Polygon is one of the most popular layer-2 solutions out there. Its native coin, MATIC, frequently ranks in the top 10 by market cap and is an attractive choice for many investors. If you plan to add MATIC to your portfolio, here’s everything you need to know in 2025.

KEY TAKEAWAYS

➤ Polygon is a layer-2 scaling solution designed to enhance Ethereum’s transaction speed and efficiency.

➤ Polygon’s popularity stems from its ability to offer low-cost, fast transactions and strong DApp support.

➤ POL (ex-MATIC), Polygon’s native asset, consistently ranks in the top 10 cryptos and is generally viewed as a strong investment.

➤ POL (ex-MATIC) trading pairs are widely available on most major exchanges.

How to buy Polygon

Before we get into the details, here’s a quick summary of the necessary steps any user must take before buying Polygon:

- Sign up for a crypto exchange or log in to an existing account.

- Verify your identity according to the platform’s requirements.

- Review your account security.

- Deposit funds

- Trade your funds for POL (ex-MATIC).

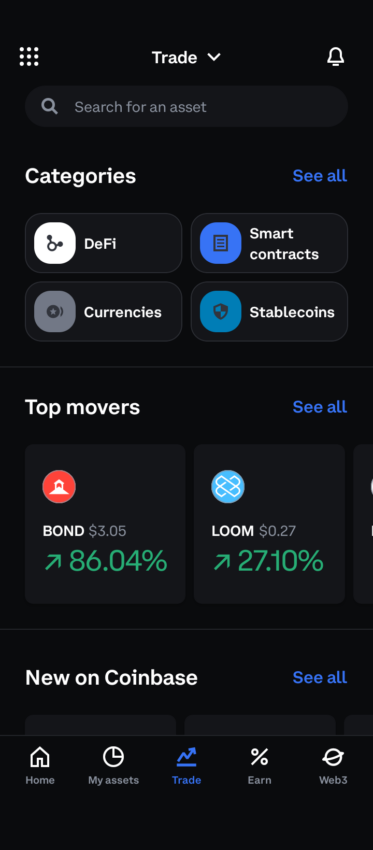

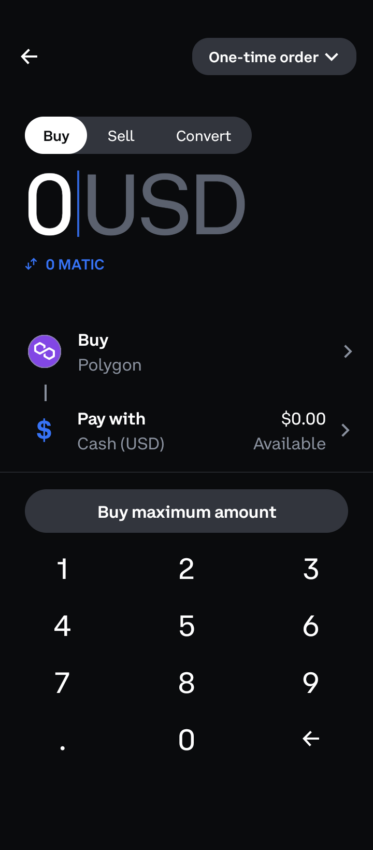

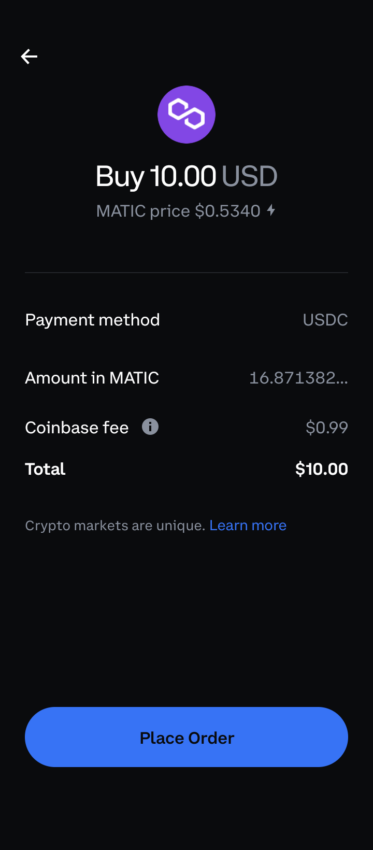

Now that we’ve covered the basics, here’s a step-by-step guide to buying Polygon using Coinbase, one of the top-choice centralized exchanges.

