As a retail investor, navigating the complex crypto landscape takes skill and intuition. However, there are still ways to stay ahead of the game and make better, more informed decisions. One of these is tracking smart money.

In crypto, smart money refers to traders and institutional players with deep market understanding. These traders have ready access to information. They make market-moving, large-volume trades. Tracking them makes it possible to gather directional info about the market. This guide covers everything about smart money, including how to track this group and receive actionable info. We cover on-chain tools, analysis of market sentiments, blockchain analytics, the role of explorers, and more.

- Why call it “smart money”?

- Institutional investors in crypto (smart money in crypto)

- The concept of market manipulation

- Can I use the smart money concept in crypto?

- The risks of relying on smart money

- On-chain analysis & blockchain analytics

- Tracking smart money: metrics to consider

- The role of market sentiment in tracking smart money

- Exploring order book depth

- Enlisting the top platforms for tracking smart money in crypto

- How do I follow smart money?

- Is tracking smart money in crypto a “smart” approach?

- Frequently asked questions

Why call it “smart money”?

The term “smart money” contrasts the moves made by intelligent traders and the big guns in crypto with those made by general investors or the public. It is assumed that the general public or retail investors aren’t as smart. Of course, this certainly isn’t the case despite the verbatim becoming popular as part of the crypto lexicon.

Smart money refers to a bunch of investors who do not just have deep pockets. Instead, smart money refers to firms and individuals with extensive resources, access to advanced trading strategies, and access to proactive information. Do note that while individual investors can still qualify as smart money, institutions are better off qualifying and making those market-moving trading moves.

Also, smart money traders aren’t just the ones with resources. Here is a quick thread for your reference.

‘

Institutional investors in crypto (smart money in crypto)

As mentioned earlier, institutional investors qualify as smart money. What makes them stand out is their ability to infuse liquidity across markets. And while individual “smart money” traders often act in a clandestine manner, institutional investors often take it upon themselves to dampen massive market swings by lowering volatility.

Tracking smart money from the charts

A good indication of institutional involvement is a sudden surge in the trading volume of an asset. If you wish to start tracking early, using trading charts in the process, indicators like the Chaikin Money Flow (CMF), Volume Rate of Change (VROC), and On-Balance-Volume (OBV) come in handy.

Another way of tracking institutional involvement is to track the volatility of the asset. Indicators like the Volatility Index (VIX) and Average True Range (ATR) can work well. The idea here is to see how the rise in volume has impacted volatility. A huge surge in trading volume followed by lowering volatility indicates that smart money is showing interest in the asset.

Other ways to track

As everything in crypto is trackable, on-chain insights can give an idea regarding massive trading activities. The idea is to find market movers’ wallet addresses and track their inflows and outflows using tools like Dune Analytics, Nansen, and even explorers like Etherscan.

If tracking wallets seems daunting, you can also track exchange inflows and outflows. This means simply looking at the bulk crypto flows entering and exiting specific centralized exchanges. Tools like Chainanlysis and Cryptoquant can help you with this.

Lastly, you can focus on social media monitoring by tracking announcements and press releases from institutions to gauge interest in specific cryptos. This helps gauge the trends and overall sentiments of the market or any given crypto.

Therefore, it is now clear that tracking smart money holistically is a combination of on-chain and investor sentiment analysis, monitoring of exchange flows, and even identification of market trends based on available information.

The concept of market manipulation

Where there is smart money, there is the concern of market manipulation. Bodies with deep pockets can employ artificial tactics to disrupt the market’s standard supply and demand mechanics, manipulating the market in the process. The idea here is to spread false signals by creating an illusory market trend.

Here is an example where smart money faked a dip:

Some of the more obvious market manipulation strategies include:

- Whale transactions can manipulate the price action at specific asset counters.

- Wash trading that involves artificially inflating the volume-based data of any asset, courtesy of simultaneous buying and selling.

- Pump and dump investment strategies that focus on low-cap crypto assets and involve mechanically inflating the prices.

