Ripple (XRP) had a difficult 2023. But by the end of 2024, Ripple price prediction levels significantly exceeded expectations. This comprehensive XRP price prediction covers the fundamentals, technical analysis, short-term price levels, and other elements to gauge Ripple’s possible path from 2025 till 2030 and beyond. Now the SEC has officially dropped its case, is it full steam ahead for XRP? Let’s find out.

KEY TAKEAWAYS

➨ XRP could potentially reach $320.66 in 2035, if market conditions align.

➨ While XRP faced bearish moments early in 2024, breaking key resistance levels in November triggered a bullish rally, supported by increased trading volumes, regulatory optimism, and institutional interest.

➨ After overcoming hurdles like SEC appeals and centralization critiques, XRP’s price is boosted by positive sentiment shifts, such as ETF approvals, active addresses, and long-term holder confidence — key indicators of sustained market support.

- Ripple (XRP) price prediction until the year 2035

- XRP technical analysis

- Ripple (XRP) price prediction 2024 (successful)

- Ripple (XRP) price prediction 2025 (already reached)

- Ripple (XRP) price prediction 2026

- Ripple (XRP) price prediction 2027

- Ripple (XRP) price prediction 2028

- Ripple (XRP) price prediction 2029

- Ripple (XRP) price prediction 2030

- Ripple in 2025: Hits and misses

- Fundamental factors

- Is the XRP price prediction analysis expected to hold?

- Frequently asked questions

Ripple (XRP) price prediction until the year 2035

Here is a table that captures all the possible XRP price prediction levels till 2035.

| Year | Max price of XRP (expected) | Min price of XRP (expected) |

| 2024 | $1.17 (successful) | $0.28 |

| 2025 | $2.57 (successful) — next level ➨ $4.76 | $0.94 |

| 2026 | $4.76 | $1.17 |

| 2027 | $5.98 | $1.43 |

| 2028 | $7.23 | $2.50 |

| 2029 | $12.68 | $4.70 |

| 2030 | $23.50 | $7.30 |

| 2031 | $37.03 | $11.50 |

| 2032 | $103.31 | $25.27 |

| 2033 | $120.66 | $48.67 |

| 2034 | $243.35 | $96.45 |

| 2035 | $320.66 | $122.45 |

Note: We will revise every point of this XRP price prediction discussion every year or after each milestone event to recalibrate the crucial levels.

XRP technical analysis

Before we discuss the broader price patterns, let us explore the short-term price action of XRP, identifying key resistance and support levels it needs to breach or should protect.

XRP short-term analysis (March 2025)

XRP breached two key and long-standing resistance levels on Nov. 11, 2024, $0.63 and $0.64, respectively, led by strong factors like Trump getting re-elected and 21Shares filling the S-1 form with the SEC, specific to the Core XRP Trust shares.

All of that pushed the prices above $1 rather quickly. In November 2024, XRP was trading at $1.42 and it quickly picked pace to come close to $3. But then, the prices have settled and stagnated a bit.

As of 20 Mar. 2025, the pennant pattern still holds and XRP has managed to ward off the lower trendline jitters. It has even crossed the above trendline but for the prices to pick pace, we need higher trading volumes. A push above $2.84 can take the prices all the way to $3.12, which also aligns with our December 2024 predictions.

Based on the latest analysis, XRP is currently trading at $2.44. However, the RSI has been in the neutral zone for a bit, hinting at a surge if market conditions permit. It is expected that new buyers will utilize this level to take new positions, which over the next few weeks can take XRP to as high as $3.12 and then $3.77, in the short-term.

But to track the yearly moves, let us take historical patterns into consideration.