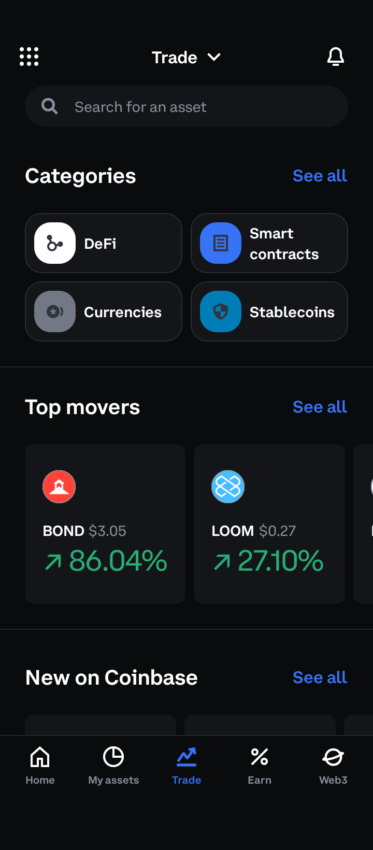

1. Open the Coinbase app, select “Trade,” and search for MATIC.

2. Select “Buy” and choose the amount you would like to purchase.

3. Choose “Place Order” to complete your transaction.

How to sell Polygon

To sell MATIC, you should send the wallet-held tokens to a CEX to sell and convert them to fiat. For standard swaps and cryptocurrency conversions, DEXs can be faster.

To sell your POL (ex-MATIC) on an exchange, do the following:

- Go to the exchange or open the mobile app.

- Search for and select MATIC.

- Create and confirm your order to sell MATIC.

Exchanges like Binance also offer P2P trading options on POL across specific regions. Here, we’ve used Coinbase to demonstrate the process.

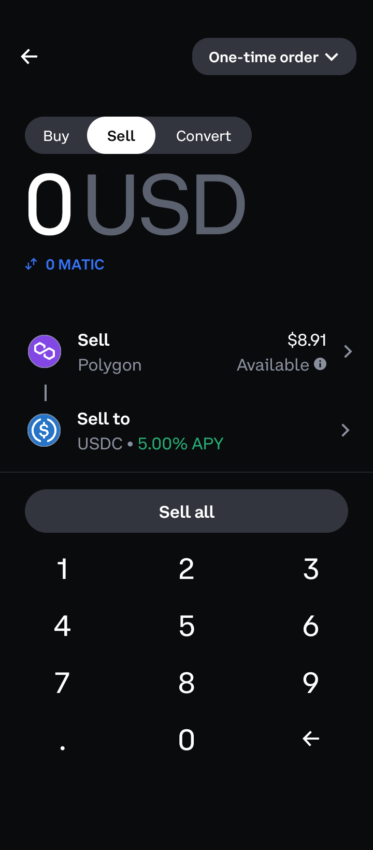

1. Open the Coinbase app and go to “Trade.” In the search bar, select “MATIC,” then press “Sell.”

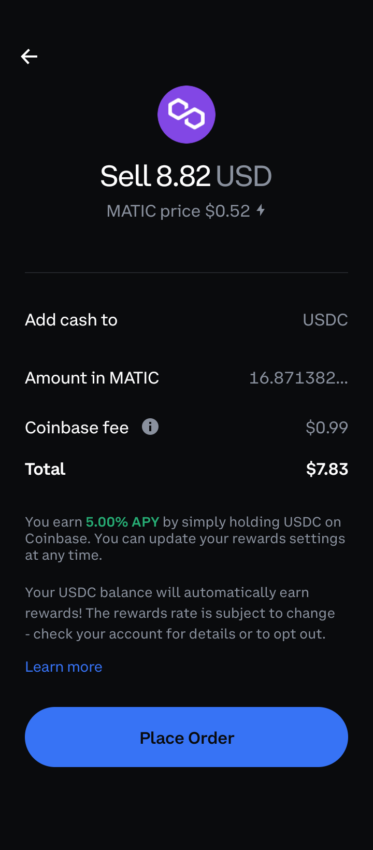

2. Choose the amount that you would like to sell.

3. Select “Place Order” to complete your sell transaction.

Where to buy POL (ex-MATIC)

