Bitcoin is the leading cryptocurrency in the market, and its price is characterized as being highly volatile. Predicting Bitcoin price fluctuations is complex and requires an understanding of various factors that influence BTC.

Still, there are several techniques and strategies that traders and investors can use to forecast Bitcoin price fluctuations.

Understanding Bitcoin Price Fluctuations

Several factors, including demand and supply, government regulations, news events, and technological advancements, influence the price of Bitcoin. For instance, governments implementing stricter regulations on Bitcoin can decrease demand and a price drop.

On the other hand, when positive news events occur, such as large companies accepting Bitcoin as a form of payment, it can lead to an increase in demand and a rise in its price.

Another important factor that influences Bitcoin price fluctuations is its supply. It is limited to 21 million BTC, and its production rate halves every four years.

As a result, Bitcoin has a deflationary nature, which means that its value can increase over time due to scarcity.

Hack #1: Technical Analysis

Technical analysis involves analyzing past market data, primarily price and volume, to identify patterns and trends that can help predict future Bitcoin price movements.

Technical analysts use various tools and techniques, such as chart patterns, trendlines, and moving averages, to analyze the price data and identify potential buy and sell signals.

Hack #2: Fundamental Analysis

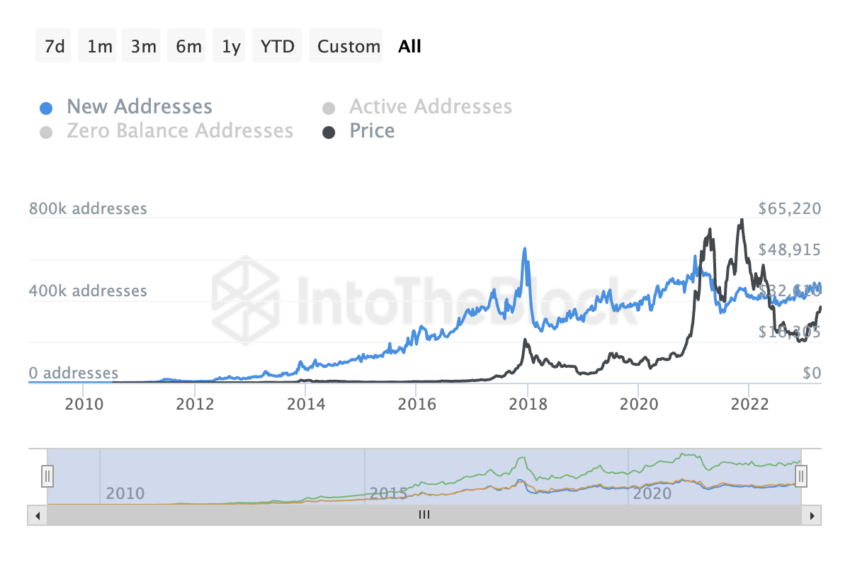

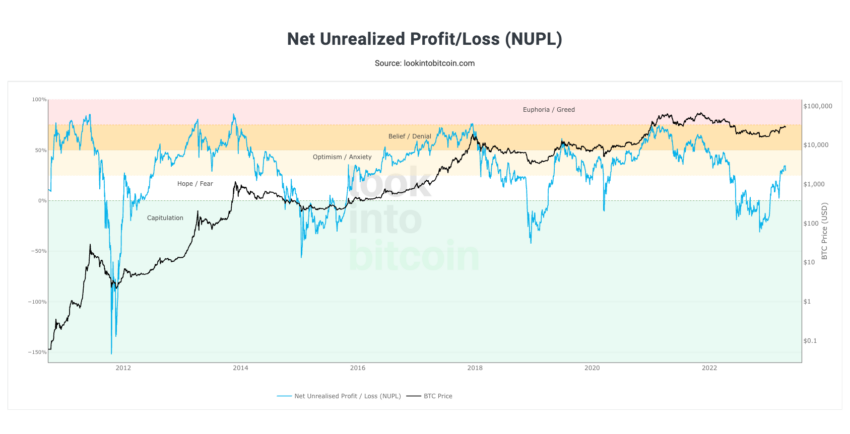

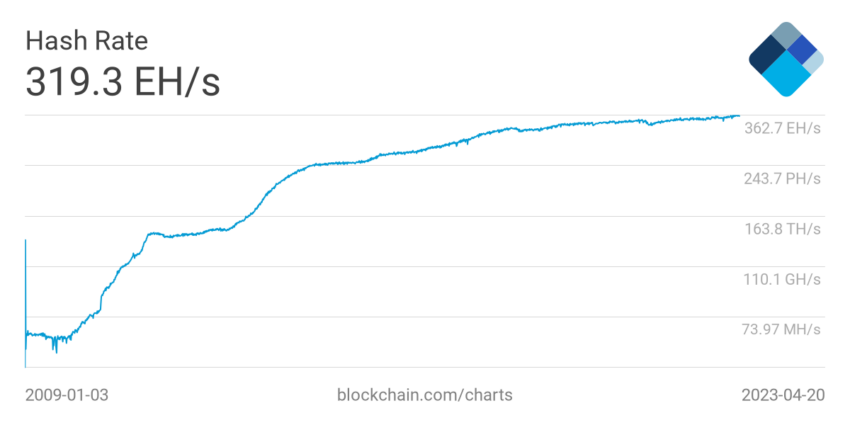

Fundamental analysis involves analyzing the underlying factors that affect the value of an asset. In the case of Bitcoin, fundamental analysts would look at factors such as network activity, adoption rates, and regulatory developments.

By analyzing these factors, fundamental analysts can identify potential buy or sell opportunities based on Bitcoin’s intrinsic value.

Hack #3: Sentiment Analysis

