Online brokerage Robinhood Markets will cut 150 full-time staff jobs as US crypto companies feel the sting of lower volumes caused by recent regulatory enforcement actions.

Robinhood announced its third tranche of layoffs in just over a year to streamline teams according to lower trading volumes.

Robinhood Launches Third Round of Job Cuts

The cost-reduction measure will see Robinhood cut 150 staff in customer experience and platform shared services, customer trust and safety, and safety and productivity. In its annual report last year, the company said it employed 2,300 people despite two rounds of cuts affecting at least 1,000 people.

Last week, the company announced the acquisition of credit-card startup X1 to expand its income streams. Additionally, stock traders can now access markets for major stocks and exchange-traded funds 24 hours a day, five days a week. Initially, eligible traders can exchange stocks from Apple, Amazon, and Tesla.

Notably, the company was fined by the US Securities and Exchange Commission in 2020 for not disclosing income from routing customer trades. According to the charge sheet, Robinhood deprived customers of $34.1 million through trade routes benefiting itself. Later, the company settled with the SEC for $65 million and agreed to stop the practice.

Robinhood Delists Tokens After Regulatory Enforcement

However, recent SEC crypto crackdowns are still giving US industry players, including Robinhood, jitters. Coinbase, the largest US exchange, is facing an SEC enforcement action for operating as an unregistered broker and crypto clearinghouse.

In its lawsuit, the SEC listed multiple assets it considered unregistered securities that Coinbase listed illegally. The group included three of the 18 crypto assets Robinhood offered.

After a review, Robinhood announced it would delist the tokens on Tuesday, cutting off trading revenues for affected pairs.

Find out here the full list of tokens the SEC deems unregistered securities.

But the recent boom in institutional interest could be the company’s salvation.

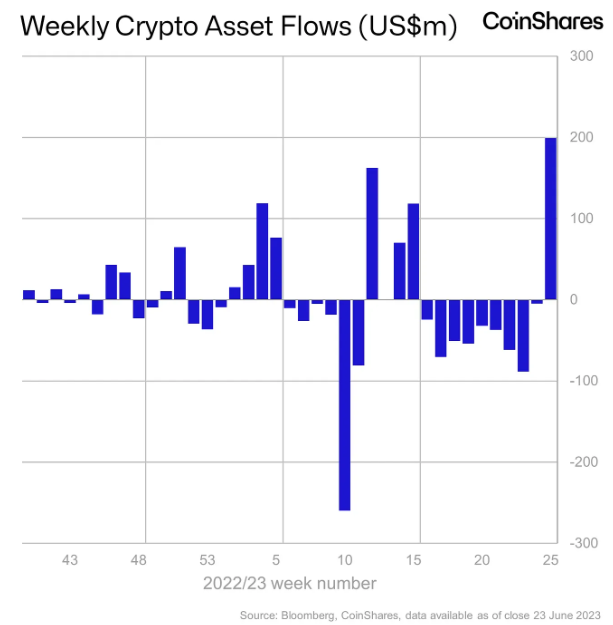

Last week, several big investment firms filed applications with the SEC to start offering a spot Bitcoin Exchange-Traded Fund. The applications pushed Bitcoin’s price over $31,000 as prospects of greater institutional inflows and better liquidity inspired investors.

Additionally, Institutional trading firms coming onboard can offer Robinhood customers access to more liquid markets. On Monday, Sygnum Bank announced a new crypto asset custody and brokerage service to match buy and sell orders.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.