- Binance: With deep order books and tight spreads, we executed MATIC transactions seamlessly on Binance without any slippage. The intuitive interface enabled easy navigation to buy, sell, and trade MATIC efficiently against other cryptocurrencies.

Additionally, its low fees and advanced charting tools further enhanced our trading experience, making Binance one of the best platforms for MATIC transactions. - Coinbase: During our testing, we noticed that Coinbase provides a streamlined path to Polygon, catering to both new and seasoned traders. Its educational content is particularly impressive, making it an invaluable resource for understanding Polygon before investing.

The added benefit for U.S. users is the platform’s compliance with stringent regulatory standards, ensuring a high trust quotient. - Kraken: For U.S. traders seeking granular control over their MATIC trades, Kraken offers an advanced trading interface that enables sophisticated order placement and risk management strategies. Its range of order types, including limit, stop-limit, and market orders, empowers traders to execute their trading plans with precision.

We found Kraken’s advanced trading interface to be intuitive and easy to navigate, making it an ideal platform for experienced traders seeking to maximize their trading potential.

If you’re looking for a platform to buy Polygon, note that all options listed above have been chosen for their good liquidity levels, global presence, decent usability, and solid security offerings. While no transaction within decentralized ecosystems is risk-free, the above options all represent established players in web3.

Platforms to buy POL compared

| Supported countries | Fees | Minimum purchase | |

|---|---|---|---|

| Binance | 100+ | 0.1% | $1-$10 |

| Coinbase | 100+ | $0.99-$4.19 | $5 |

| Kraken | 190+ | 1-4% | $1, €1, etc. |

If you want to buy Polygon anonymously, ex-MATIC is also available on decentralized exchanges, including Uniswap, PancakeSwap, and Curve. Choose the right MATIC pair and ensure you check liquidity before you proceed with your purchase.

What is Polygon?

Polygon is one of Ethereum’s biggest allies. It is a decentralized scaling platform for the Ethereum mainnet that speeds up transactions, reduces costs, and maintains Ethereum’s security. Polygon started out as the Matic Network but eventually rebranded to Polygon in 2021. In October 2023, it initiated the process of transitioning its native token from MATIC to POL.

Polygon’s multi-chain ecosystem, known as a sidechain ecosystem, uses the plasma framework to process Ethereum-centric transactions on these sidechains.

Polygon has Indian roots. It was created by Sandeep Nailwal, Jaynti Kanani, and Anurag Arjun, with MATIC as the native, transaction-specific token.

The Polygon ecosystem supports DApps that run on smart contracts. Each Polygon smart contract gains its security posture via Ethereum-submitted checkpoints.

As a standard layer-2 scalability client, Polygon leverages Ethereum’s security while supporting up to 65,000 transactions per sidechain.

The Plasma framework and the sidechain ecosystem allow Polygon to host many DApps on the platform. MATIC, the ERC-20 token, is also used as a mode of payment across the Polygon ecosystem.

What makes Polygon unique?

There are quite a few exclusive traits that make Polygon work. These include:

- Polygon’s presence as a modular chain, with the ability to customize DApps as needed.

- An interoperability-focussed ecosystem

- One of the more secure scalability solutions

- Ultra-fast transaction finality of under two seconds

- An expanding network of DeFi solutions

- Proof-of-stake chain and hence highly energy-efficient

- The MATIC crypto supports staking

Polygon can also bridge assets from Ethereum. The Polygon bridge makes the layer-2 blockchain more scalable and interoperable than ever.