Sentiment analysis involves analyzing the opinions and emotions of market participants toward an asset. In the case of Bitcoin, sentiment analysts would analyze social media posts, news articles, and other sources to identify the general sentiment toward Bitcoin.

Positive sentiment can lead to an increase in demand, while negative sentiment can lead to a decrease in demand and a drop in its price.

Hack #4: Network Analysis

Network analysis involves analyzing the Bitcoin network to identify potential price movements. Bitcoin’s network is a decentralized system of nodes that verify transactions and maintain the blockchain.

Analysts can identify potential buy or sell signals by analyzing the network’s activity, such as the number of active nodes and the number of transactions.

Hack #5: Whale Watching

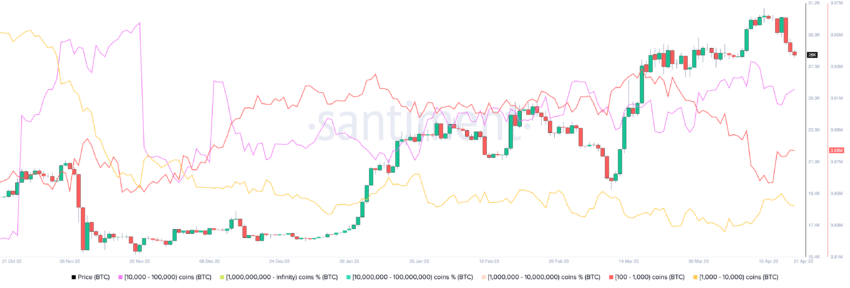

Whale watching involves analyzing the activities of large Bitcoin holders, also known as whales. Whales can influence the price of Bitcoin by buying or selling large amounts of Bitcoin.

By analyzing crypto whales activity, traders and investors can identify potential price movements and adjust their positions accordingly.

Summing All Up

What causes Bitcoin price to fluctuate is a complex question, and there are no guaranteed methods for accurately forecasting its value. However, by using the five secret hacks discussed in this article, traders and investors can gain valuable insights and increase their chances of making profitable trades.

Technical analysis, fundamental analysis, sentiment analysis, network analysis, and whale watching are all powerful tools that can help identify potential buy and sell signals in the Bitcoin market.

By using a combination of these techniques and keeping up to date with the latest news and developments, traders and investors can stay ahead of the curve and maximize their profits.

FAQs

Is it possible to predict the price of Bitcoin accurately?

What is technical analysis, and how does it work?

What is fundamental analysis, and how does it work?

What is sentiment analysis, and how does it work?

What is whale watching, and how does it work?

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.