- Spoofing, which involves keeping static buy-sell orders to give the impression of high demand or supply.

One of the most basic traits of a reliable crypto asset is significantly low whale holdings. This, in turn, prevents market manipulation.

“Bitcoin distribution keeps getting better. Whales now hold only 25% of the supply.”

Ryan Woo (Willy Woo), co-founder of Woobull: Twitter (2021)

Market manipulation detection

As seen, most market manipulation strategies involve smart money, as only big pockets can initiate pump-and-dump and wash trades. However, strategies to track smart money can also help with market manipulation detection. These include:

- On-chain analysis via tools like Nansen and more.

- Trading volume analysis via on-chart indicators

- Investor sentiment analysis via tools like TheTIE, LunarCrush, and more.

- Using manipulation detection tools like Whale Alerts to get intimations regarding massive transactions and whale movements.

- Reading through regulatory reports.

Can I use the smart money concept in crypto?

The concept of smart money makes sense when used in crypto. Crypto concerns a transparent ledger; every transaction is recorded immutably on the blockchain. This way, any act of manipulation can be tracked. Also, the crypto space is relatively less mature than bond markets and equities, allowing bodies with deep pockets, i.e., smart money, to move the market in a specific direction.

As for traders, smart money gives them the edge, allowing them to preempt trends and make moves accordingly.

How does it work?

Here is a quick example of how it works. Below is a Tweet that notes big wallets hoarding Chainlink (LINK) at close to $7.50. Investors who followed the smart money profiles and accumulated LINK at the time of the tweet were at an advantage as LINK moved as high as $8.20 in a span of a few hours.

The risks of relying on smart money

Despite the advantages, tracking smart money to trade has its share of risks. These include:

- Possible inaccuracy

- A rapid sentimental change thwarting the efforts of smart money

- The trades could be a way to manipulate the markets

Now that we have covered the basics of smart money tracking let us get up close and personal with the tools.

On-chain analysis & blockchain analytics

The first approach to tracking smart money is to analyze on-chain metrics. Here are the insights that you should eye:

- Token holdings

- Address activity

- Transaction volume

Data analysis tools are necessary for tracking these metrics. We shall come to that later!

Did you know? An ETH ICO participant wallet awoke after eight years, depositing all of the 61,216 ETH to Kraken on July 19, 2023. The ICO price of ETH for this wallet was $0.31.

Which tools can you use, and how to use them?

As for the tools and platforms, some of the most obvious choices for looking at blockchain analytics include:

- Nansen: An analytics platform that specializes in whale tracking, social media monitoring, and even on-chain analysis.

- Dune Analytics: A platform meant to create custom queries related to blockchain data.

- Glassnode: One of the more reliable platforms that can help track derivatives data in the crypto space along with network metrics and other on-chain metrics.

These are only a handful of platforms. You can also rely on the likes of Arkham, Elliptic, CryptoQuant, Token Analyst, Whale Alert, and more to track diverse aspects of smart money movements in crypto.

Tracking smart money: metrics to consider

Let us now simplify this entire discussion by mentioning the specific activities that you need to indulge in for tracking smart money.

Tracking token holdings

Some platforms allow you to track the holding patterns of specific tokens. This approach helps track projects that are popular among “smart money” traders.

Nansen is one of the best platforms for the same. There is a special section called “Token Holdings” to help you locate the projects that are being accumulated by the big names.

Tracking whale activity

Crypto whales have the most potential to be smart money traders. Therefore, tracking smart money by closely monitoring whale activity is advisable. Twitter bot Whale Alert is one of the more credible sources for the same, as it provides real-time info regarding whale transactions.

Here is how Whale Alert — a blockchain tracker — reports data:

Notice how this piece of info shows that a massive chunk of ETH is being moved to an exchange. This might indicate an incoming ETH dum, indicating it is a good time to monitor the prices closely.

