A former acting Comptroller of the Currency has spoken out about the need for stablecoins in America while urging Congress to regulate them amid a wave of de-dollarization across Asia and Latin America.

On Aug. 9, Brian P. Brooks, former acting Comptroller of the Currency, aired his views on why America needs stablecoins. He added that they are “at the heart of a dollar-based revolution happening throughout the developing world.”

Stablecoins Can Slow De-Dollarization

The former Coinbase chief legal officer described stablecoins as “important tools of American soft power in a world where the role of the dollar is in question.” Global USD bank reserves have declined by 20% over the past two decades.

Moreover, stablecoins can provide an alternative for global citizens suffering from high inflation and devaluation of their local currencies. Stablecoins like USDC and USDT also allow savings in dollars via mobile devices without needing local bank accounts.

“Stablecoins could be to finance what Voice of America has been to diplomacy.”

Major economies are settling trades in local currencies, reducing global dollar demand. Furthermore, several countries have been actively distancing themselves from dollar hegemony in recent years. These include China, Russia, Brazil, India, Argentina, Saudi Arabia, Iran, and Thailand.

Additionally, the BRICS (Brazil, Russia, India, China, and South Africa) bloc is reportedly working on its own alternative digital currency.

Take a look at our explainer for a better understanding of stablecoins: What Is a Stablecoin? A Beginner’s Guide

Ecosystem Outlook and ‘Issues to Work Out’

Brooks said that Patrick McHenry’s Payment Stablecoins Act would establish federal oversight, asset reserve requirements, redemption rules, and disclosure. Moreover, the bill had bipartisan support, but Democrats unexpectedly withdrew, diminishing the hope of regulatory clarity.

He said that Congress needs to recognize the potential of stablecoins to strengthen the dollar and empower ordinary citizens abroad.

“Some key issues to work out as Congress works on the Payment Stablecoin Act, but America is waking up to the future of digital dollars,” commented Circle CEO Jeremy Allaire.

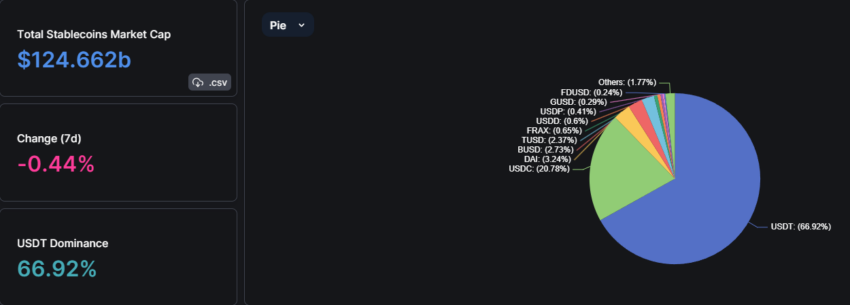

Tether currently dominates the stablecoin ecosystem. USDT supply has increased by 26% since the beginning of the year to $83.5 billion. This gives the firm a commanding market share of 66.5%.

Its closest rival, Circle, has seen market share and supplies plummet this year, with USDC now only representing 21% of the market.

There are $26.2 billion in USDC circulating, and the firm claims that 70% of its adoption is outside the United States. Decentralized DAI is the third largest stablecoin, with $4 billion circulating and a market share of 3.2%.

Earlier this week, PayPal announced the launch of a new stablecoin, but it has been criticized over centralization concerns.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.