The Monetary Authority of Singapore (MAS) has released new rules for single-currency, non-government-issued stablecoins. Laws including capital requirements will apply to stablecoins pegged to the Singapore dollar or other fiat money from Belgium, Canada, France, and eight other Group of 10 countries.

The central bank must still hold consultations before the rules become law. Among other things, stablecoin issuers must hold 100% low-risk capital and enforce price stability to comply.

New Singapore Stablecoin Rules Impose Capital Requirements and Price Stability

Private issuers mostly back stablecoins 1:1 using cash, cash equivalents, and short-term treasuries. To redeem a stablecoin, the issuer “burns” the asset and credits the seller with the commensurate fiat value.

Hence, the issuer must have enough funds in the event of a bank run. Additionally, the issuer must have a way to restore the asset’s fiat peg.

Stablecoin traders can flatten the asset’s price through arbitrage trades on centralized exchanges. When the price moves away from one unit of fiat currency, traders can buy or sell the asset against the fiat currency it represents.

A flat price allows stablecoins to be a stable medium of exchange for overseas transfers.

Earlier this year, USDC lost its peg to the US dollar after Silicon Valley Bank froze its reserves. Last year, Tether‘s USDT, the world’s largest stablecoin, dropped as low as 95 cents after the failure of TerraUSD.

How Regulators View Stablecoins

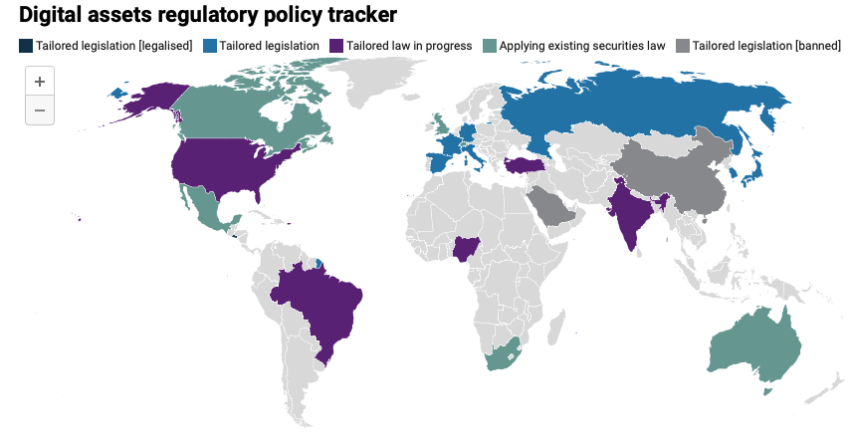

Meanwhile, several other jurisdictions are working on new stablecoin regulations to enable their safe use. On July 27, the US Senate passed a new bill enforcing anti-money laundering laws for stablecoins.

Want to know more about how stablecoins work? Read our deep-dive here.

The Clarity for Payment Stablecoins Act, which codifies rules for issuing stablecoins specifically geared towards payments, failed to pass the House Financial Services Committee. Like Singapore, the bill imposes minimum capital, rules on redemptions, and establishes oversight at the state and federal levels.

Notably, it places a two-year ban on algorithmic stablecoins akin to TerraUSD.

After becoming one of the first regions to pass crypto regulation, the Hong Kong Securities and Futures Commission is working on new stablecoin laws. Several crypto companies, including USDC issuer Circle, have expressed interest in doing business there.

Got something to say about Singapore’s stablecoin rules or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.