Here is another example with additional details:

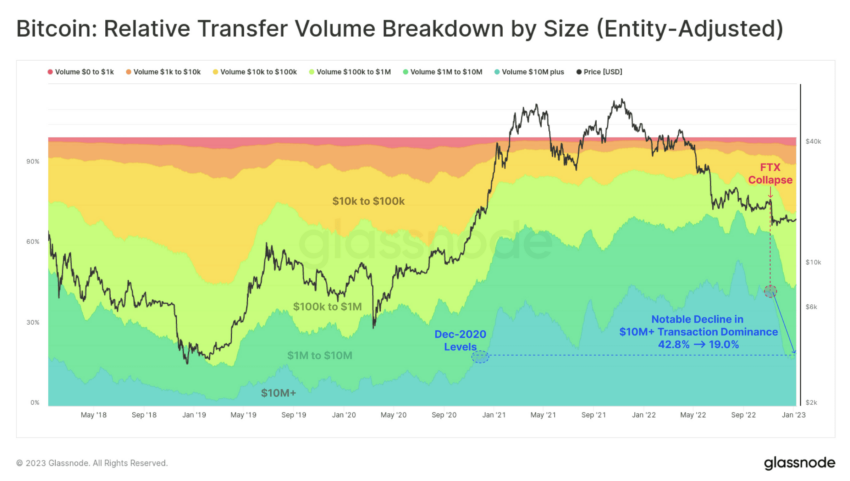

Tracking transaction volume

The transaction volume specific to a crypto asset is a good way to track smart money inflow. You can use this metric to track the transaction volume of any blockchain platform, identifying a sudden rise in institutional interest.

Glassnode’s “Transfer Volume” is a good source for getting a lead on an asset’s transaction volume by the hour. You can identify periods of high activity and locate potential turning points. However, we would recommend using this metric with on-chart trading indicators as confirmations.

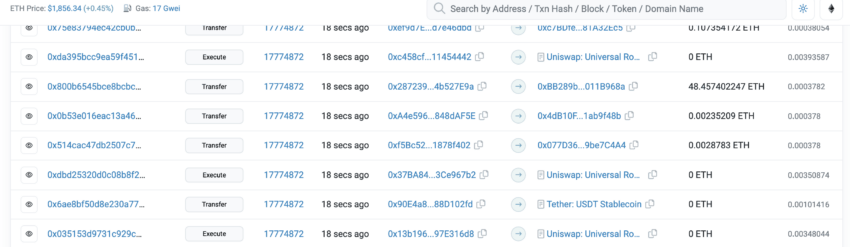

Tracking address activity: the role of blockchain explorers

Another specific technique tracking smart money in crypto is to locate specific addresses by first tracking whales and saving their public addresses. Once you have a smart money address, you can use diverse explorers and platforms to track their holdings, new buys, token movements, exchange dumps, and more.

Etherscan is a reliable explorer for Ethereum-based addresses, whereas for Bitcoin-related addresses, you can use Blockchain.com.

You can track Twitter handles like Lookonchain to identify smart money addresses that are most active.

Once you have the address, tracking becomes easy.

