Bhutan has been secretly investing in cryptocurrencies like Bitcoin, according to new bankruptcy filings.

Bhutan, the isolated Himalayan kingdom, has quietly invested millions of dollars in cryptocurrencies, including Bitcoin and Ether, over the past year.

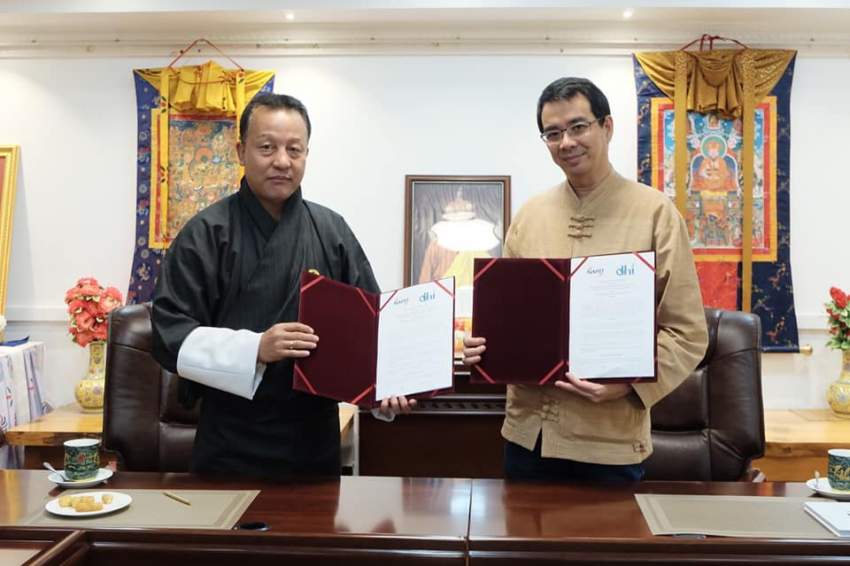

Forbes has reviewed the bankruptcy filings of BlockFi and Celcius and discovered the country’s secret crypto portfolio. Druk Holding & Investments (DHI), Bhutan’s $2.9 billion sovereign investment arm, was a customer of both bankrupt crypto lenders.

Bhutan has never publicly disclosed the investments by DHI. Their contents raise questions about Bhutan’s relationship with the crypto economy. Whether the holdings support recent and ongoing modernization initiatives in Bhutan is unclear.

In February 2022, DHI agreed to borrow $30 million USDC from BlockFi but defaulted on loan repayment. Prompting lawyers for BlockFi to serve a complaint to DHI last month. Even after the lender liquidated collateral of 1,888 bitcoin, there was still an unpaid balance of $820,000.

The CEO of DHI, Ujjwal Deep Dahal, told Forbes via email:

“We do not have any comments as the matter with BlockFi has been settled. We are not able to comment due to confidentiality.”

Bhutan’s Secrecy About Its Holding Company

Months earlier, DHI was also outed as an institutional customer of Celsius. The firm made many trades between April and June 2022, depositing, withdrawing, and borrowing Bitcoin, Ether, Tether, and a handful of other cryptocurrencies.

It is unclear where these funds originated or how officials have used them. But DHI’s holdings could trigger further legal action as Celsius’s lawyers have noted their intent to seek “clawbacks” of deposits made within 90 days of its bankruptcy.

DHI’s investment of tens of millions of dollars in crypto may seem odd. Given the holding company’s supposed role of promoting domestic ventures, it seems strange for DHI to invest in crypto. It would be the first to own crypto directly if it is a sovereign wealth fund.

The royal charter, which set up the fund in 2007, says that the purpose of DHI is “to safeguard the national wealth, and manage and enhance such wealth through prudent investments.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.