Did you know: Polygon’s Plasma Framework works in the manner initially proposed by Ethereum co-founder Vitalik Buterin.

If you buy MATIC, you can still consider using it to generate additional passive income, all while you wait for the token to surge. A good way to do that is via MATIC staking or to rely on the top yield farms for Polygon like Aave, SushiSwap, and more to generate generous APYs.

MATIC price prediction

If you are willing to buy POL (ex-MATIC), holding the coin for a considerable period might be better. Our MATIC price prediction validates this statement, foreseeing a price of $5.40 by 2025 but a level closer to $47 by 2030.

Regardless, it is advisable to invest only a small sum in cryptocurrency to avoid significant losses in case the market turns.

Price predictions — even those like ours, fortified by comprehensive analysis including fundamentals, social sentiment, and in-depth technical analysis — are not an exact science. Always DYOR rather than relying solely on a single prediction, and only even invest if you believe in the value and longevity of a project.

Polygon alternatives

Now that we have examined Polygon’s technical elements, we can compare it to other layer-2 blockchain solutions.

Polygon vs. Loopring

Both Polygon and Loopring are layer-2 solutions in the blockchain domain, yet they cater to different functionalities. Polygon primarily focuses on hosting decentralized applications (DApps) and managing smart contracts, making it a versatile choice for low-cost payments, DApp integration, and smart contract execution.

Conversely, Loopring specializes in decentralized trading with a strong emphasis on automated market makers (AMM) on Ethereum. It stands out for trading financial assets with minimal fees.

Although both platforms promise fast transactions at reduced costs, their suitability varies based on user needs:

- Loopring is optimal for those seeking efficient and affordable trading of Ethereum assets.

- Polygon appeals to users looking for a robust blockchain ecosystem encompassing NFTs and DeFi components.

Polygon vs. Arbitrum

Arbitrum relies solely on Optimistic Rollups for Ethereum scalability. This layer-2 blockchain also supports unmodified EVM-compatible contracts.

Polygon, on the other hand, offers an extensive suite of options featuring PoS Plasma, Optimistic Rollups, or even ZK-rollups, depending on requirements.

It also compares with other layer-2 blockchains, including Optimism—the latter only focuses on Optimistic rollups, whereas the former brings the entire suite.

Polygon vs. Loopring vs. Arbitrum

Here’s a quick table comparing the key features of these competing L2s.

| Feature | Polygon | Loopring | Arbitrum |

| Primary focus | Hosting DApps, managing smart contracts | Decentralized trading, AMM on Ethereum | Ethereum scalability with Optimistic Rollups |

| Key functionalities | Supports NFTs, DeFi, multiple scaling solutions | Low-cost trading, efficient Ethereum transactions | Optimistic Rollups, EVM-compatible contracts |

| Scaling solutions | PoS Plasma, Optimistic Rollups, ZK-Rollups | None (focuses on trading) | Optimistic Rollups only |

| Ideal for | Users seeking a versatile blockchain ecosystem | Users trading Ethereum assets with minimal fees | Developers needing simple, scalable solutions |

| Transaction speed | Up to 65,000 transactions per sidechain | Fast transactions with minimal fees | Fast transactions via Optimistic Rollups |

Should you buy POL (ex-MATIC) in 2025?

Should you buy Polygon in 2025? That depends on what you plan to do with the crypto. You can buy Polygon anytime if you wish to invest in it in the long term. However, suppose you wish to buy MATIC for short-term trading. In that case, it is advisable to rely on market sentiments, technical analysis, and other factors to acquire the native coin at a cheaper tick.

Disclaimer: This article is for informational purposes only and is not intended as investment advice. Crypto is volatile and profits are never guaranteed. DYOR and never invest more than you can afford to lose.

Frequently asked questions

How can I buy Polygon?

Where to buy Polygon in the U.S.?

Is Polygon MATIC available in WazirX?

Is Polygon coin on Binance?

Is MATIC crypto Indian?

Who is India’s first crypto billionaire?

Who is the owner of Polygon?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.