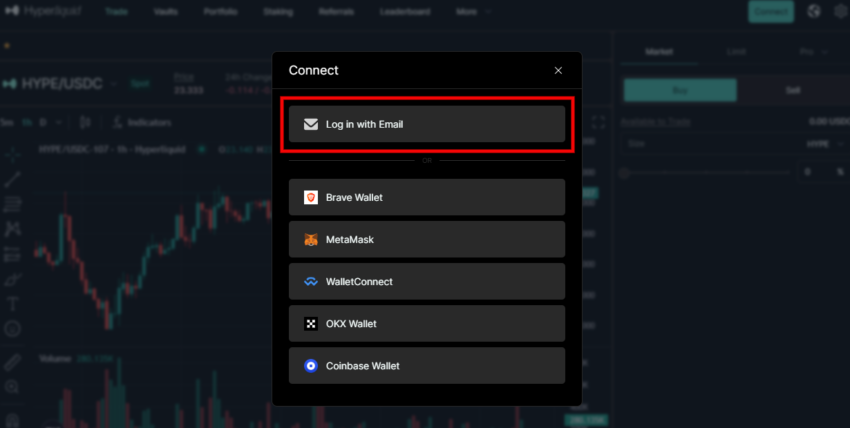

1. Navigate to the website: Go to the website and launch the app.

2. Enter your email address: On the following page, enter your email address. After you submit your email, you will receive a 6-digit code in your email. Type in the code to log in.

Step 2: Acquire ETH and USDC

After you sign in, you will need to acquire Arbitrum Ethereum (ETH) and USDC for transactions and trades. ETH will only be used to pay gas fees for depositing USDC. USDC will be used as collateral or margin for your Hyperliquid trading account. Here is a list of exchanges that you can use to purchase ETH and USDC:

After you acquire ETH and USDC, you will have to bridge your tokens to Arbitrum and then from Arbitrum to Hyperliquid. If you signed up with a wallet, switch to the Arbitrum network.

If you used an email address, a new blockchain address was created for you. You will still need to send Arbitrum USDC from an exchange or a wallet to the blockchain address attached to your email.

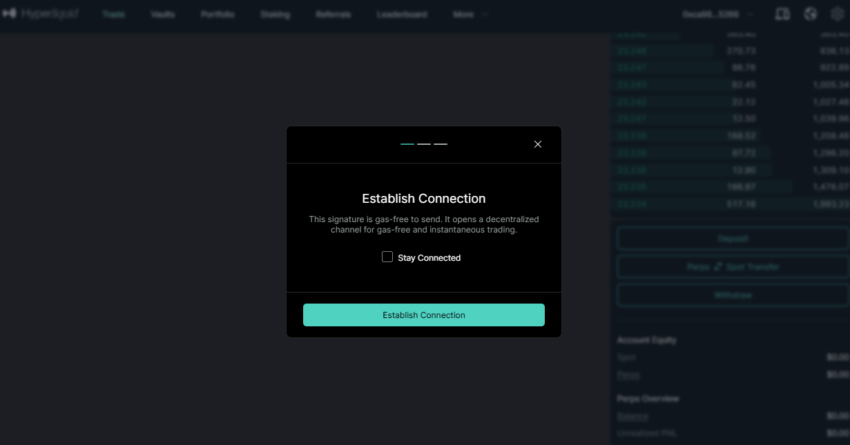

1. Establish a connection: Firstly, after you have acquired ETH and USDC, you will need to establish a connection on Hyperliquid. Connect your wallet and sign the following transaction in your wallet.

2. Bridge to Hyperliquid: Secondly, you will have to bridge your ETH and USDC from Arbitrum to Hyperliquid. You can use the Arbitrum bridge or Squid router. You will only use ETH for gas when you deposit USDC. Trading on Hyperliquid is gas-free.

