Bitcoin mining stocks are outperforming tech stocks and indexes so far this year, following an 80% gain in the underlying asset, BTC.

There has been a resurgence in Bitcoin mining stock performance this year. The big moves for the leading players follow a painful drawdown for many in 2022.

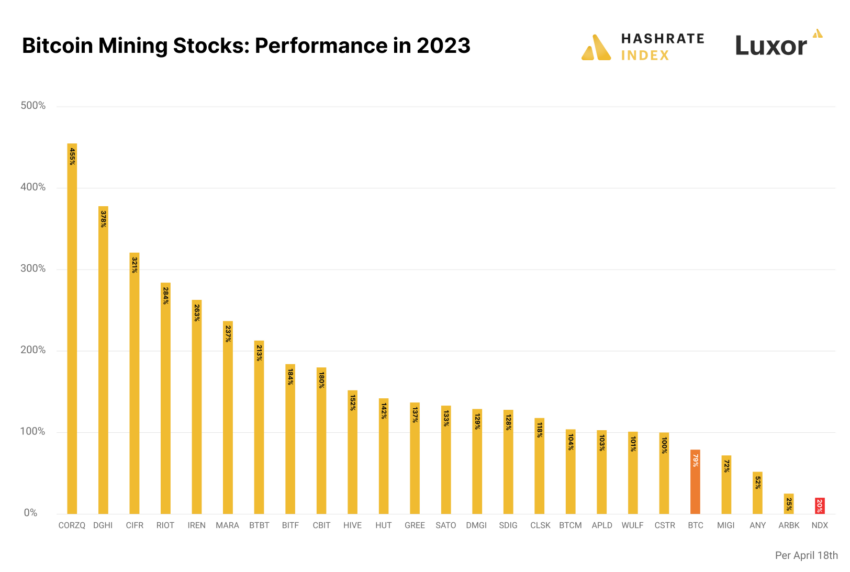

According to BTC mining expert Jaran Mellerud, 20 of the industry’s leading mining firms have seen stock double or more this year.

Their performance has outpaced Bitcoin itself and trounced that of the top tech stocks.

On April 18, Mellerud posted a summary of the mining industry’s top performers in 2023.

Massive Gains For Bitcoin Mining Stocks

Core Scientific is the best-performing Bitcoin mining firm so far in 2023, with a whopping 455% gain. The analyst explained the motives behind the big stock move.

“Its massive debt has given its equity a boost during the up-only market environment so far in 2023. Its cash flows relative to equity have been positively affected (but disproportionately so) by the improvements in mining economics.”

Furthermore, Digihost, Cipher, Riot, Iris Energy, and Marathon have also seen huge gains between 237% and 378%.

Most of these companies have relatively low debt levels relative to equity and are significantly less financially leveraged than Core Scientific, Mellerud pointed out.

“The outperformance of these stocks is likely caused by company-specific factors, as they have all delivered solid monthly operational updates exceeding expectations this quarter.”

Moreover, Bit Digital, Bitfarms, Cathedra, Hive Blockchain, and Hut 8 all gained between 142% and 213% this year.

Remarkably, the 20 mining companies have done better than Bitcoin’s 80% rise since the beginning of the year.

The analyst predicted that if BTC price increased by an additional 40% to reach $42,000 this year, “most mining stocks would rise by more than 50% from today’s level, while the four-to-five biggest gainers would soar by more than 150%.”

Tech Stocks Can’t Compete

Comparatively, according to MarketWatch, the tech-heavy NASDAQ 100 Index has only managed a 20% gain so far this year.

The world’s dominant search firm, Alphabet, has seen a miserly 17% gain for stock this year. Since New Year’s Day, software giant Microsoft has only scraped a 20% gain.

Furthermore, the world’s largest tech corporation Apple has managed a 33% rise in share prices in 2023.

Gold prices, which are often touted as a store of value, have inched up just 9% this year.

Even Coinbase stock (COIN) has doubled in price since the beginning of the year. Therefore, the crypto narrative has returned with a bang in 2023, but can it be maintained for the rest of the year?

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.