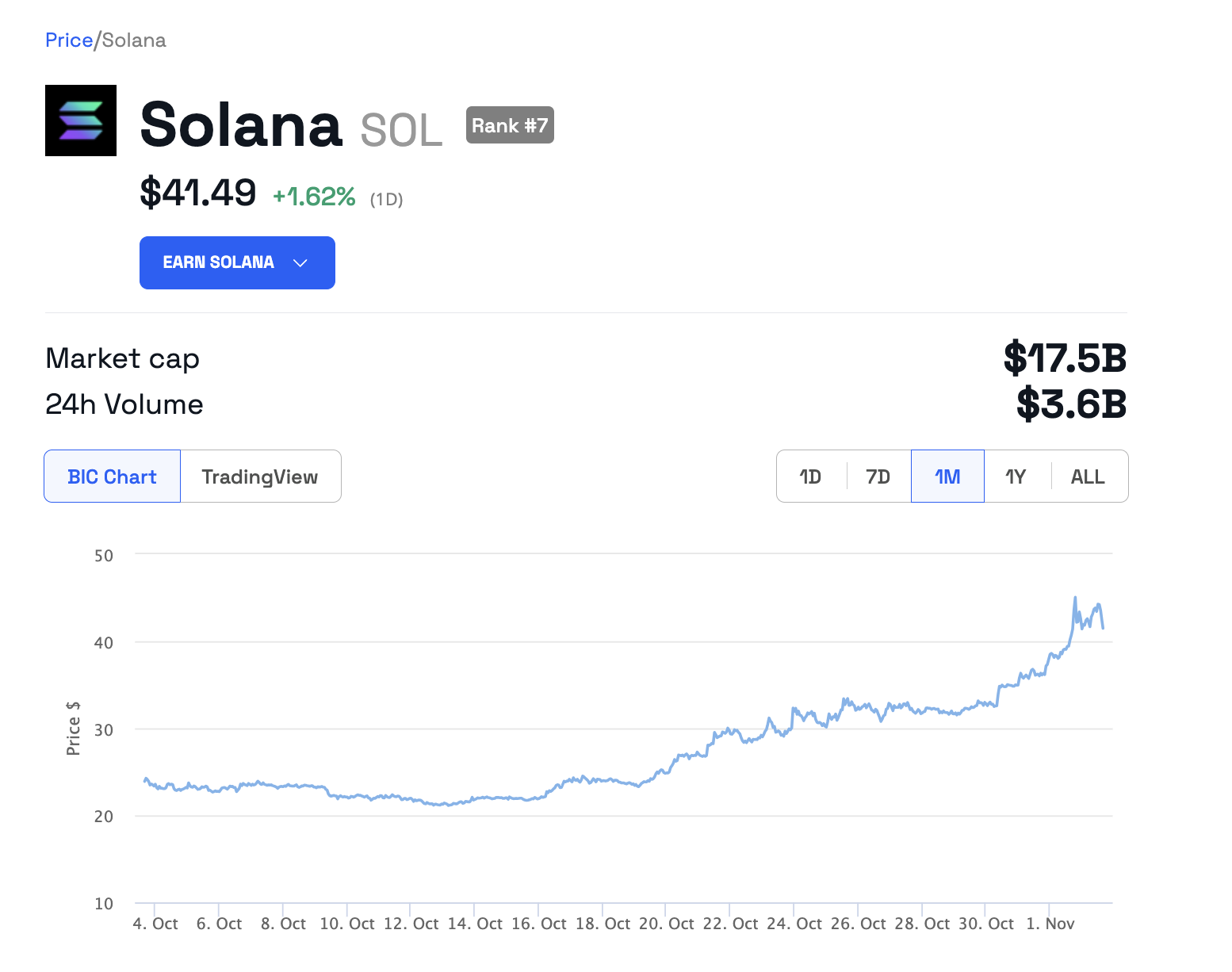

The price of Solana (SOL) has been up by over 80% in the past 30 days. Meanwhile, there has been a significant movement of funds in the FTX and Alameda research wallets. Has the price pumped to give a favorable exit to FTX?

It is a well-known fact that FTX and its sister trading company, Alameda Research, had significant exposure to Solana. As the company is undergoing bankruptcy, it needs to liquidate the assets to make the depositors whole.

Solana Outperforms Market While Spot Trading Volume Is at Yearly Lows

According to Bloomberg, the market depth and the spot trading crypto volume are at the lowest point in 2023.

Read more: Order Book: What Is It and How To Use It in Crypto Trading?

Despite the lower volume, Bitcoin rallied by over 25% in October. And Solana skyrocketed by over 80%, outperforming the flagship crypto, Bitcoin. On Wednesday, it recorded a new yearly high of $46, pumping over 25% in 24 hours.

FTX is Moving Solana: Is it a Pump and Dump?

