Kraken is a long-standing centralized exchange (CEX), having weathered many a crypto winter. In this Kraken review, we will assess the proficiency of the leading CEX. We discover why Kraken endured while many of its peers have fallen, offering a comprehensive analysis of the global platform’s features, pros, and cons.

Kraken

- Kraken

- Who is this Kraken review for?

- What is Kraken?

- How to sign up for Kraken in 2024

- Welcome offer/bonus

- History of Kraken

- Number of users and trading volume

- Features

- Pros and cons

- How does Kraken compare to others?

- Customer support

- How we have tested Kraken

- Regulatory compliance and safety

- Invest responsibly

- Survival of the fittest

- Frequently asked questions

Kraken at a glance: Our overall rating

Kraken is a U.S.-based exchange that has global reach. Additionally, the platform is very transparent about its commitment to security. This includes not only customers’ assets but its own data as well.

Moreover, they offer a wide range of assets and products. Considering the current regulatory environment, this is no small feat. Overall, Kraken is an exceptional exchange. While exchanges like Binance offer more features, we prefer Kraken for security and usability.

| Features | Security | Customer support | Fees | Assets | Products | BeInCrypto Score |

| Score | 5/5 | 3/5 | 4/5 | 5/5 | 4/5 | 4.2 |

Who is this Kraken review for?

Whether you are currently a CEX user or a beginner interested in exchanges, you can rest assured this review will tell you what you need to know about Kraken. Anyone interested in trading can also take advantage of this review. This includes solo day traders or institutions that trade at a high level with significant size.

In short, keep reading if you are a:

- Cryptocurrency enthusiast (new or old)

- Trader (retail or institutional)

- Person interested in fintech

What is Kraken?

Kraken is a well-known exchange platform that facilitates the buying, selling, and trading of various cryptocurrencies. It was founded by Jesse Powell and Thanh Luu in 2011 and became one of the first bitcoin exchanges to be listed on Bloomberg Terminal.

Kraken is headquartered in San Francisco, California, and is a prominent player in the U.S. cryptocurrency industry. Over the years, Kraken has expanded its services to cater to a global user base, offering a wide range of cryptocurrencies for trading, as well as advanced trading features and tools.

As one of the older and more established cryptocurrency exchanges, Kraken has earned a reputation for its commitment to security and regulatory compliance.

How to sign up for Kraken in 2024

1. Go to the Kraken website. Click “Sign up.”

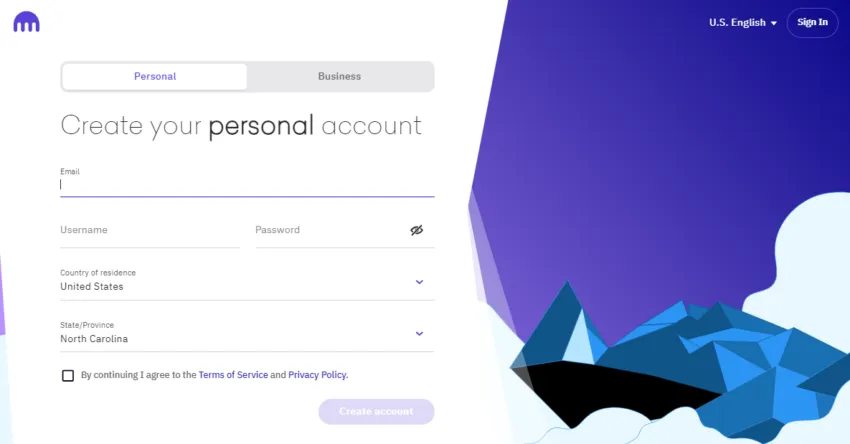

2. After you are redirected to the following page, choose “Personal” or “Business.” Enter the necessary information and select “Create Account.”

