They say that the only certain things in life are death and taxes. In spite of a potential desire to hide from the Internal Revenue Service (IRS), this will also hold true for cryptocurrency owners when paying their 2018 taxes. Three of the largest exchanges — Coinbase, Kraken, and Gemini — will be issuing 1099-K statements to their users. This will effectively alert the IRS that these citizens own cryptocurrencies.

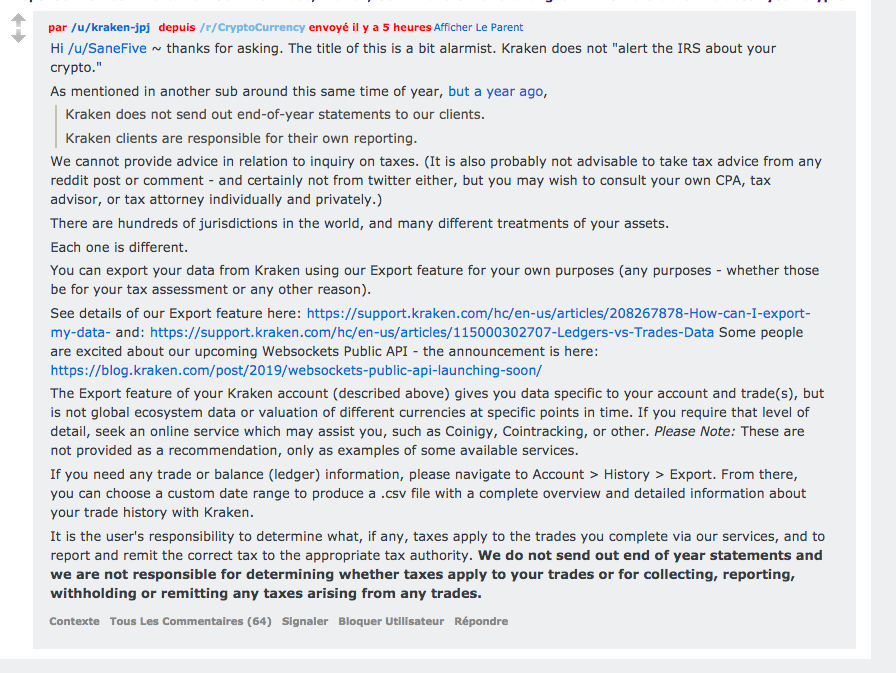

Update (2019-01-24 8:27 PM): Kraken has responded to this article on Reddit to clarify that the platform does not alert the Internal Revenue Service (IRS) about users’ cryptocurrency holdings and transactions. The full response is published below. The remainder of the article has been left untouched.

Unlike the more common 1099-B form, the 1099-K does not specify transaction amounts or frequency, so long as these numbers don’t exceed $20,000 or 200 transactions. At the same time, realized losses — any cryptocurrency converted back to fiat currency for a net loss before the end of 2018 — could result in a $3,000 loss tax deduction. Many investors faced substantial losses in the price declines of most coins throughout the year and would, therefore, be receiving this deduction. Interestingly, because cryptocurrencies are not considered securities as of yet, it would have been possible to sell on Dec 31 and buy back just hours later on Jan 1 — and record a realized loss for the year. This would have the effect of maintaining a portfolio while taking advantage of any losses sustained during the crypto winter. For those concerned about IRS influence on their portfolios, this news may come with a silver lining. Regardless of how anti-government one may be, the offer of tax reductions for losses may be very attractive.

For 2018, Coinbase, Kraken, and Gemini will be reporting to the IRS, so you may receive a 1099-K.

— Crypto Tax Girl (@CryptoTaxGirl) January 23, 2019

A 1099-K doesn’t have any specifics about your transactions (like a 1099-B does), but it does signal to the IRS that you hold crypto.

Anonymity? Nope.

Cryptocurrencies have garnered a large number of believers because of the relative anonymity these instruments provide their owners. Transfers and sales can happen from one wallet to another — without the influence or knowledge of the federal government. However, exchanges like Coinbase and others are forced to report user transactions directly to the IRS. This allows the IRS to track and evaluate the income and loss of those investors. While it is still unclear whether these exchanges provide all investors’ transaction information, the simple awareness that cryptocurrencies were held and traded is enough. The IRS will know and will look for information on the respective tax return.

HODLers are safe

Another potential positive is that those who held their cryptocurrencies through the course of the year without selling do not have a taxable event to report. The only events that must be reported are sales or transfers. At this same time, those who left their portfolios alone through the course of the year will not be able to take advantage of the loss deduction. Since they did not liquidate their cryptocurrencies within the 2018 calendar year, they would be unable to claim any realized loss. While the IRS, Congress, and the Securities and Exchange Commission (SEC) continue to wrangle over how to best classify cryptocurrencies, owners must be careful to make appropriate declarations for tax reasons. Some, like John MacAfee, may refuse to pay taxes altogether — but it behooves the general public to file an honest tax return and avoid any risk of audit. You can’t hide from the tax man. Will you file a tax return with detailed cryptocurrency holdings? Or will you refuse? Let us know (or don’t) in the comments below!Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Jon Buck

With a background in science and writing, Jon's cryptophile days started in 2011 when he first heard about Bitcoin. Since then he's been learning, investing, and writing about cryptocurrencies and blockchain technology for some of the biggest publications and ICOs in the industry. After a brief stint in India, he and his family live in southern CA.

With a background in science and writing, Jon's cryptophile days started in 2011 when he first heard about Bitcoin. Since then he's been learning, investing, and writing about cryptocurrencies and blockchain technology for some of the biggest publications and ICOs in the industry. After a brief stint in India, he and his family live in southern CA.

READ FULL BIO

Sponsored

Sponsored

![You Better File a Tax Return (The IRS Knows You Own Crypto) [Updated]](https://beincrypto.com/wp-content/uploads/2019/01/bic_irs.jpg.optimal.jpg)