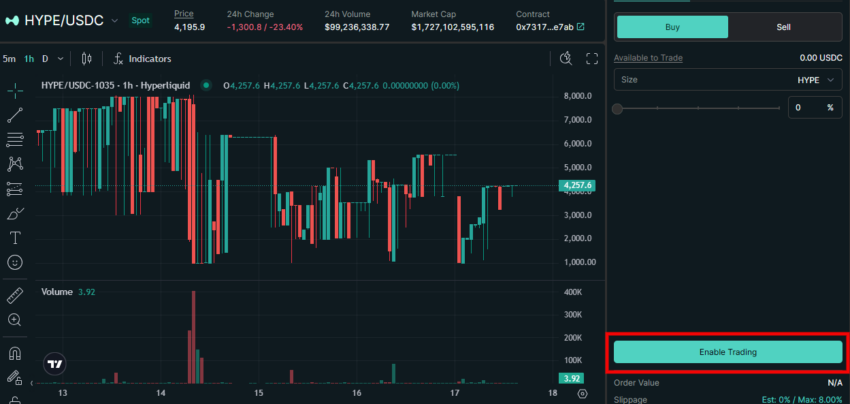

3. Enable trading: Select “Enable Trading” to deposit the USDC into your trading account. After this, you are ready to begin trading perpetuals on Hyperliquid.

Step 3: Place trades on Hyperliquid

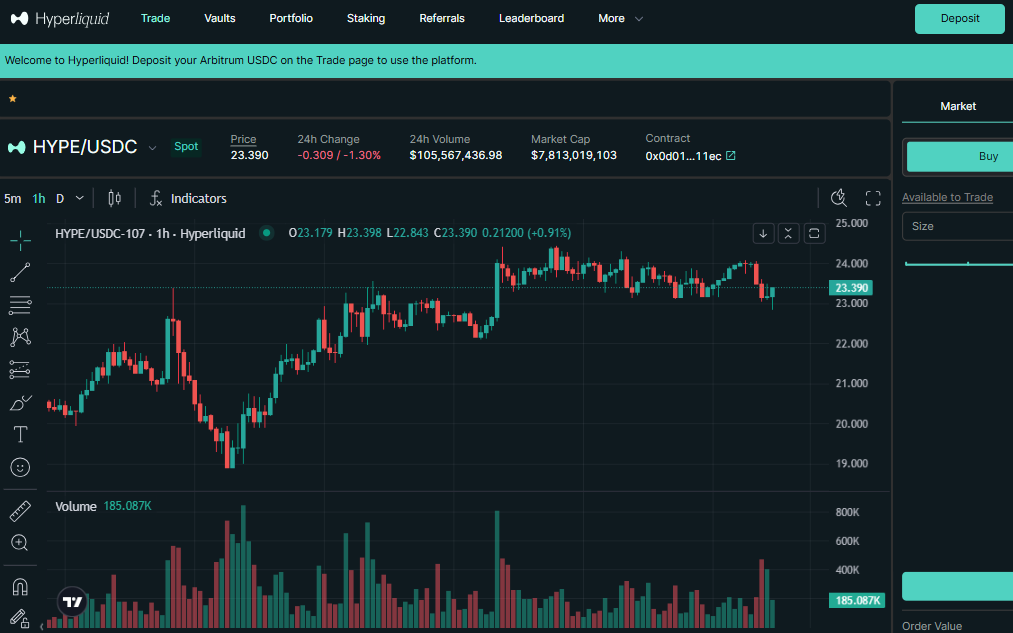

Placing trades on Hyperliquid is rather straightforward and differs very little from most trading interfaces. Here is how it works.

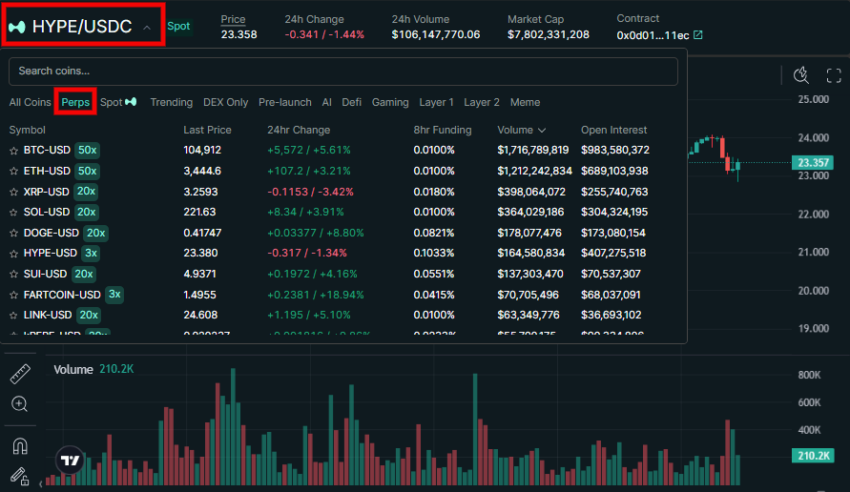

1. Select the contract: Select the perpetual contract using the token selector.

2. Create an order: Decide whether to take a long or short position.

3. Select the position size: Select the size of your position using the slider. This is the amount of leverage you wish to use.

