The United States Securities and Exchange Commission (SEC) has approved two spot Ethereum exchange-traded funds (ETFs) – Grayscale Ethereum Mini Trust and ProShares Ethereum ETF.

They are set to list on the New York Stock Exchange’s Arca platform. The SEC’s nod came through a Form 19b-4 filing, enabling NYSE Arca to initiate the trading of these funds.

Ethereum ETFs Await SEC’s Approval of S-1 Filings

However, trading for these two ETFs cannot start immediately. The final steps include awaiting comments on the ETFs’ respective S-1 filings.

“After careful review, the Commission finds that the Proposals are consistent with the Exchange Act and rules and regulations thereunder applicable to a national securities exchange,” the SEC said.

Read more: Ethereum ETF Explained: What It Is and How It Works

Grayscale Ethereum Mini Trust stands out as a key player. It represents an evolution from its predecessor, the Grayscale Ethereum Trust (ETHE), a closed-end fund that recently transformed into an ETF. This transition illustrates Grayscale’s strategy of adapting to investor needs and regulatory standards and offering more accessible investment products.

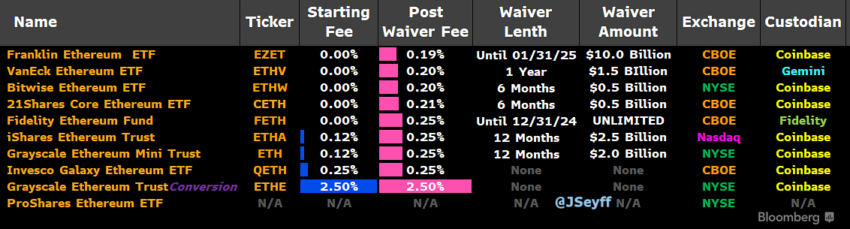

Bloomberg ETF analyst James Seyffart commented on the strategic asset allocation for the Grayscale Ethereum Mini Trust. This strategy aims to provide stability as the product launches, cushioning against potential outflows.

“The mini Ethereum ETF is set to launch simultaneously with the others. ETH will seed with 10% of ETHE’s assets essentially off the bat. This should help alleviate some of the likely Grayscale outflows,” Seyffart said.

Meanwhile, the ProShares Ethereum ETF entered the scene slightly late. Consequently, these ETFs are part of a broader wave of similar products soon hitting the market. A total of eight spot Ethereum ETFs are poised for imminent listing, pending final SEC approval.

These developments follow prolonged deliberations between issuers and the SEC. Such discussions highlight the rigorous scrutiny involved in introducing cryptocurrency-based products into regulated financial exchanges. This approach is crucial for ensuring investor protection while accommodating the growing interest in digital assets.

Moreover, the financial structure of these ETFs aims to attract investors. Most of the forthcoming Ethereum ETFs, including those from Franklin Templeton, VanEck, and Fidelity, will initially offer a 0% fee period. On the other hand, Grayscale’s offerings will maintain a higher fee structure, similar to its Bitcoin-focused funds, at 2.5%.

This reflects the premium associated with Grayscale’s brand and its management expertise in the cryptocurrency investment space.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.