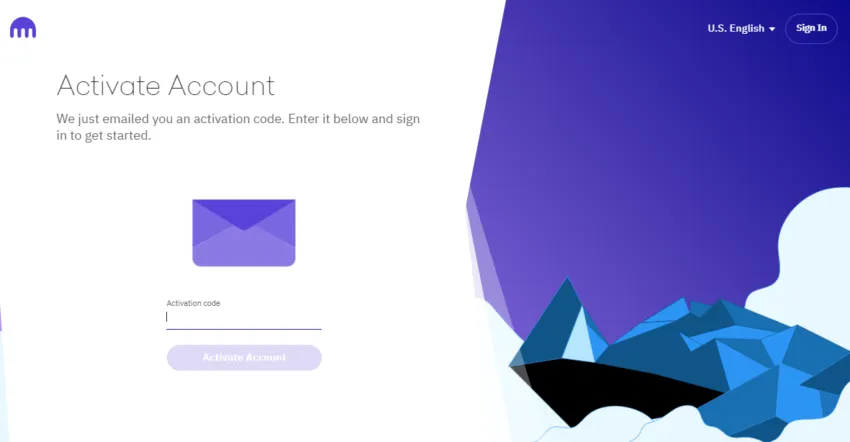

3. Lastly, enter the activation code that you will receive in your email.

Voila! You are now an official Kraken user.

Welcome offer/bonus

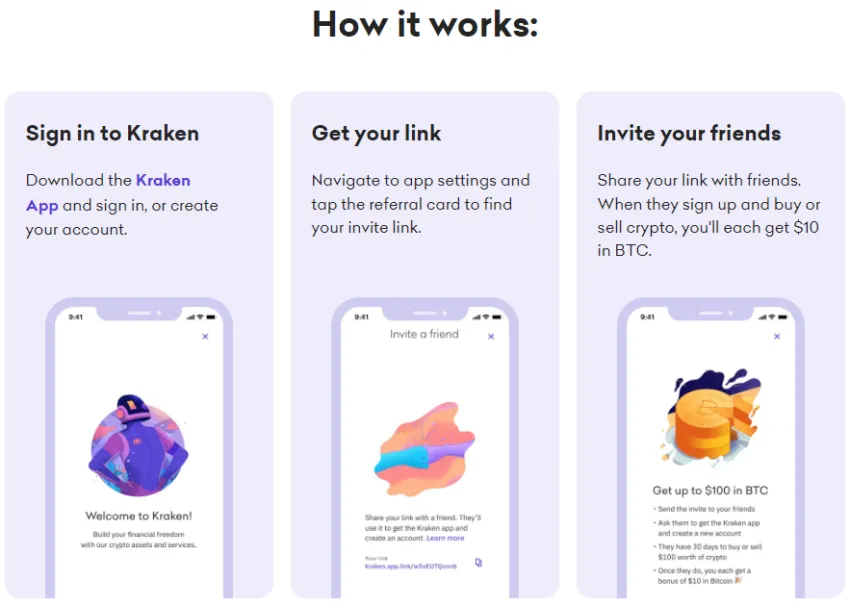

When you download the Kraken app and refer a friend, you have the opportunity to earn BTC. The way Kraken’s referral program works is by going into the app and retrieving your unique referral link.

Afterwards, give it to a friend, family, or followers. Once they sign-up using your link, and buy or sell $100 in crypto within 30 days of signing up, you and they will receive $10 in bitcoin.

The maximum amount of bitcoin that you can receive for referrals is $100. Additionally, the referral bonus is not available for Washington and New York state residents.

History of Kraken

Kraken made history by becoming the first cryptocurrency exchange to secure a Special Purpose Depository Institution (SPDI) charter in Wyoming.

This charter empowered Kraken to serve as a bridge to the banking ecosystem, reducing its dependence on external banks for payment processing. It’s essential to note that Kraken, despite this distinction, does not hold FDIC insurance as a traditional bank would.

This significant milestone did not shield Kraken from SEC scrutiny. In early 2022, the SEC initiated a reevaluation of cryptocurrency regulations, introducing additional operational challenges for exchanges like Kraken.

Whether it’s through staking-as-a-service, lending, or other means, crypto intermediaries must provide the proper disclosures & safeguards required by our laws.

