The Oasis Network announced a partnership with SYNTHR on October 5, introducing a synthetic variation of its native token, ROSE.

The ROSE price has not reacted to the news positively so far. On the contrary, it began a downward movement on October 9.

Oasis Network Partnership Adds Multiple New Chains

In a groundbreaking partnership, Oasis Network, backed by a16z, is collaborating with SYNTHR to introduce syROSE. This is a synthetic iteration of ROSE, the native token of the Oasis ecosystem.

This innovative move unlocks omni-chain compatibility, bridging Oasis to multiple blockchain networks, including Ethereum, Arbitrum, Avalanche, Polygon, and BNB Chain.

SYNTHR, renowned for its technical prowess in supporting synthetic omnichain assets, aims to revolutionize liquidity access for users across ecosystems.

This strategic alliance not only enhances user privacy but also amplifies the utility of ROSE, facilitating swapping, staking, lending, and much more within the decentralized world of Web3.

Interview With Jernej Kos – Director at Oasis Foundation

Speaking to BeInCrypto, Jernej Kos, a director at the Oasis Foundation, spoke about the difficulties of implementing this integration, some key features designed for security and confidentiality, and ideas for future adoption.

Kos commented on the integration process, saying that SYNTHR’s initiative to unveil syROSE was enthusiastic, ushering in a new chapter of seamless access to all of Web3 for the global Oasis community.

Focus on enhancing user privacy is a key driver, with industry-leading confidentiality tools on the base layer.

“For builders already running dApps on other networks, we have built tools like the Oasis Privacy Layer framework. This is done so builders can add smart privacy to existing dApps running on any EVM network.” Kos added.

In the broader developmental trajectory, partnerships with entities like Transak, Oraichain, and Ocean Predictor exemplify the collaborative strides powering Oasis’s expansion.

These key collaborations aim to offer Web3 adoption through the Oasis Ecosystem, “from easy onboarding into Web3 and sophisticated upgrades to omnichain asset swaps and price exposure to Oasis privacy frameworks introduced to Cosmos, Ocean, and other ecosystems, the future of Oasis integration into Web3 is extremely bright.” Kos added.

Read More: 9 Best Crypto Demo Accounts For Trading

ROSE Price Prediction: How Will Price React?

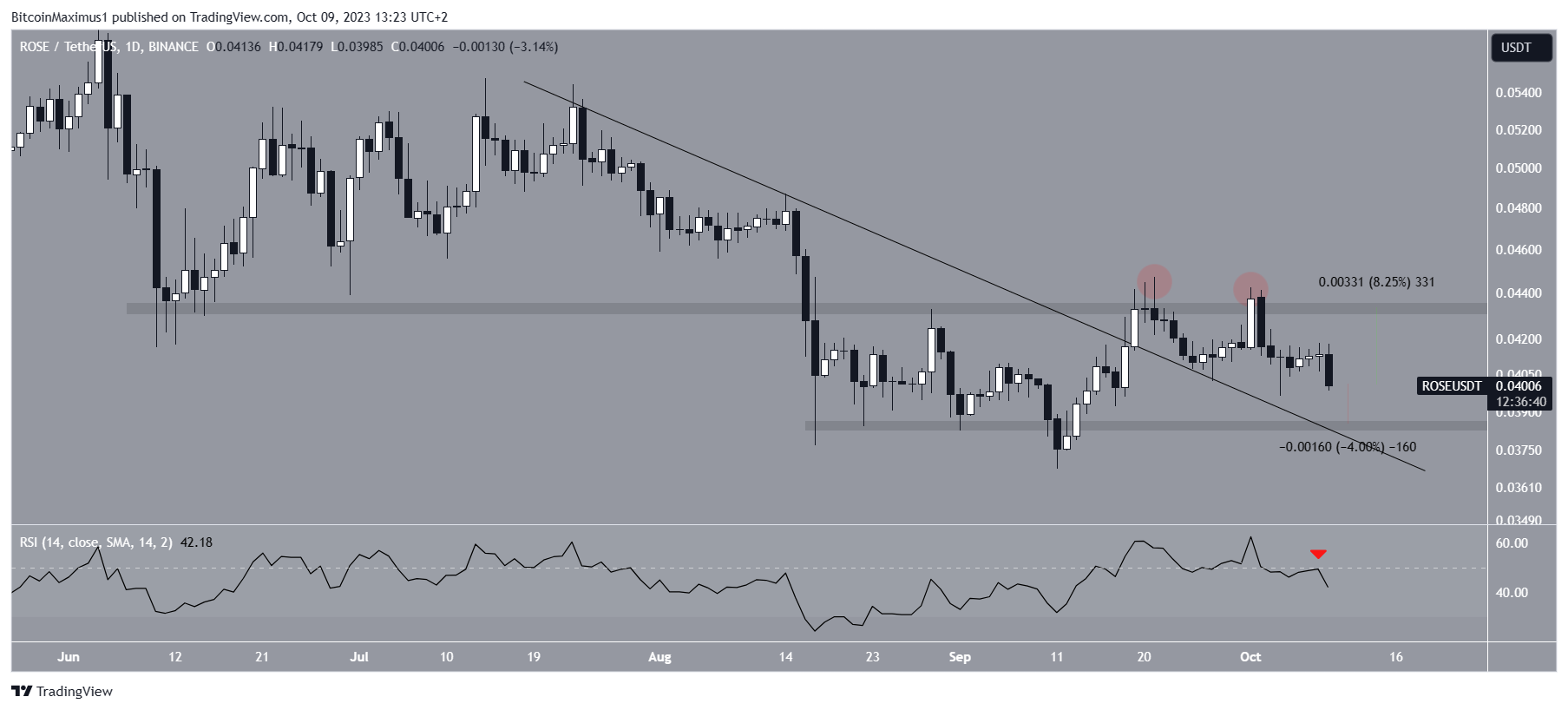

The daily timeframe analysis shows that the ROSE price broke out from a descending resistance trendline on September 19. However, it failed to sustain its increase and break out from the $0.043 resistance area.

Rather, it deviated above it twice (red circles) and has now fallen below it. Such deviations are considered bearish signs since they indicate that buyers could not sustain the increase and sellers took over.

Furthermore, the daily RSI supports the continuation of the drop. The indicator is below 50 and falling, both signs of a bearish trend.

If the decrease continues, the closest support will be at $0.038. A horizontal support area and the aforementioned descending resistance trendline create the support.

Despite this bearish ROSE price prediction, a strong bounce at the current level could lead to a retest of the $0.043 resistance area. This will be an increase of 8%, measuring from the current price.

Currently, there are no signs that suggest this will be the case.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.