Weekly chart analysis of XRP

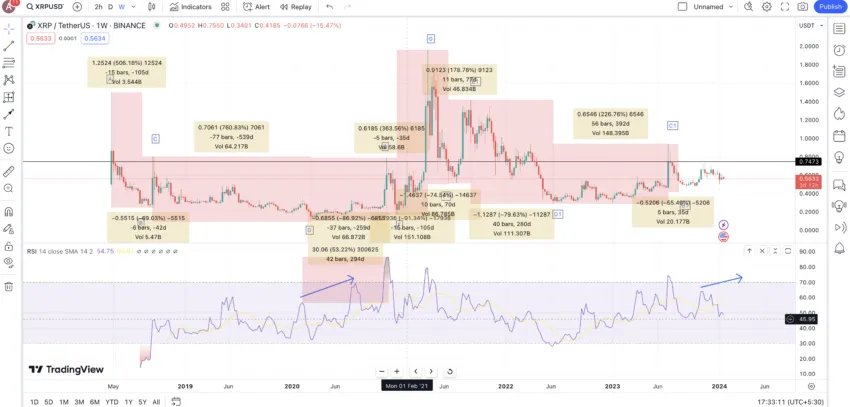

Here is the weekly chart of XRP, per Binance’s XRP/USDT pair. Notice how we have marked points through A to G and G to B1 on the left and right sides of the charts.

At first glance, the chart resembles a foldback pattern, with the left side being a rough mirror image of the right. The idea now is to find the distance between every high-to-low and low-to-high to get hold of the expected average percentages.

Note: For the sake of simplicity, we have chosen not to consider the smaller highs or lows that occur between two crucial points.

Also, as we are going from B1 to A1, we shall take the levels from G to F1, F1 to E1, and so forth. Therefore, for the left side of the chart, we take levels starting from G and going all the way to A.

Chart plotting and calculations

Let us plot the chart’s left side, starting at G and moving towards A. We shall take the percentage gain/loss and the time frame:

| G to F | -91.34% in 105 days |

| F to E | 363.56% in 35 days |

| E to D | -86.92% in 259 days |

| D to C | 760.83% in 539 days |

| C to B | -69.03% in 42 days |

| B to A | 506.18 in 105 days |

Let us now plot the right side of the chart, starting at G and going all the way to B1.

| G to F1 | –74.54% in 70 days |

| F1 to E1 | 178.78% in 77 days |

| E1 to D1 | -79.63% in 280 days |

| D1 to C1 | 226.76% in 392 days |

| C1 to B1 | -55.49% in 35 days |

Now let us find the average of all high-to-lows and low-to-highs (all the negative and all the positive moves to locate the next point or A1 on the chart)

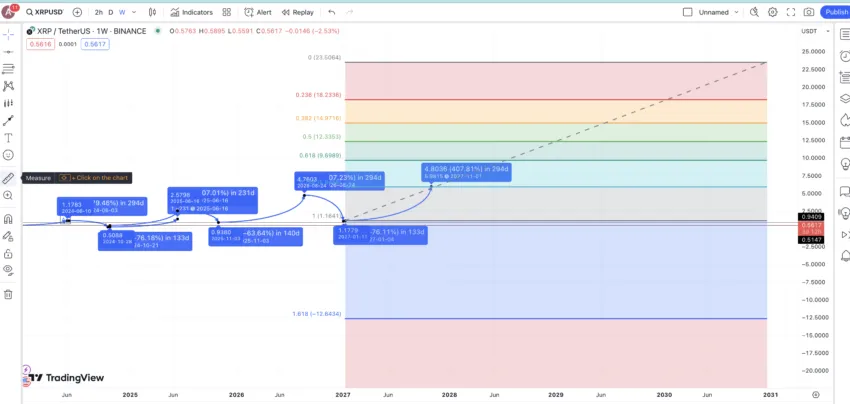

Average price hike: 407.22% and 230 days (lowest estimate would be 178.78%)

Average price drop: 76.16% and 132 days (highest drop estimate would be 91.34%)

Also, it is worth noting that the price surge on the left side of the chart, from E to G, happened when the RSI made higher highs. Therefore, while we can expect the next high or A1 to be according to the average levels, a higher high made by the RSI would be a good signal. The previous RSI hike took 294 days, which we must remember.

Ripple (XRP) price prediction 2024 (successful)

XRP managed to cross our predicted price for 2024. Here is how the analysis read, in case you want to know more about our methods:

As our calculations brought us to an average price hike level of 407.22% in 230 days, the target was as high as $2. However, considering the bearish sentiments and no XRP ETF in sight, the level went as high as the lowest estimate of 178.78%.