Gary Gensler, SEC Chairperson

This intensified regulatory oversight culminated in Kraken reaching a settlement with the SEC in February 2023 concerning the company’s U.S. staking product.

/Related

More ArticlesAs a result of an SEC enforcement action that alleged Kraken’s failure to register its staking-as-a-service platform appropriately, Kraken ceased its U.S. staking service operations in February 2023.

Where is Kraken available?

Founded in 2011 by Jesse Powell, Kraken is one of the oldest and most well-established cryptocurrency exchanges in the world. Kraken operates across various continents, encompassing regions such as Africa, Asia, Europe, North America, Oceania, and South America. This widespread presence underscores its global reach and commitment to serving a diverse user base.

Number of users and trading volume

Kraken reported approximately 4 million users in February 2019, around 6 million in June 2021, and approximately 9 million in May 2022. It’s worth noting that it is uncertain whether Kraken’s reported user figures represent active users or merely registered accounts.

Additionally, in terms of yearly trading volume, Kraken recorded $397.76 trillion in 2022, $802.82 trillion in 2021, and $24.78 trillion in 2020, as per data sourced from Nomics.

The company has at least 45 investors across various rounds of funding, according to Crunchbase. Some of these investors include SBI Investment, Digital Currency Group, and Blockchain Capital, among others.

Features

- Spot trading: Allows users to buy and sell a wide range of cryptocurrencies at current market prices.

- Margin trading: Enables users to borrow funds to trade larger positions than their account balance, potentially amplifying both profits and losses.

- Futures trading: Allows users to purchase and trade various crypto futures.

- NFT marketplace: Kraken offers an NFT (non-fungible token) marketplace where users can trade, buy, and sell unique digital assets.

- Earn feature: Often referred to as staking-as-a-service, users can stake their cryptocurrencies to earn rewards or interest over time.