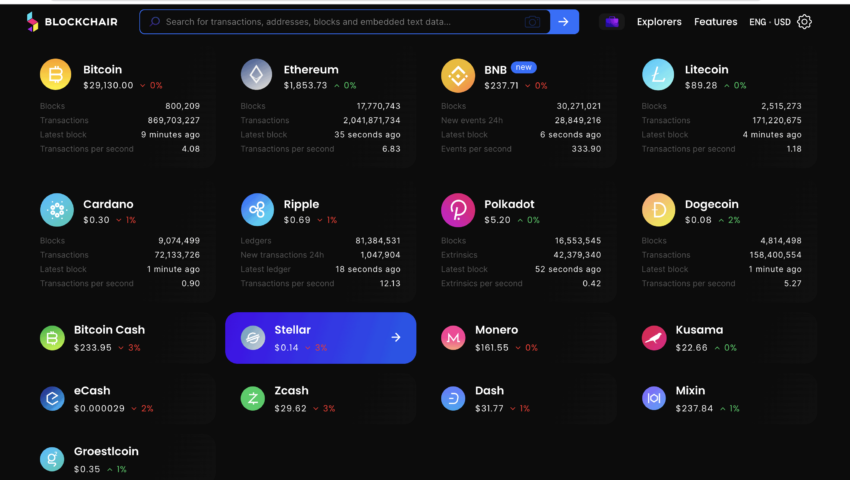

You can even use a platform called Blockchair to explore addresses specific to diverse blockchains.

Tracking exchange flows

Another way of gauging the flow of smart money is to track exchange flows — inflows and outflows included. If you see a massive chunk of crypto holdings moving to an exchange, it might indicate incoming selling pressure.

Conversely, if a significant volume of an asset is seen leaving an exchange, all signs hint at smart money accumulation. While Twitter-based on-chain smart money trackers like Lookonchain can offer that info, you can use platforms like Chainalysis or Cryptoquant to track the inflows and outflows of specific assets.

The role of market sentiment in tracking smart money

Even though market sentiment doesn’t directly equate to smart money numbers, tracking it can still help you as a retail investor. Here is how it works. Smart money traders gauge market sentiments early to enter or exit an asset. This is the reason why we track their addresses and fund movements.

Also, several smart money traders are institutional investors or socially active traders who talk openly about their preferences. Therefore, tracking social media popularity or keeping abreast of relevant news pieces and articles can be a good way to track smart money interests.

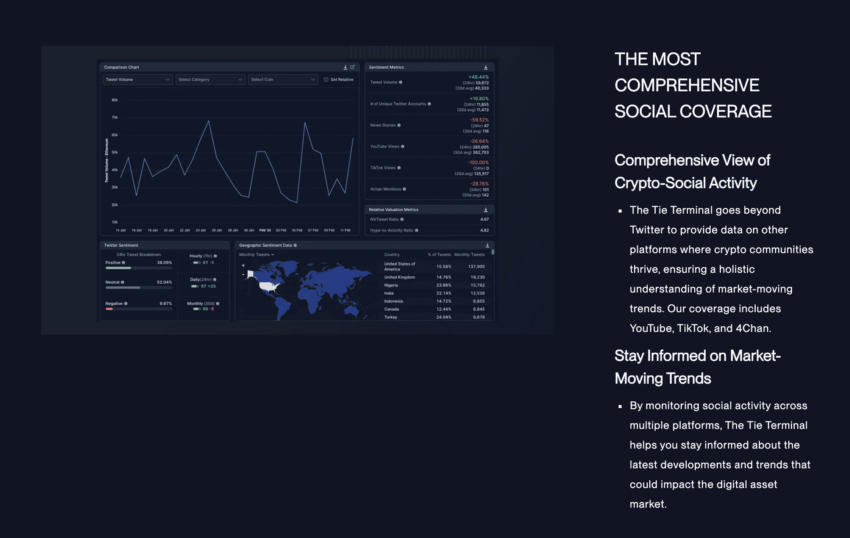

Tracking social sentiments and insights is made easy with The TIE. From getting a comprehensive view of the market to staying ahead of the smart money-driven trends, you can get every insight at your fingertip. Plus, this platform tracks web traffic and emerging asset trends and even initiates historical coverage to help you stay ahead of the game.

You need not look beyond BeInCrypto for readable picks, courtesy of our constantly updated news section. You can even check BeInCrypto’s LEARN section for deep dives into broader market trends and happenings.

Exploring order book depth

Order book depth is one of the more underrated strategies for tracking smart money. It measures the available market liquidity for a given crypto asset relevant to a given exchange. Order book depth takes all the active buy and sell orders for a given crypto and for a given price.