The expected high was anywhere between 230 and 294 days (the time taken for the left side RSI surge).

Therefore, the more conservative XRP price prediction high for 2024 was $1.17. Also, as the projected low was 76.16%.

Ripple (XRP) price prediction 2025 (already reached)

Outlook: Very bullish

It is worth mentioning that the bullish market has taken XRP past the $2.70 mark, a level that already exceeds our 2025 analysis. However, we expect some correction in the months to come, keeping the 2025 XRP price level closer to the $2.50 mark, on average.

Here is the analysis we are going with:

Provided B2 or the XRP price prediction low holds for 2024, we can extrapolate the next high in 230 days by 407.22%. Therefore, the XRP price prediction for 2025 was at $1.42. However, this level was calculated based on the 2024 high of $1.17, a level that is far out of contention.

Note that this is a conservative estimate, and the final price will depend on the low charted by XRP in 2024. If XRP respects the crucial support level of $0.504, per the short-term analysis, the 2025 high could be $2.57. This seems very likely as only a market crash can take XRP down and even with that $0.50 doesn’t look likely.

Provided XRP moves to the bull market phase by 2025, the low in 2025 could either be at $1.17, one of the earlier highs of 2024, or $0.94, the previous high made in 2023.

But then, if XRP follows the same trajectory, we can even expect the 2026 high of $4.76 to surface in 2025. In that case, the expected ROI could be close to 230%.

Projected ROI from the current level: 230%

Ripple (XRP) price prediction 2026

Outlook: Bullish

Provided the lowest XRP goes to $0.94 in 2025, the next high, in 2026, could be at $4.76, considering the level of 407.22%. Also, based on the average price drop of 76.16%, the 2026 low could be expected to surface at $1.13 to $1.17, the expected high of 2024.

From that low, the next high in 2027 could surface at $5.98.

Projected ROI from the current level: 235%

Ripple (XRP) price prediction 2027

Outlook: Very bullish

2027 marks an exciting phase for XRP, riding on the momentum built in the preceding years. Assuming the low for 2026 remains around $1.17, the potential high for 2027 could reach $5.98, based on the average price hike of 407.22%.

This growth aligns with a possible bull market cycle fueled by institutional adoption, improved global regulations, and Ripple’s advancements in payment solutions.

Projected ROI from the current level: 321%

Ripple (XRP) price prediction 2028

Outlook: Moderately bullish

In 2028, Ripple could witness steady growth, building on its 2027 high of $5.98. The projected high for 2028 stands at $7.23, supported by the 76.16% average price drop from prior highs serving as a consolidation marker.

The low for 2028 could stabilize at $2.50, reflecting investor confidence in Ripple’s long-term prospects.

Projected ROI from the current level: 410%

Ripple (XRP) price prediction 2029

Outlook: Very bullish

2029 could herald a breakout year for XRP, with the maximum price expected to hit $12.68. By this year, Ripple might achieve significant milestones, such as integrating CBDC projects and solidifying its role as a liquidity solution for banks and exchanges.

The minimum price for 2029 could rise to $4.70, reflecting continued market support and accumulation by long-term holders.

Projected ROI from the current level: 792%

Ripple (XRP) price prediction 2030

Outlook: Bullish

Now, if we use the 2026 low and 2027 high as the swing high and low or even use the 2029 data points, the expected XRP price prediction level in 2030 could surface at $23.50.

However, that would be a generous estimate, considering XRP also continues to grow fundamentally.

Projected ROI from the current level: 1554%

Ripple in 2025: Hits and misses

2024 for XRP started with some heavy offloading. Ripple unlocked one billion XRP tokens, of which 20% were moved to the spending account. But that wasn’t all. Ripple moved eighty billion of this 20% to an undisclosed wallet.

Result: Speculations regarding a market-wide sell-off from the parent firm itself. This could be another reason why, despite the buoyant market conditions, XRP continued to underperform for some time

Do note that the large transfer doesn’t indicate an actual sell-off. Besides the official token transfer, a notable XRP whale was also seen offloading close to 26 million XRP tokens. This could be disconcerting with the tokens moving to an exchange — notably Bitstamp.