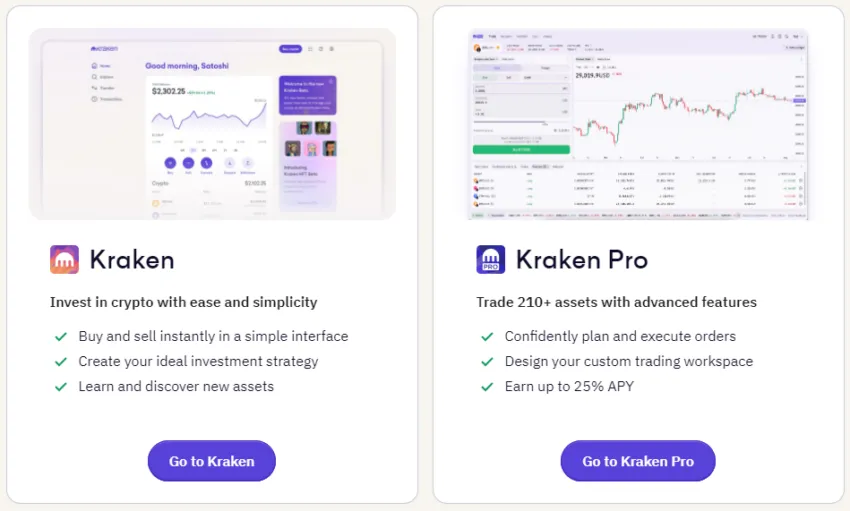

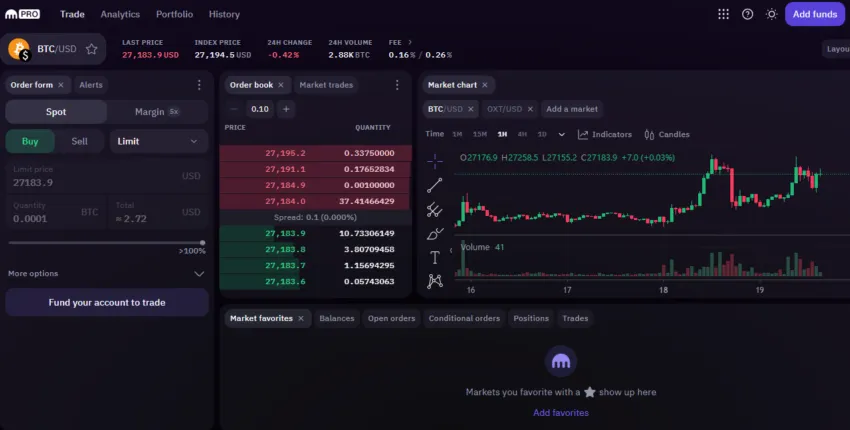

- Advanced trading interface: Kraken provides an advanced trading interface equipped with various tools and features like chart analysis, multiple order types, and customizable trading layouts to cater to the needs of experienced traders.

Security

Kraken places a strong emphasis on user security. The platform offers multiple layers of protection, including strong password options and multi-factor authentication. Users can also secure their accounts with FIDO2 devices and require extra approval for new device access.

Sensitive client data is kept offline, encrypted, and tightly controlled. Access to this data demands access to highly secure systems, ensuring data confidentiality. Kraken’s fund security is robust, with advanced cold storage and hot wallet solutions. Consequently, the crypto infrastructure is physically secured in monitored, guarded cages.

In 2014, Kraken passed the world’s first cryptographic proof of reserves (PoR) audit, and in 2022, re-emphasized its commitment to transparency, announcing “implementation of next-generation auditing standards designed to let clients prove their bitcoin and ether balances are backed by real assets held in our custody.”

Fees

Kraken’s fee schedule is based on the trading volume a user conducts over a rolling 30-day period. For spot trading, where users exchange cryptocurrencies directly, there are two categories: makers and takers.

Makers, who provide liquidity by placing orders that don’t immediately fill, incur a fee of 0.16% for trading volumes up to $50,000, while takers, who remove liquidity by matching existing orders, pay a fee of 0.26%. However, as trading volume increases, fees decrease significantly. For instance, users trading more than $500,000,000 enjoy a fee of 0.00% for makers and 0.04% for takers, encouraging higher-volume traders to use the platform.

Kraken also offers futures trading, with fees structured similarly. For trading volumes up to $100,000, users pay a maker fee of 0.0200% and a taker fee of 0.0500%. As the trading volume surpasses $100,000,001, the maker fee becomes 0.0000%, while the taker fee reduces to 0.0100%. This sliding fee scale incentivizes both smaller and larger traders to participate in futures markets.

Margin trading fees on Kraken vary by the specific cryptocurrency being traded. Users are charged an opening fee ranging from 0.015% to 0.02%, and there are rollover fees, typically within the range of 0.01% to 0.02%, applicable over a 4-hour period.

For stablecoins, pegged tokens, and FX pairs, the fees are again based on trading volume. For volumes between $0 and $50,000, makers and takers pay 0.20%. However, for those trading over $100,000,000, makers enjoy a fee of 0.00%, while takers pay a minimal fee of 0.001%.

Pros and cons

Kraken offers a range of features and services in the cryptocurrency trading space, but like any platform, it has its strengths and weaknesses. Let’s explore some of the notable pros and cons of using Kraken as a cryptocurrency exchange.

Pros

- Regulatory compliance: Kraken’s efforts to comply with regulatory requirements and its transparency contribute to its trustworthiness.

- Diverse trading options: Kraken offers a variety of trading options, including spot, margin, and futures trading, allowing users to diversify their trading strategies.

- Advanced trading tools: The platform provides advanced trading tools and features. This includes customizable interfaces and chart analysis, suitable for experienced traders.

- Security focus: Kraken is known for its strong commitment to security. With features like multi-factor authentication, cold storage for funds, and continuous monitoring, Kraken’s enhanced security measures are second to none.

- Zero gas fees for NFTs: Kraken’s NFT marketplace offers the advantage of zero gas fees. This makes it cost-effective for users to trade and transact non-fungible tokens without incurring additional blockchain transaction fees.