Blockchain analytic platform Nansen told BeInCrypto that FTX and Alameda labeled wallets have been moving funds to Coinbase and other centralized exchanges. In total, there have been movements of $110 million worth of SOL tokens.

Due to the rally in Solana price, the community suspects a pump-and-dump scenario. As FTX has been selling SOL, the on-chain analysis platform Lookonchain posted on X (Twitter):

“Maybe someone is jacking up the price and selling?”

However, Nansen analysts declined to comment on whether there is a possibility of manipulation in SOL price, saying nothing is obvious or wrong with the transactions.

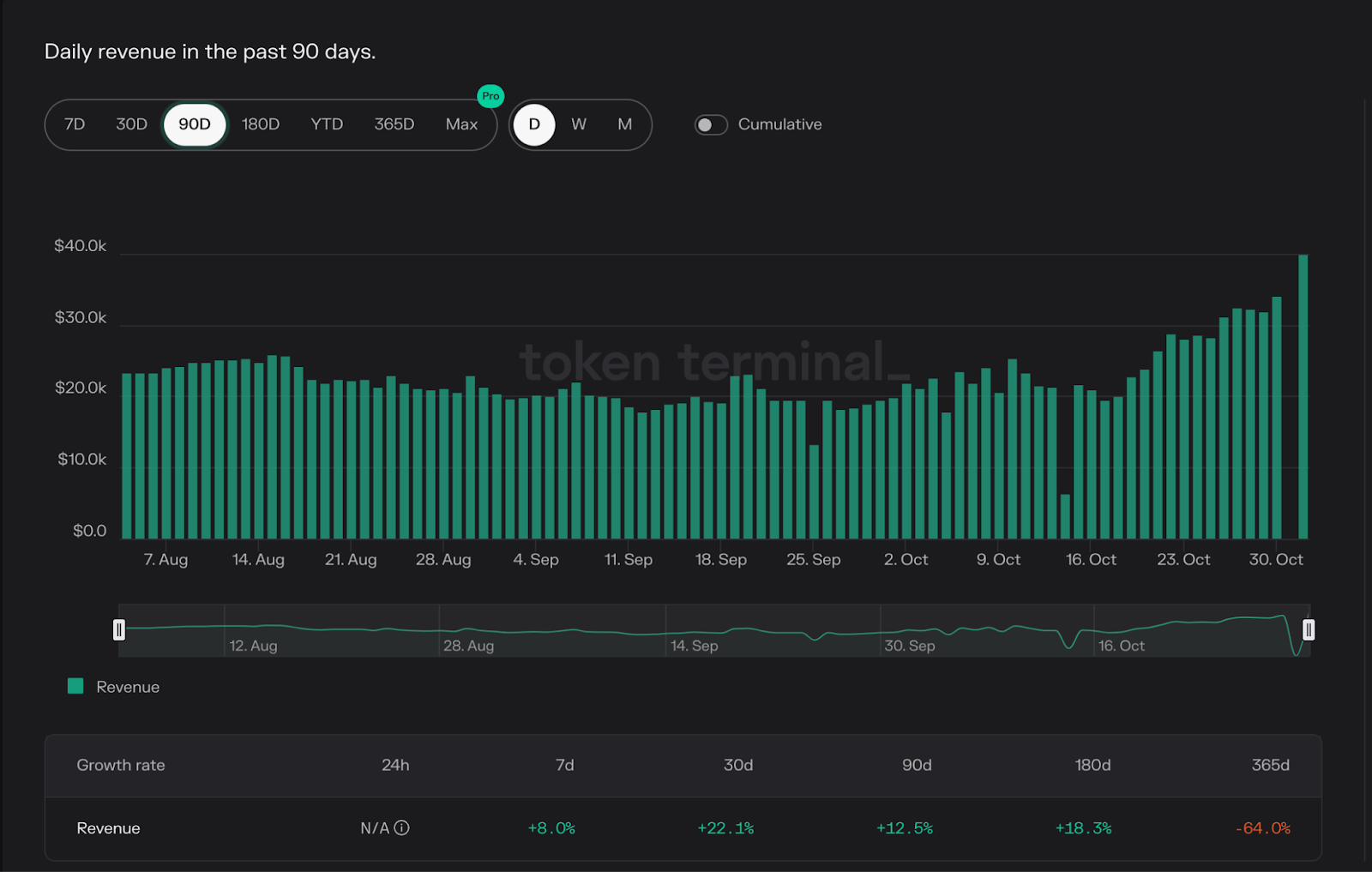

On the bright side, there has been a growth in on-chain metrics, along with the growth in price. For instance, the Solana revenue increased 22% in the past 30 days. Token Terminal defines revenue as:

“Share of transaction fees that are burned (accrue to SOL holders).”

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

Do you have anything to say about FTX’s Solana transactions or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.