Moreover, whale trackers were constantly identifying XRP exchange inflows, in early 2024.

But before that, it is appropriate to mention the “Partial Payments Exploit” hack, which external hackers attempted. The hackers aimed to exploit the Partial Payments feature associated with XRP Ledger to deceive the Bitfinex exchange into accepting a transaction that was much smaller than what it appeared to be.

Did you know? XRP Ledger’s Partial Payments feature allows the sender to specify a higher transaction amount than what is being sent. This legitimate feature allows for flexible payments and settlements, completing transactions with insufficient funds, and streamlining recurring digital payments.

As a critical feature was hacked, Ripple and XRP attracted some negative sentiment in early 2024, which negatively impacted the price action.

The ongoing legal battle with the U.S. Securities and Exchange Commission (SEC) has been a significant hurdle. In October 2024, the SEC appealed a July court ruling that had limited its oversight of cryptocurrency markets, particularly concerning XRP. This appeal introduced uncertainty, affecting investor confidence.

But in late 2024, several positives surfaced, transforming the fortunes of XRP investors and ensuring the crypto moved rather quickly above the $2.50 mark.

Good things for XRP

Despite earlier setbacks, XRP experienced a remarkable surge, surpassing $1.50 in November 2024 and over $2.70 by early December 2024. This rally is attributed to several factors:

- Regulatory optimism: The announcement of SEC Chair Gary Gensler’s resignation, effective Jan. 20, 2025, has fueled expectations of a more crypto-friendly regulatory environment.

- Institutional Interest: The filing of an XRP Exchange-Traded Product (ETP) by WisdomTree in Europe has attracted institutional investors, enhancing XRP’s credibility and accessibility.

- Technical breakout: XRP’s price broke above key resistance levels in March 2025, triggering bullish momentum and attracting traders seeking potential gains.

Let us dig deeper into this with fundamental analysis.

Fundamental factors

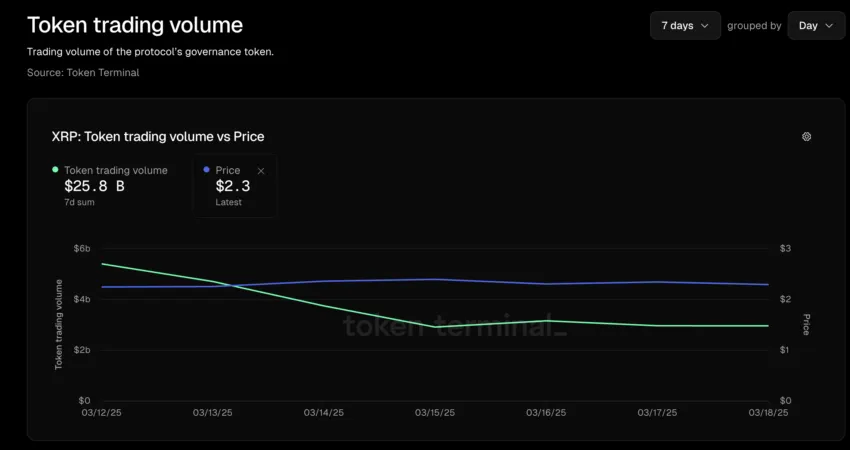

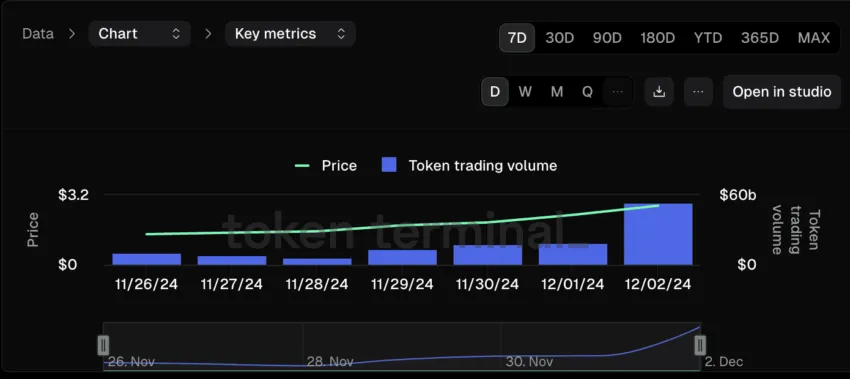

Trading volume from late November 2024 was much higher than the early 2024, hinting at the positive sentiments.

