The world’s largest asset manager BlackRock appears to be going all-in on Bitcoin. In addition to its recently filed spot ETF application, the firm has also recommended an optimal portfolio allocation for the world’s largest digital asset.

Economic analysts have been delving into previous BlackRock reports on the optimal portfolio in terms of risk vs. reward. Their findings are heavily weighted toward Bitcoin, which could drive its value to new highs should the recommendations be acted upon.

BlackRock Bitcoin Drive

On July 25, Blockware’s Joe Burnett commented on a 2022 BlackRock report on optimal Bitcoin allocation.

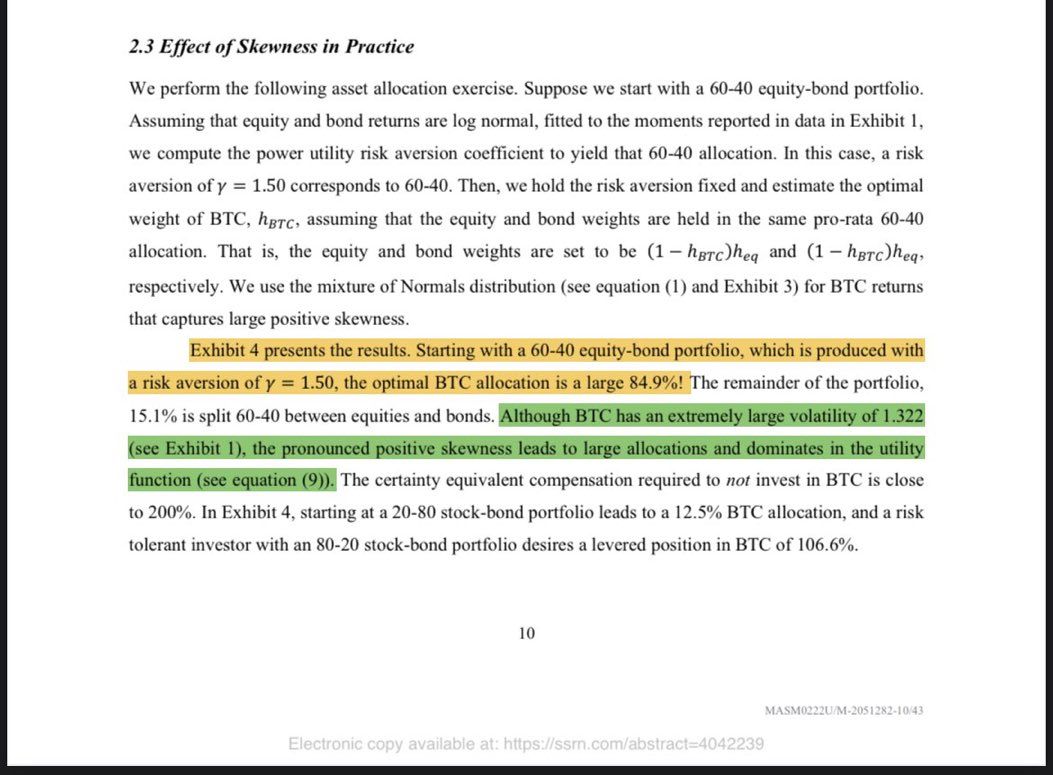

Remarkably, the asset manager recommended 84.9% BTC, 9.06% stocks, and 6.04% bonds. Burnett commented that:

“If all investors follow BlackRock’s optimal BTC allocation, Bitcoin will be worth more than 5x the total value of all equities, real estate, and bonds.”

He speculated that if total global wealth is around $800 trillion today, Bitcoin would be $190 million per coin.

Economist Alessandro Ottaviani added to the sentiment, commenting:

“Soon or later, it will be clear for everyone that Bitcoin is a must have in every portfolio.”

At the time, BlackRock wrote, “Although Bitcoin has extremely large volatility, the pronounced positive skewness leads to large allocations and dominates in the utility function.”

Re-posting his stock-to-flow model on July 25, analyst ‘PlanB’ said that things were in the early stage of a bull market, adding:

“Of course BlackRock wants to buy cheap, just before ETF approval, and just before stage-2 full-blown bull market.”

Although the paper was written last year, it has been widely shared across crypto Twitter today.

Read more about BTC: Bitcoin Stock-To-Flow Model: A Beginner’s Guide

Bitcoin Spot ETF Outlook

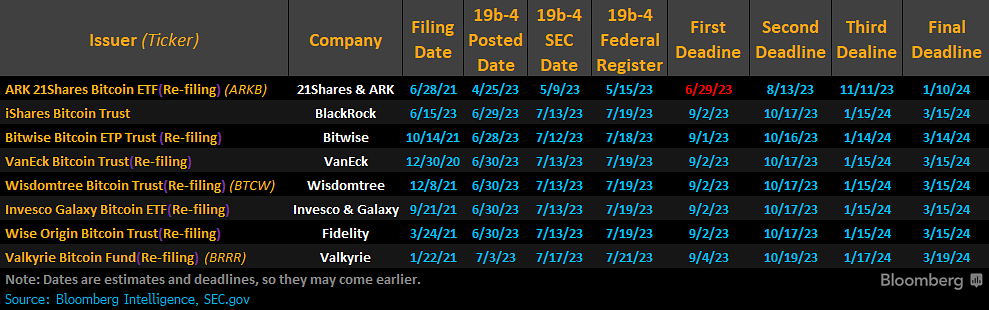

On July 25, Bloomberg’s exchange-traded fund expert James Seyffart shared an updated list of dates to watch for the current Bitcoin ETF race.

BlackRock filed for its spot ETF in mid-June; the first deadline for SEC response is Sept. 2.

However, the Ark and 21Shares Bitcoin ETF refiling has passed the first deadline and is approaching the second on Aug. 13.

The first deadlines for Bitwise, VanEck, Wisdomtree, Invesco, Fidelity, and Valkyrie are all in early September.

The SEC has yet to approve a spot Bitcoin ETF, but analysts are confident that BlackRock could be the first. It has also been speculated that the SEC is trying to control the crypto ecosystem through these Wall Street giants.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.