Here is a quick example of how it works:

Imagine you check the order book for a given crypto that has 100 buy orders at $100 and 70 sell orders at $100. Therefore, at $100, the order book depth is 100 + 70 = 170.

Order book depth can be a handy tool for tracking smart money. Firstly, it helps you locate some of the largest trades. Secondly, order book depth can also help track the fund flow, in or out of a given crypto. For instance, if you see the buy orders piling up, you can be sure that big guns are accumulating the given asset,

While order book depth is a useful metric, it works best with the likes of market sentiment, whale alerts, on-chain insights like transaction volume, address activity, etc, and exchange flows.

TradingView is a go-to platform if you want to check the order book depth for any given asset. You simply need to open the preferred trading pair and reach the bottom for an option called the “Trading Panel.” Then connect the broker of choice, and start looking at the order book from there.

Enlisting the top platforms for tracking smart money in crypto

We have now discussed a handful of smart money tracking platforms across capacities. Here is a quick list of our favorites, which allow you to minimize the searching effort and get to tracking rapidly:

Nansen

This platform emphasizes Ethereum-based cryptos and comes with a specialized “smart money” interface to capture wallet-specific on-chain activity, token holdings, DEX trades, and transactions.

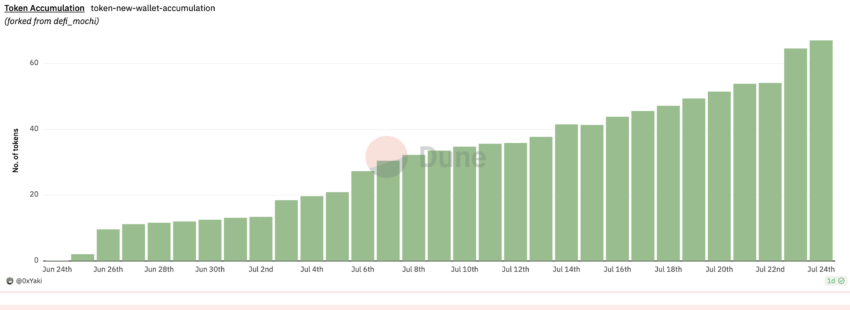

Dune Analytics

Dune has specialized dashboards, which can be created, customized, and studied for tracking whale activities and everything related to smart money. Some of the most popular dashboards include the Token God Mode for specific crypto, Sushiswap analysis, and more.

You can track these dashboards to acquire data regarding new token holding trends, top liquidity providers across DEXs, and other relevant data points.

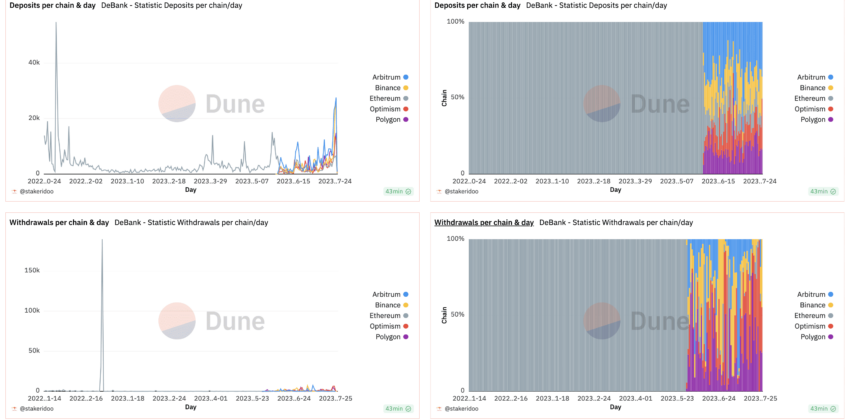

DeBank

DeBank is more like a wallet tracker that works hand-in-hand with Dune Analytics. Once you identify high-value or rather smart money wallets on Dune, you can copy the addresses to DeBank to track them more holistically. Moreover, DeBank — as a standalone dashboard — also offers several smart money insights like chain-specific deposits and withdrawals.