5. Select order type (optional): You can select your order type if you so choose. The default order type is a market order.

5. Place your order: Select “Place Order” to purchase the perpetual contract. Click “Confirm” in the pop-up. You can opt to forego the confirmation message in the future by selecting the “Don’t show this again” box.

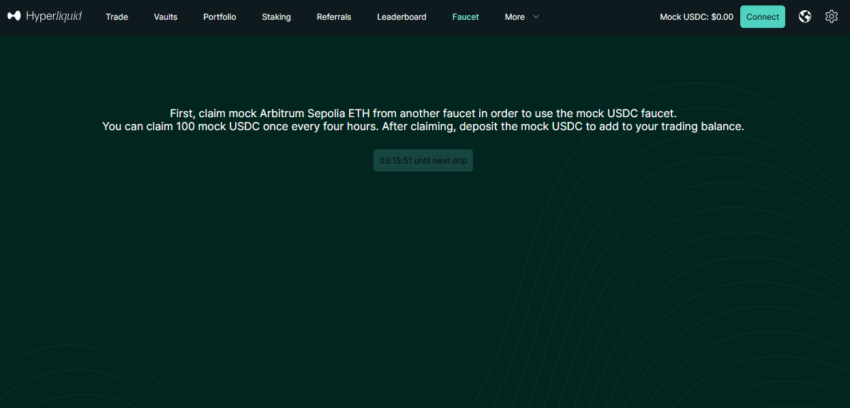

Trading perpetuals on the Hyperliquid testnet

If you are strapped for cash or just want to begin trading without risking any real capital, you can trade perpetuals on the Hyperliquid testnet. This process is similar to trading on the mainnet, except that you must use the Arbitrum Sepolia testnet.

1. Acquire Arbitrum Sepolia ETH: You will need to acquire Arbitrum Sepolia ETH through a faucet for gas and swap it for mock USDC. Some of the popular faucets are:

- Alchemy

- Chainlink

- Quicknode

Acquiring testnet ETH used to be free but rate limited to filter out Sybil accounts. As of July 2025, most faucets will require you to have about 0.5 ETH in your wallet to receive testnet tokens. This ETH balance will not be used to swap, but is used to filter out Sybil accounts.

2. Login with wallet: Log in to your wallet. Navigate to the testnet site for Hyperliquid. Log in to the platform with your wallet and accept the terms if you agree with them.

