Decentralized exchanges have opened innovative doorways for DeFi users, facilitating yield farming and borrowing. Yet, many limitations remain in scaling a DEX according to its respective blockchain. The Osmosis crypto platform aims to offer a solution by integrating multi-chain capabilities with a next-generation feel. This guide dives into the functionality and mechanism behind the Osmosis project, its underlying Cosmos ecosystem, and native OSMO crypto.

KEY TAKEAWAYS

► Osmosis is a DEX app-chain built with the Cosmos SDK, providing customizable liquidity pools and cross-chain capabilities.

► Users can benefit from superfluid staking on Osmosis, which allows them to stake OSMO coins while simultaneously earning liquidity pool rewards.

► The platform features a unique “thirdening” model to control OSMO token inflation, similar to Bitcoin’s halving mechanism but reduces supply growth by one-third.

► Osmosis emphasizes decentralized governance, where OSMO holders vote on key upgrades, but potential risks like validator slashing and high inflation require careful consideration.

What is Osmosis crypto?

Osmosis is an application-specific decentralized exchange (DEX) and automated market maker (AMM) built on the Cosmos SDK — an open-source software development kit for building application-specific blockchains.

In other words, Cosmos helps developers create custom and scalable blockchains. Osmosis offers customizable AMMs that enable liquidity pool owners to create better market conditions. It is interoperable with other blockchains since it is built using the Cosmos SDK.

In contrast to how centralized exchanges work, automated market makers use smart contracts to determine the prices of digital pairs, enabling a smooth flow of peer-to-peer transactions.

Osmosis differs from other popular DEXs because it allows users to customize their liquidity pools and deploy customized AMMs. This gives liquidity providers more control over their DeFi activities since they can essentially set their own rules.

Osmosis team

Osmosis Labs is the company behind the Osmosis crypto project. Sunny Aggarwal and Josh Lee are the leading founders. Both built the Byzantine-Fault Tolerant engine Tendermint technology, which governs the platform.

Osmosis Labs is responsible for the protocol’s initial code development. However, a decentralized validator set runs Osmosis. Launched in June 2021, the decentralized nature of the protocol allows the community to vote on upgrades and modifications.

How does Osmosis work?

Osmosis derives its functionality from the Cosmos ecosystem. Cosmos enables the overarching of blockchain networks referred to as the “internet of blockchains.” As a result, tokens and data move via Cosmos’ Inter-Blockchain Communication (IBC) Protocol.

The Osmosis platform works by supplying self-governing liquidity pools. Users can make changes to the protocol, including swap fees, incentives, TWAP calculations, or Curve algorithms. Here is a concise breakdown of how it works:

AMM model: Osmosis utilizes an AMM model to facilitate trades.

- It uses liquidity pools, a pool of tokens that users contribute to.

- Users create these pools based on available token pairs.

- Users can add or remove liquidity from these pools.

- When a trader wants to swap one token for another, they interact with these liquidity pools.

- The swap price is determined based on the ratio of tokens in the pool, following a constant product formula.

Inter-blockchain communication: Osmosis leverages the IBC protocol to enable cross-chain functionality.

- It can communicate and interact with other compatible blockchains within the Cosmos ecosystem.

- This allows users to access and trade tokens from different blockchains.

Customizable liquidity pools: One of Osmosis’ unique features is the ability for users to create and customize liquidity pools.

- Users can create new pools or duplicate existing ones with unique parameters.

- This flexibility allows for more efficient liquidity provision and potentially reduces market volatility.

Moreover, one of the platform’s primary features is its superfluid staking. This means its users can earn rewards by staking their OSMO coins and receive a cut of liquidity pool transaction fees simultaneously. This could be considered a predecessor to EigenLayer’s restaking mechanism.

Osmosis features

The Osmosis crypto project aims to differentiate itself from other DEX platforms like Uniswap and Curve, which also offer AMMs. The platform is technically a proof-of-stake blockchain that offers unique features, including:

- Sovereignty and unified incentivization – Osmosis aligns liquidity providers, DAO members, and delegator interests with varied incentives. For example, staked LPs have sovereign ownership over their pools and have the freedom to adjust their market parameters since liquidity pools are self-governing.

- Cross-chain native – Osmosis is also cross-chain native with IBC compatibility as its core element. The platform plans to branch out to other non-IBC chains, such as ERC-20s.

- Superfluid staking – The OSMO coin can be used for liquidity and staking simultaneously without any tradeoffs, maximizing rewards for its users.

- Osmosis thirdening – Similar to a halving, the thirdening is a model adopted to create OSMO token scarcity and increase its price.

Osmosis (OSMO) coin

OSMO is the native coin that runs the Osmosis ecosystem. Firstly, it facilitates the platform’s transactions, including liquidity mining reward allocation and the base network swap fee.

OSMO also acts as a governance coin, enabling holders to add direction to the project’s strategic positioning and vote on upgrades. Holders determine which pools are eligible for liquidity rewards. The goal is to align stakeholders and LPs with the protocol’s longevity.

Tokenomics

The current circulating supply (as of October 2024) of OSMO is 997 million, with a 1 billion max supply.