Glassnode

Here is a comprehensive platform to get your hands on on-chain data. With Glassnode, you can easily track whale activity and exchange flows and even look at specific holders and their wallets for more granular research.

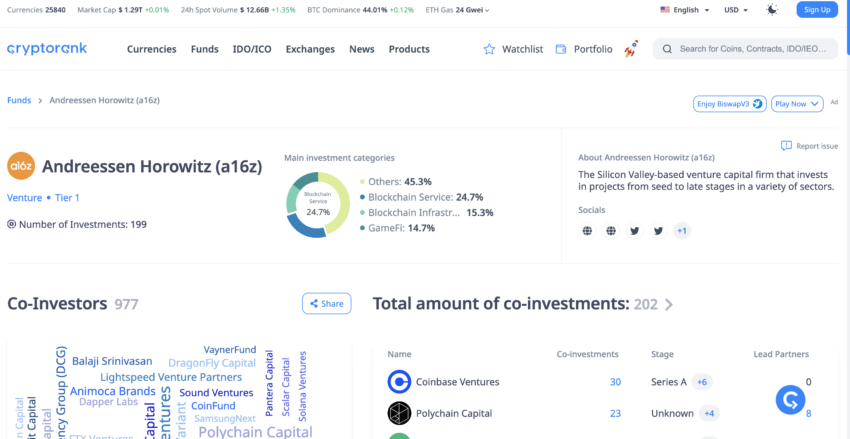

CryptoRank

This is a great platform for tracking investment trends. CryptoRank has a special “Funds” section that lets you capture the nature and size of investments made by VCs. The ability to track VC investments across segments and cryptos can help you identify the next market trend and gain an investment-related advantage.

While these are some of the most promising tools/platforms, there are quite a few more data analysis tools to test out in case you want additional info and perspectives:

- Arkham: For identifying smart money traders

- Whale Alerts: For tracking large crypto transactions

- Santiment: For tracking finer details like active addresses, network growth, and more.

- LunarCrush: For tracking social trends

- CryptoCompare: For tracking emerging trends that even smart money traders follow

Apart from these, you can also use any of the other platforms mentioned previously as part of individual discussions.

How do I follow smart money?

Now that we have all the tools needed for tracking let’s look at the individual steps you can take:

- Identify key market trends that you want to track. It is best to focus on large-volume trades, rapid price movements, and exchange flows.

- Another approach could be to check for the price aberrations for a given crypto on a standard trading chart and then reverse engineer the reasons using on-chain metrics.

- The next step involves choosing the right set of tools. Whale Alert can be a good option if you want to focus solely on whale transactions. If you want a deep dive into the world of on-chain analysis, looking at Nansen or Glassnode can be a good option.

- Ensure that you always pair social and trend-based tools like The TIE and LunarCrush to validate the on-chain findings.

- While you track, it is advisable to gauge the market or the specific asset simultaneously. The best way to do so is to check for exchange flows and changes in the fear and greed index.

- If you prefer specific coins or tokens, you can even make use of blockchain explorers or wallet trackers like EtherScan or Blockchair to track the most active addresses.

- A closer analysis of the price action and the addresses would give you every possibility of market manipulation. This way, you can reach a higher ground quicker if something goes south.

The final piece of the puzzle

Once you are confident about reading the metrics, we advise you to open the price chart of the concerned asset side-by-side and track the future possibilities using trading indicators. Do note that this is a tentative strategy to follow smart money in crypto. Yours might be different depending on your experience level and preferences.

Is tracking smart money in crypto a “smart” approach?

Tracking smart money is all about tracking the influence and resources of the big market players. And while the approach to tracking smart money for getting better at trades is a rewarding approach, it isn’t infallible. Smart money traders might enter the market at different price levels and conditions, which might differ from those of retail investors. Therefore, while their trades can be used as reference points, copying them blindly isn’t the best option.

Frequently asked questions

How do I track smart money in crypto?

What is smart money in crypto?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.