Asset management firm Grayscale is set to launch the first US-based XRP trust, opening the door for a possible exchange-traded fund (ETF). The fund will offer eligible investors direct exposure to Ripple’s native token.

The Bitcoin ETF approval set the stage for other similar financial instruments like Ethereum. While Solana’s ETF prospects diminish, XRP is presenting as a possible next in line.

Grayscale to Pioneer XRP Trust in the US

Fox Business reported a so-called “closed-end” fund expected to offer direct exposure to XRP. Grayscale released the four-stage product life cycle plan for the XRP trust fund, and could pursue regulatory approval to have it converted into an ETF in the future.

“We believe Grayscale XRP Trust provides investors with exposure to a blockchain solution that is potentially positioned to play a crucial role in optimizing legacy financial systems by streamlining cross-border payments,” said Rayhaneh Sharif-Askary, Grayscale’s head of product and research.

Noteworthy, while an ETF demands approval from the SEC before being presented to retail investors, a trust uses a different structure, with the sales pitch targeted at select investors. This differentiation gives it a lighter regulatory touch and explains Grayscale’s first-mover advantage.

Read more: XRP ETF Explained: What It Is and How It Works

The XRP Trust comes barely a day after the firm opened a Sui Trust, providing accredited investors access to SUI. Beyond XRP and SUI, other Grayscale trusts include Solana (SOL), Polkadot (DOT), Aave (AAVE), Near Protocol (NEAR), and Stacks (STX). These are all open for daily subscription by eligible individual and institutional accredited investors.

Meanwhile, Grayscale’s GBTC and ETHE ETFs continue to give institutional investors access to Bitcoin and Ethereum, respectively. It also has an Ethereum Minitrust and a ProShares Ethereum ETF running. These developments mirror the premium that is associated with the firm’s brand and its management expertise.

Notably, the firm’s victory against the US SEC in August 2023 set the pace for spot Bitcoin ETF approvals in January 2024. The push to have Grayscale Bitcoin Trust converted to a spot BTC ETF reinvigorated the effort for BlackRock, Fidelity, and Wisdom Tree, among others, to pursue their own Bitcoin ETFs.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

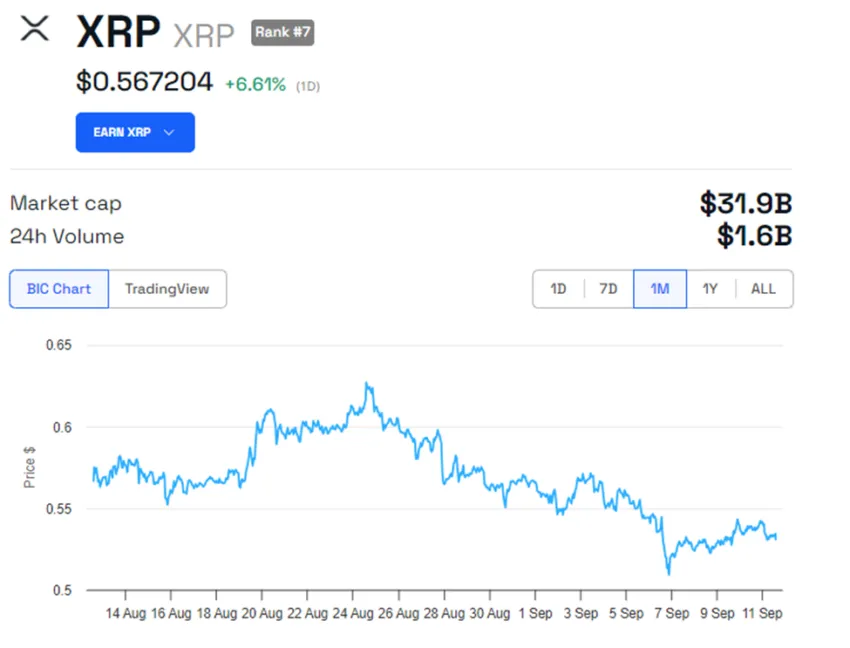

Like the SUI token, which rallied 20% on Grayscale Sui Trust announcement, XRP is up almost 7%. As of this writing, it is trading for $0.5672.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.