Cons

- Geographical restrictions: Kraken’s services are not available in Washington or New York. The Earn product (staking-as-a-service) is not available to any U.S. customers whatsoever.

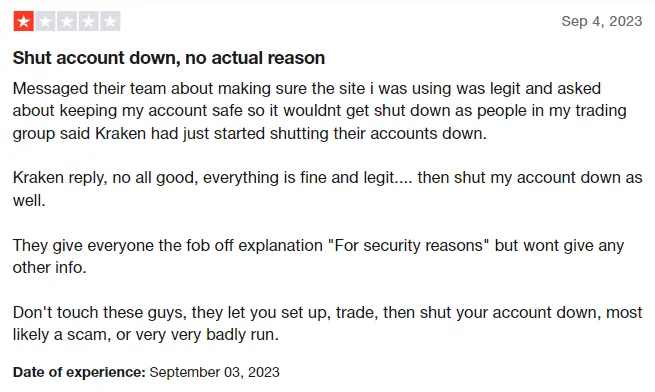

- Customer support concerns: Customer support has received mixed reviews. Some users express frustration over issues like delayed withdrawals and abrupt account closures.

- Regulatory concerns: Regulatory agencies like the SEC and CFTC have actively pursued legal actions against cryptocurrency exchanges. This heightened regulatory environment may pose potential risks and uncertainties for users of Kraken.

How does Kraken compare to others?

How does Kraken hold up against its competitors? In terms of features, we’ve already covered that the exchange offers a range of trading services, including spot, margin, and futures trading.

While Coinbase primarily focuses on spot trading and does not directly offer futures, Binance provides an extensive array of options, including spot, futures, and margin trading. Robinhood, on the other hand, primarily focuses on spot trading and margin trading for crypto and stocks.

Kraken offers an “Earn” feature, which includes staking services that allow users to earn rewards on their cryptocurrency holdings. In contrast, Coinbase does not directly offer an “Earn” feature. Binance offers a similar “Earn” feature, making it competitive with Kraken in this regard. Robinhood, on the other hand, does not provide staking or earnings on cryptocurrencies. In terms of advanced features, Binance slightly edges Kraken’s offerings.

Kraken boasts a diverse range of supported assets, with over 230 cryptocurrencies and trading pairs available. Coinbase offers more than 250 cryptocurrencies, while Binance again leads the pack with over 500 cryptocurrencies and trading pairs.

In contrast, Robinhood supports a relatively limited selection of cryptocurrencies, numbering around 15. Instead, Robinhood offers a much larger selection of stocks.

| Features | Kraken | Coinbase | Binance | Robinhood |

| Trading services | Spot, margin, futures | Spot trading (Does not directly offer futures) | Spot, futures, margin | Spot trading & margin trading |

| Earn | Yes | No | Yes | No |

| Assets | 230+ | 250+ | 500+ | 15 (not including stocks, ETFs, etc.) |

| Mobile app | Yes | Yes | Yes | Yes |

| Unique features | Zero gas fees for NFTs, staking services | Coinbase Pro | Binance Smart Chain, Launchpad, staking pools | Commission-free stock and cryptocurrency trading, fractional shares |