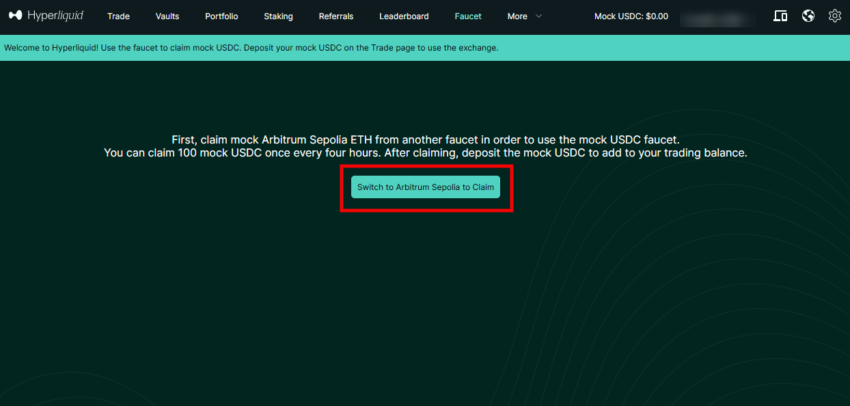

3. Switch networks: After you log in to your wallet, switch to the Arbitrum Sepolia Network to claim mock USDC.

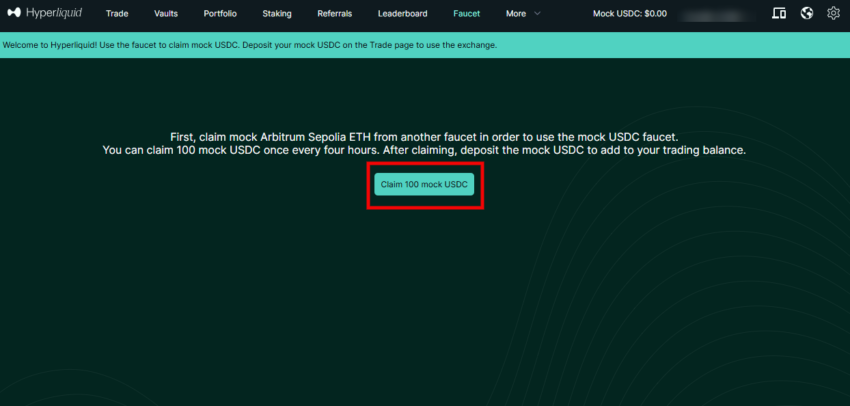

4. Claim mock USDC: After you have acquired a wallet, acquired Arbitrum Sepolia ETH, and logged into the testnet site, you can claim 100 mock USDC.

5. Enable trading: Enable trading on your account to start trading perpetuals.

6. Deposit mock USDC: Deposit the mock USDC that you acquired from the faucet to the platform to begin creating trade orders.

Demonstrating a trade on the Hyperliquid testnet

Below is a demonstration of an actual trade taking place on the Hyperliquid testnet. In it, you can see that the BTC/USD perpetual contract is selected.

Before the actual trade is placed, you can observe around the three-second mark, where we can cycle through the different order types. As you can see, each order type has different order options customized to that type. We ultimately chose the market order to buy long, as this is the simplest order type.

At around 23 seconds, we selected the contract size or the leverage. Because we are working with a limited amount of mock USDC, we kept the leverage small, at 24%.

Now that the parameters of the order are created, it is time to place the order. A pop-up will occur to confirm your order. After you confirm, the order is executed and happens nearly instantaneously.

What is Hyperliquid?

Hyperliquid is an application-specific layer-1 blockchain. It is optimized to support its natively built spot and perpetual exchange. Jeff Yan and Illiensic co-founded Hyperliquid Labs and were classmates at Harvard.

Hyperliquid became popular because it is entirely self-funded and does not take any venture capital. The airdrop was extremely lucrative for recipients because there were no private investors who could use retail holders as exit liquidity. Additionally, the HYPE token maintained its value after the token generation event, which sets it apart from most airdrops.

What to know before trading on Hyperliquid

It is important to keep in mind that trading on Hyperliquid requires a number of intermediate steps. This includes creating a wallet, buying crypto, sending the crypto to your wallet, bridging, etc.

Therefore, you should practice good operational security throughout each process. Additionally, the Hyperliquid network is a private blockchain and has the same validator set for the bridge and Hyperliquid layer-1.

This means that the validators could censor transactions or trade against you, which could impact your trades.

Hyperliquid validators are the broker-dealers in this scenario. They make trades on behalf of users and can control orders sent to the order book because they run validator nodes. Therefore, they could censor transactions or make trades for their own benefit.

Easy trading, complex onboarding

While the trading experience on Hyperliquid is comparable to a centralized exchange, the onboarding is slightly more complicated. It is important to take the necessary precautions so as not to become vulnerable to any security risks. Always remember to exercise safe trading practices manage your emotions, and never risk more capital than you can comfortably afford to lose.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Trading perpetual futures is a high risk activity, and you can lose money. Always do your own research (DYOR).

Frequently asked questions

To trade on Hyperliquid, you must acquire ETH and USDC. Bridge the ETH and USDC to Hyperliquid. Connect your wallet to the exchange and deposit USDC to begin trading.

Hyperliquid is a blockchain and exchange that specializes in trading spot and perpetuals contracts. It became popular due to recreating a TradFi trading experience on-chain. Transactions on Hyperliquid are cheap, fast, and do not require gas fees.

Hyperliquid has some centralization risks. The validator set is small and the majority of the stake is held by the Hyperliquid foundation. Users should remain aware of these risks and never risk more capital than they can comfortably afford to lose.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.