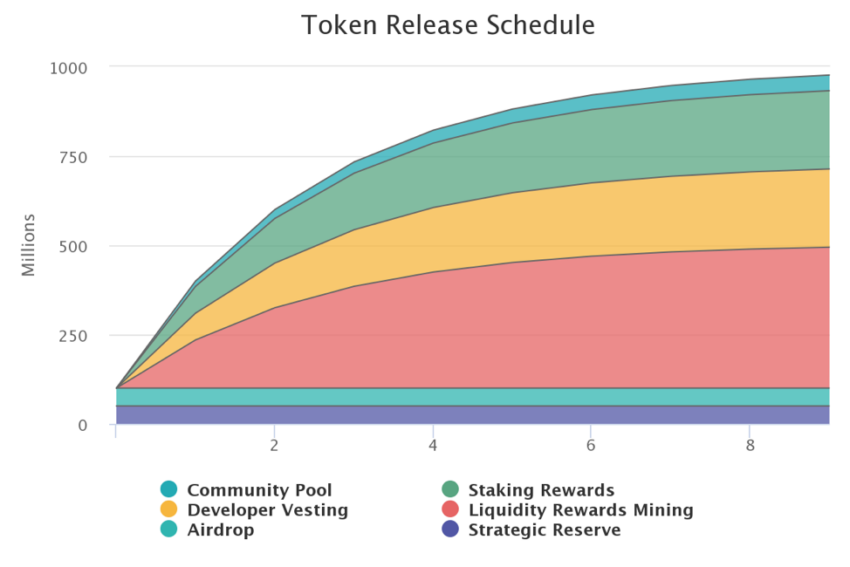

There was an initial supply of 100 million OSMO split between the strategic reserve and Fairdrop recipients. As the OSMO token released, over time this would account for a small portion of the total supply. The distribution is as follows:

- Liquidity mining incentives: 45%

- Staking rewards: 25%

- Developer vesting: 25%

- Community pool: 5%

Thirdening supply

The inflation is based on a thirdening model (cut by a third), as opposed to a halving, which is the case for Bitcoin. Although it is similar to how halvings work in other cryptocurrencies. For example:

- Initial supply of 100 million OSMO released June 2021

- Year 1: 300 million OSMO

- Year 2: 200 million OSMO

- Year 3: 133 million OSMO

OSMO wallet

Trust Wallet provides an Osmosis (OSMO) wallet, and this mobile app works with several different cryptos. Trust Wallet is non-custodial, meaning you have complete control over your OSMO and any other digital assets. You can download Trust Wallet on the Apple store, Google Play, Chrome, or Android.

How to use Osmosis crypto

There are a variety of ways someone can use the Osmosis platform. You can start by funding a crypto wallet with ATOM before transferring to an Osmosis chain wallet to purchase Osmosis OSMO.

This currency pair can be pooled to earn rewards with a ratio of up to 50:50. Users earn money by providing liquidity. In addition, bonding allows you to lock up funds for a specified time with higher returns the longer they are held.

Another way to take advantage of Osmosis is by utilizing platform fees. For example, transaction fees go to validators and OSMO stakers. You can also swap fees for trading assets on the DEX or earn exit fees for users who pull out their funds from liquidity pools. The shares are burned, and then the value is distributed to the remaining LPs.

Osmosis pros and cons

| Pros | Cons |

|---|---|

| Provides tools for customized liquidity provisioning on liquidity pools | Validators must take care to avoid any slashing risks or penalties |

| Can communicate between multiple blockchains, mitigating fragmented liquidity | High inflation rewards may not be advantageous for holders or validators |

| Thirdening model may offset high inflation risks | |

| The governance model incentivizes active participation in the ecosystem |

The Osmosis crypto platform provides an array of possibilities in DeFi, opening new opportunities for investors. It has pioneered many early concepts, facilitated the efficient inter-blockchain trading of assets without fragmenting liquidity, and is often lauded for its strong governance model and culture.

However, while the benefits of Osmosis are seemingly clear, users must always be wary of potential setbacks and risks. Firstly, the slashing mechanism disincentivizes bad behavior in the protocol. The protocol burns a validator’s portion stake in such a case.

That said, risks such as double-signing still exist and can harm the entire system. As a result, 5% of a validator’s total stake can be burned. In addition, if validators don’t participate in a consensus for over 28,500 blocks in a row, downtime is penalized, and the validator is considered jailed.

All of this may impact the scalability of the network. But, if you’re a consistent and involved user of Osmosis, the platform can certainly be an apt partner for decentralized, responsible investing.

Osmosis is an IBC success story

The Osmosis crypto platform is perhaps the most notable project to come out of the Cosmos ecosystem. It has many benefits and a few drawbacks. The governance model incentivizes active participation in the ecosystem. It is also the beneficiary of groundbreaking ideas ahead of its time, such as inter-blockchain communication and superfluid staking, a likely predecessor to restaking.

However, interested validators should remain aware of the subtleties of the OSMO tokenomics, such as the high inflation schedule, the thirdening, and the necessity of active participation to receive rewards.

Frequently asked questions

Who is the founder of Osmosis crypto?

How much can you make staking Osmosis?

How do you make money from Osmosis?

When did Osmosis crypto launch?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.