Satoshi Nakamoto conceived Bitcoin (BTC) to be an independent payment instrument. Financial markets, however, still influence the crypto industry, and economic problems affect crypto. The digital asset market risks the consequences of a U.S. debt ceiling default. BeInCrypto asked experts to weigh in on the effects of a default on Bitcoin and stablecoins.

What’s Happened?

The United States reached its debt ceiling in January 2023. The ceiling is a limit Congress places on loans the government can take.

U.S. Treasury Secretary Janet Yellen predicted in May that the U.S. could default by June 1 if Congress didn’t raise the debt ceiling. The consequences of this scenario are unpredictable.

Mark Zandi, the chief economist at Moody’s rating agency, says a U.S. default could destroy the existing financial system.

His opinion is not universally shared. For example, JPMorgan CEO Jamie Dimon argues that the U.S. authorities will not risk a default.

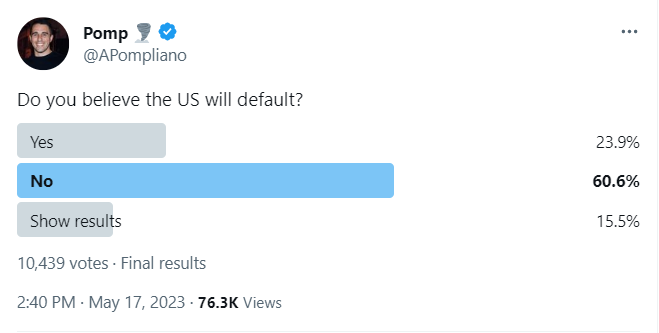

President Joe Biden backs the optimists. On May 17, the head of the country announced that there would be no default. However, online polls reveal that many expect the worst.

Now let’s investigate how the U.S. ended up in this unpleasant situation.

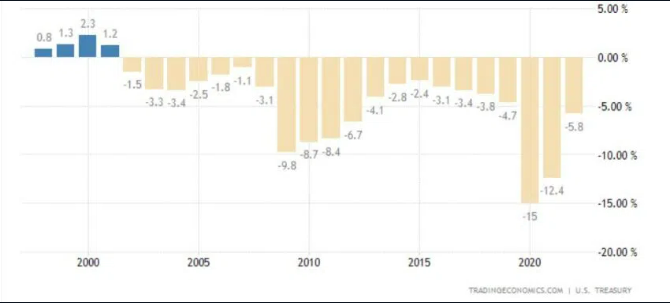

U.S. spending since 2022 exceeded the income that the U.S. Treasury received from taxes and fees. The country’s debt grew significantly against the backdrop of the 2008 financial crisis and the height of the coronavirus pandemic.

During these periods, the U.S. authorities spent large sums on stimulus payments. The growing tension in the geopolitical arena in 2022 dealt another blow to the American economy.

How the U.S. Default Will Affect Crypto

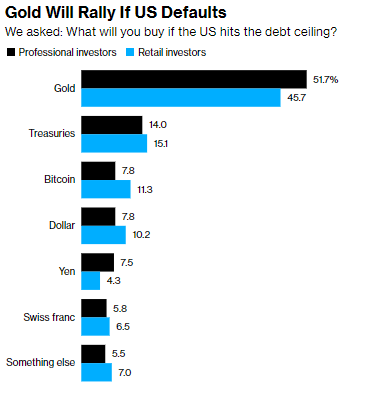

Bloomberg analysts write that a U.S. default will provoke a flow of assets into gold, U.S. Treasury bonds, and Bitcoin. As polls have shown, professional investors prefer precious metals.

The editors of BeInCrypto decided to conduct their own survey to understand the effects a U.S. default could have on BTC and the general crypto market. Experts envisage two potential outcomes:

- Bitcoin will rise despite the collapse in the stock market, which cryptos often track.

- The stablecoin market may face a serious crisis.

Dmitry Noskov of the StormGain crypto exchange says that the U.S. default will promote gold and Bitcoin’s growth since Bitcoin is a digital asset analog of the precious metal. Noskov says the default could quicken BTC’s rise to the $30,000 level and beyond.

Nikolai Zhuravlev, General Director of TsFA.RF agreed.

“A U.S. default will definitely support the growth of Bitcoin, since many investors consider it a kind of ‘safe haven’ not only in comparison with the dollar, but even with traditional ‘safe haven currencies’ – the yen and the Swiss franc. Bitcoin is called “digital gold,” which has become more popular than any fiat currency.”

Dean of the Faculty of Digital Economy and Mass Communications of MTUCI Sergey Gataullin agreed with the forecast, saying the gold, Bitcoin, and U.S. Treasury Bonds could be in the spotlight.

Blockchain developer Evgeny Grechenok chipped in, noting that BTC attracts investors with its decentralized nature and limited issuance. At the same time, he drew attention to Bitcoin’s high volatility.

“During the default period, a sharp demand for Bitcoin will create the prerequisites for the growth of the asset, but then there will be a period of correction, due to which its value can drop significantly. It will be very important to find the right entry and exit points for the asset.”

Arthur Meinhard, Head of the Analytical Department for Global Markets at IC Fontvielle, reflected on a default’s effect on the stablecoin market.

He said stablecoins could lose their investment appeal since most are in short-term U.S. government bonds and cash.

“Stablecoins, being a derivative of the U.S. dollar, will experience significant selling pressure: crypto-investors will begin to massively get rid of them, preferring to shift to Bitcoin and other crypto-assets.

“Against this background, increased volatility of the entire cryptocurrency market is expected, firstly, due to massive purchases of crypto-assets, and, secondly, downward decoupling of stablecoins from parity to the US dollar one to one.”

Summing Up

A U.S. default could trigger a flow of assets into the crypto industry. There were many historical examples when the problems of the traditional finance market caused an increase in investor interest in cryptocurrency.

For example, Bitcoin experienced its best week against the backdrop of the U.S. banking crisis in the spring of 2023.

At the same time, experts recalled the high volatility of BTC. A significant correction is possible in the event of a rapid increase in the Bitcoin price.

Do not forget the connection between the crypto industry and the traditional financial market. The latter’s problems can prove bearish for crypto long-term.

Also, experts suggest a crisis in the stablecoin market should the U.S. government default on its debt. This crisis could worsen the overall health of the crypto industry.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.