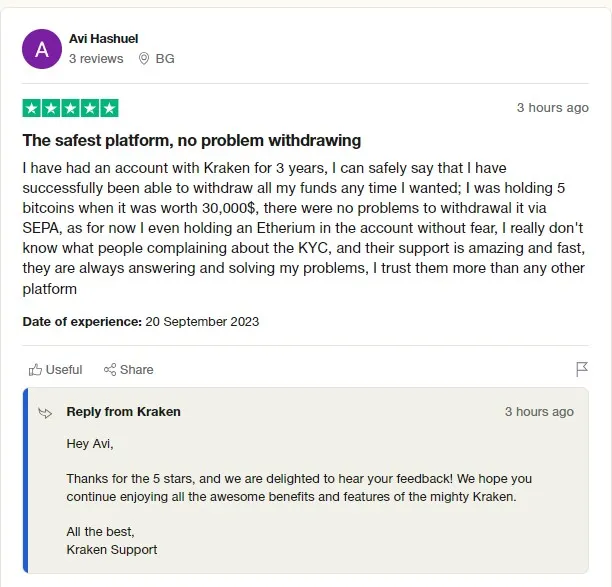

Customer support

Based on publicly accessible reviews, Kraken‘s customer support appears to have received mostly negative feedback. Many users have expressed frustration and dissatisfaction with their experiences, citing issues such as delayed withdrawals, demands for additional KYC (Know Your Customer) verification, and abrupt account closures.

However, there are also some positive comments, with users acknowledging improvements in the platform’s user interface with the introduction of Kraken Pro.

Overall, it appears that while some users have had satisfactory experiences with Kraken’s customer support and the platform in general, more have encountered significant frustrations and difficulties, particularly related to withdrawals.

How we have tested Kraken

In this evaluation of Kraken, the BeInCrypto team examined this crypto exchange. Our analysis encompassed the platform’s features, functions, advantages, and drawbacks.

- Spot trading: We assessed the platform’s ability to facilitate the immediate buying and selling of cryptocurrencies at prevailing market rates.

- Margin trading: Our evaluation included a review of the platform’s provisions for lending, allowing users to trade positions larger than their initial capital, considering the inherent risks and potential returns.

- Futures trading: We examined the platform’s infrastructure to handle contracts that allow buying and selling of crypto at preset prices in the future.

- NFT marketplace: Our testing encompassed the platform’s marketplace designed for the trading of unique digital tokens, gauging its versatility and security.

- Earn feature: We looked into the platform’s system that lets users lock-in their cryptocurrencies, exploring the return rates and the reliability of reward payouts.

- Advanced trading interface: Our analysis covered the intricacies of the platform’s advanced trading tools, checking for user-friendliness, precision, and customization options for seasoned traders.

Regulatory compliance and safety

To cater to clients within the United States, Kraken holds a registration as a Money Services Business with FinCEN through its entity ‘Payward Ventures, Inc.’

Kraken Bank also operates under the oversight of the Wyoming Division of Banking, operating under a Special Purpose Depository Institution (SPDI) charter.

For clients in Canada, Kraken maintains its status as a Money Services Business, regulated by FINTRAC through Payward Canada, Inc. Additionally, Kraken has secured licenses to operate in the UK, Italy, APAC, and the Middle East.

Invest responsibly

It is important to remember that trading and investing inherently carries risks, and you could potentially lose money. Therefore, you should never invest more money than you can comfortably afford to lose.

Furthermore, this Kraken review does not constitute an official Kraken endorsement; it is solely for informational and entertainment purposes only. Readers should always do their own research and consider their personal goals and financial obligations when making investment decisions.

Survival of the fittest

In all, this Kraken review finds that this exchange has stood the test of time for a reason. Kraken certainly has elements it must improve upon, particularly around customer support and experience. Yet, the platform has garnered a solid reputation in the industry with an overall excellent product.

The company has also walked the walk when it comes to transparency, demonstrating a genuine commitment to compliance and responsible fund management. Consequently, Kraken has survived everything that has been thrown at it over the years and still stands tall in 2024.

Frequently asked questions

Can Kraken be trusted?

Is Kraken the safest?

Is Kraken as good as Binance?

Why not use Kraken?

What is safer than Kraken?

What is the disadvantage of Kraken?

How do I withdraw money from Kraken?

Does Kraken have any fees?

Which countries cannot use Kraken?

Can I store money in Kraken?

Can I transfer money from Kraken to my bank account?

What can I trade on Kraken?

Is Kraken regulated?

What is the minimum deposit on Kraken?

Does Kraken require KYC?

What are the withdrawal times on Kraken?

Does Kraken have a mobile app?

Does Kraken offer a demo account?

Does Kraken offer any special offers or bonuses?

Does Kraken have good customer support?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.