As of March 2025, the token trading volume has picked up pace and the prices have managed to follow, hinting at optimism.

But things went berserk for XRP post-November 2024. The 7-day trading volume chart reveals that the November 2024 momentum has been bettered. In case the trading volume dips, you might want to brace for some correction. As of now, signs are bullish.

Moreover, the 90-day active addresses chart showed an activity peak in late November 2024. This saw prices moving higher with it. The same trend is now visible, as of March 2025.

Did you know? A steep decline in the 365-day mean coin age of a coin (as seen in December 2023 with XRP) means that long-term holders plan to offload their assets. This could indicate a possible sell pressure in the short term.

Is the XRP price prediction analysis expected to hold?

This XRP price prediction model follows the latest ecosystem developments. The technical analysis and charts are recorded at the onset of an upcoming bull market and after the market has shrugged off the Bitcoin ETF bias. This makes this data-powered XRP price prediction as accurate as possible. Of course, nothing is certain, and we would suggest a quintessential DYOR approach to find the right entry and exit levels for you should you look to buy XRP.

Disclaimer: The information provided in this XRP price prediction is for informational purposes only and should not be considered financial advice. All projected levels and ROI calculations are speculative, based on historical trends, and subject to change due to market conditions, regulatory developments, and other unforeseen factors. Cryptocurrency investments are inherently risky, and you should conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions. Always invest responsibly and within your risk tolerance.

Frequently asked questions

Ripple (XRP) was always supposed to be a payments-focussed cryptocurrency. It came into existence in 2012, with a pre-mined supply of 100 billion. XRP’s foremost use-case is to facilitate low-cost money transfers across borders.

Ripple has foundational differences with other cryptocurrencies. Firstly, unlike Ethereum, it isn’t exactly general purpose and more of a payment facilitator. It also differs from the likes of Bitcoin as there is no proof-of-work (PoW) support but a novel consensus algorithm in Ripple Protocol Consensus Algorithm. Finally, Ripple’s target audience is mostly the financial institutions and not standard developers.

Even though the company — Ripple Labs (now Ripple) — claims XRP to be decentralized, there might be a bit more to this. XRP’s consensus focuses on UNLs or the Unique Node Lists, which translate to lists released by the centralized parties. Also, Ripple, the company behind XRP holds a massive chunk of the tokens, which were recently moved to a spending address, raising concerns. Therefore, Ripple might not be completely decentralized but adheres to the ethos of the concept.

The future price of Ripple (XRP) could be influenced by several key factors, including regulatory developments surrounding Ripple Labs and the broader cryptocurrency market, partnerships with financial institutions, technological advancements within the Ripple network, and overall market sentiment towards cryptocurrencies.

Thanks to its fast settlement times and low transaction costs, Ripple’s utilization in cross-border transactions positions it as a valuable tool for financial institutions and payment providers. As Ripple continues to secure partnerships with banks and expands its network, the increased adoption and utility of XRP for these transactions could positively impact its price by driving demand.

While there’s no reason XRP could not reach $1000 at some stage far in the future, this is an exceptionally long-term prediction. BeInCrypto’s technical and fundamental analysis-backed price prediction puts the maximum possible price of XRP in 2035 at $320.66.

Our price prediction puts XRP’s possible high in 2025 at $4.76 and the possible low at $0.94. While these price predictions are backed by extensive technical and fundamental analysis, it’s likely that XRP’s 2025 high will be somewhere in between these levels.

XRP does have the potential to replace SWIFT. In 2025, ISO 20022 is set to replace the current SWIFT messaging system, meaning all financial institutions will need to adapt. XRP is well-placed to replace SWIFT as the leading crypto compatible with ISO 20022. Do note, however, that there are no guarantees of institutional adoption of crypto on this wide scale at this stage.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.