Friday is Bitcoin options expiry day; contracts worth over half a billion dollars are set to expire. Bitcoin has been stuck in a lethargic state for months, but will this expiry event finally move it?

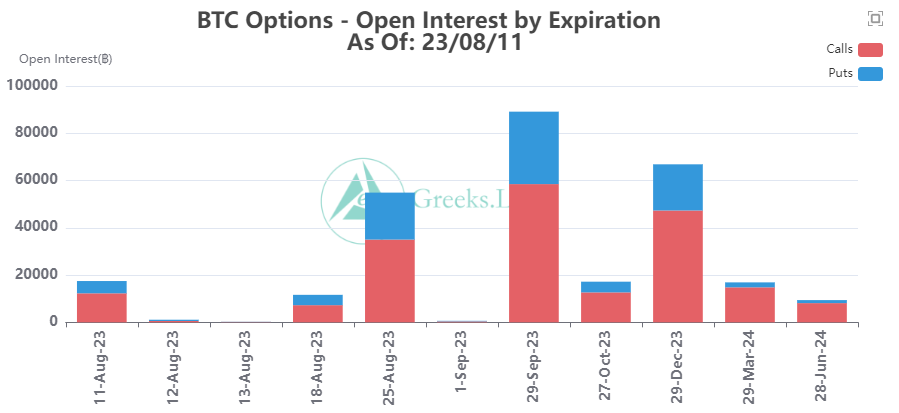

On Aug. 11, around 17,000 Bitcoin options contracts will expire with a notional value of $510 million. The open interest, or the number of contracts that have yet to expire, is very similar to last week’s options expiry event.

Bitcoin Options Expiry

Today’s expiring tranche of BTC options contracts has a max pain point of $29,500. This is pretty close to the current spot price of the underlying asset.

Max pain is the price level with the most open contracts and the level at which most losses will be made when those contracts expire.

Furthermore, the options contracts have a put/call ratio of 0.42, meaning more calls are being bought than puts.

Greeks Live commented that BTC had dominated the week. Adding that the market’s focus on mainstream crypto is due to the expectation of an ETF passing.

It added that implied volatility (IV) of the major term of BTC and ETH contracts “have been inverted frequently this year, and this week the inversion has resurfaced for three days.”

“Currently ETH weekly ATM option IV is only 22%, a few years ago the joke about BTC volatility lower than Chinese stock market, I am afraid that really will be fulfilled in the near future.”

IV is a measure of expected future volatility derived from the expiring derivatives contracts. However, spot and derivatives markets are currently at historically low volatility levels.

In addition to the Bitcoin options expiry are 121,000 Ethereum contracts. These have a notional value of $220 million and a max pain point of $1,850.

Furthermore, the put/call ratio for the ETH options is 0.60 which is also more calls (longs) than puts (shorts) being sold.

BTC Price Outlook

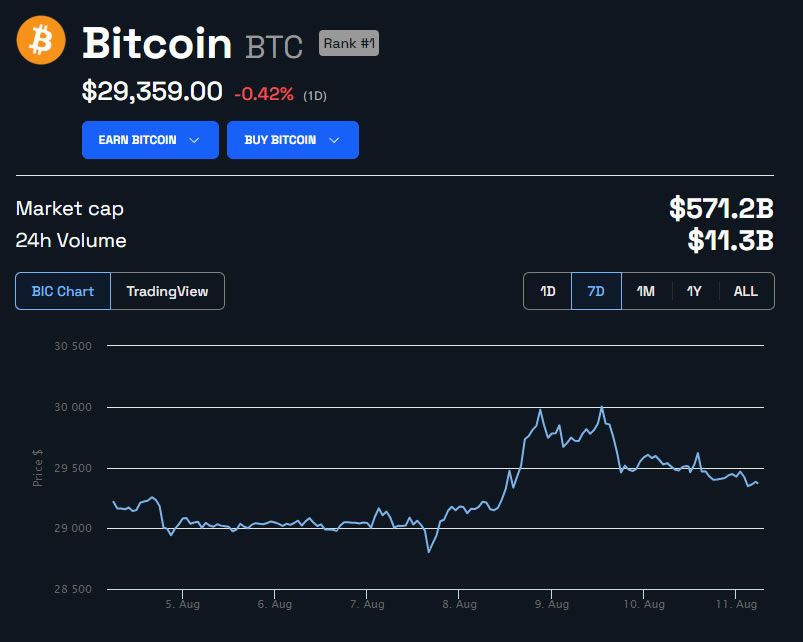

The lethargy in Bitcoin markets has continued for another week. The asset briefly touched $30K mid-week but failed to break resistance and began to retreat again.

BTC has weakened further this Friday falling to $29,359, very close to where it was trading this time last week.

The range-bound action (or lack of it) has continued for almost five months now, marking one of the longest cycle consolidation periods ever. Therefore, it is very unlikely the options expiry event today will impact spot markets.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.