What’s the difference between Bitcoin and Bitcoin Cash, and which is the better investment? In short, Bitcoin offers long-term value, while Bitcoin Cash provides affordability and faster transactions. This Bitcoin vs. Bitcoin Cash comparison breaks down the key differences between the two, helping you make an informed decision on which aligns best with your investment goals in 2025.

KEY TAKEAWAYS

•Bitcoin (BTC) is ideal for long-term investors looking for security and value retention, with strong institutional backing. Bitcoin Cash (BCH) is better suited for those seeking quicker, low-fee transactions and potential short-term gains.

•Bitcoin Cash offers faster transaction processing times and significantly lower fees than Bitcoin, making it more practical for everyday use and microtransactions.

•Bitcoin Cash is more energy-efficient than Bitcoin, appealing to ESG-conscious investors who prioritize sustainability in their investments.

What is Bitcoin (BTC)?

Satoshi Nakamoto created Bitcoin in 2008. Initially proposed as a decentralized means of payment, the original crypto remains the most popular decentralized asset in 2025.

Did you know? In 2025, the real identity of Satoshi Nakamoto, arugably the most influential figure in crypto, remains unknown.

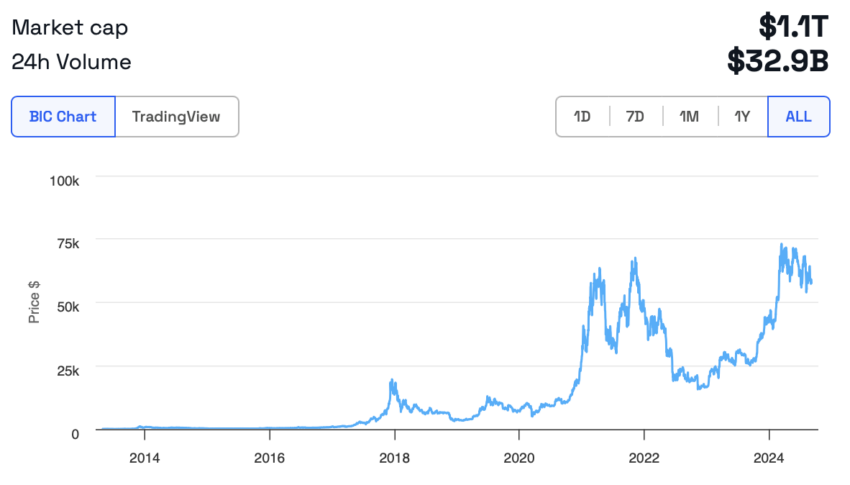

In 2010, BTC became available to trade on exchanges against fiat currency, such as the U.S. Dollar and the British Pound. The asset’s value has surged exponentially; as of Sept. 4, 2024, one BTC is worth $56,512.

Bitcoin can be used by speculators, as an investment vehicle,, and consumers for purchases or value exchange. The native coin, BTC, belongs to the Bitcoin blockchain.

Since 2009, Bitcoin has faced criticism for its carbon footprint, use in illegal activities, and lack of regulation. Despite this, it commands almost 55% of the cryptocurrency market.

What is Bitcoin Cash?

Bitcoin Cash (BCH) is a cryptocurrency that separated from Bitcoin (BTC) on Aug. 1, 2017. Founded by a group of people who had previously used Bitcoin, the coin resulted from a four-year dispute about Bitcoin’s scalability.

Did you know? The split was due to disagreements over block size limits and transaction processing speed, not just general scalability.

In 2008, Satoshi Nakamoto, the founder of Bitcoin, wrote a paper called “Bitcoin: A Peer-to-Peer Electronic Cash System,” setting out what Bitcoin’s original use should be. It was partly because of how far BTC had drifted from this that Bitcoin Cash was founded.

In 2020, one of Bitcoin Cash’s founders, Jonald Fyookball, suggested that despite opposition and setbacks, the team was pushing with the development of BCH to improve the cryptocurrency for its users. Subsequent attempts to fork the cryptocurrency in 2018 and 2020, one by its founder, Amaury Sechet, were made. However, neither of these proved successful.

In 2020, BCH faced further controversy when a plan was revealed to fund the future of Bitcoin Cash from the rewards gained on Coinbase from the cryptocurrency. The community saw this as a tax. However, after several changes, this was implemented in May 2020.

As an altcoin that is considerably more affordable than Bitcoin, BCH has fallen from over $3k in late 2017 to about $321 in 2024.

One of the major takeaways from this Bitcoin vs. Bitcoin Cash comparison is that, unlike BTC, BCH is more energy-efficient. This is positive news for ESG-conscious investors; BCH uses only a fraction of Bitcoin’s energy. The energy savings from BCH itself are a massive positive for the planet. In this regard, BCH wins hands down.

Should I buy BTC or BCH in 2025?

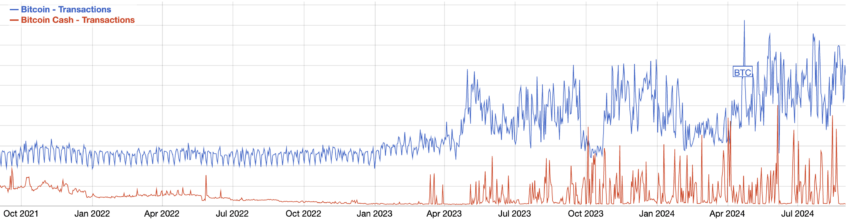

Whether or not you should buy BTC or BCH in 2025 is entirely up to you. However, you should keep a few things in mind. BCH receives a significantly lower transaction volume than BTC, suggesting low usage. As a result, BCH naturally collects lower transaction fees.

Moreover, transaction fees double as a blockchain network’s security spend. This implies that Bitcoin has a higher intrinsic value than BCH. Moving on to fundamental analysis, Bitcoin has also seen greater utilization, especially with the popularity of inscriptions.

The matter of which coin to choose boils down to your preferences. If you want to mine, then BCH may be a better option, as the Bitcoin mining atmosphere is highly competitive.

If you are looking for an asset that not only holds its value over time but also increases with time, then BTC may be a better option. Do you want to use the network, and if so, how do you want to use it? That is a pressing question to ask yourself.

At the end of 2023 and early 2024, BCH had both a greater increase in price, percentage-wise and even a decrease. This means that if you were holding BCH, you would have had a greater return on investment (ROI) when the price increased and a lower ROI when the price decreased.

Both Bitcoin and Bitcoin Cash have a few services and businesses that support various activities, such as ATMs, cards, or money transmitters. On the other hand, if you want to use the actual network, both have limited functionality for things like smart contracts. However, Bitcoin has slightly more programmability.

BTC benefits from institutional interest, including spot ETFs and investment products that make it accessible to traditional financial markets. Bitcoin Cash, on the other hand, handles more transactions at a faster rate, which is beneficial for businesses and services requiring high throughput.

Pick the strategy not just the crypto

When comparing Bitcoin vs. Bitcoin Cash, it’s about strategy. Bitcoin (BTC) suits long-term value investors with institutional backing, while Bitcoin Cash (BCH) appeals to those seeking quick, low-fee transactions. Your choice depends on your investment goals — security and value retention with BTC or speed and affordability with BCH.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Cryptocurrency investments are highly speculative and involve significant risks. Always conduct thorough research or consult with a financial advisor before making any investment decisions.

Frequently asked questions

What is the difference between Bitcoin and Bitcoin Cash?

How was Bitcoin Cash created?

Is Bitcoin better than Bitcoin Cash?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.