The price of Ripple’s XRP moved above an important long-term resistance area but failed to reach a close above it, creating a very long upper wick instead.

Due to the rejection and ensuing decrease, the XRP price has likely begun a new upward movement. Both RSI readings and the wave count support this possibility.

More From BeInCrypto: 9 Best AI Crypto Trading Bots to Maximize Your Profits

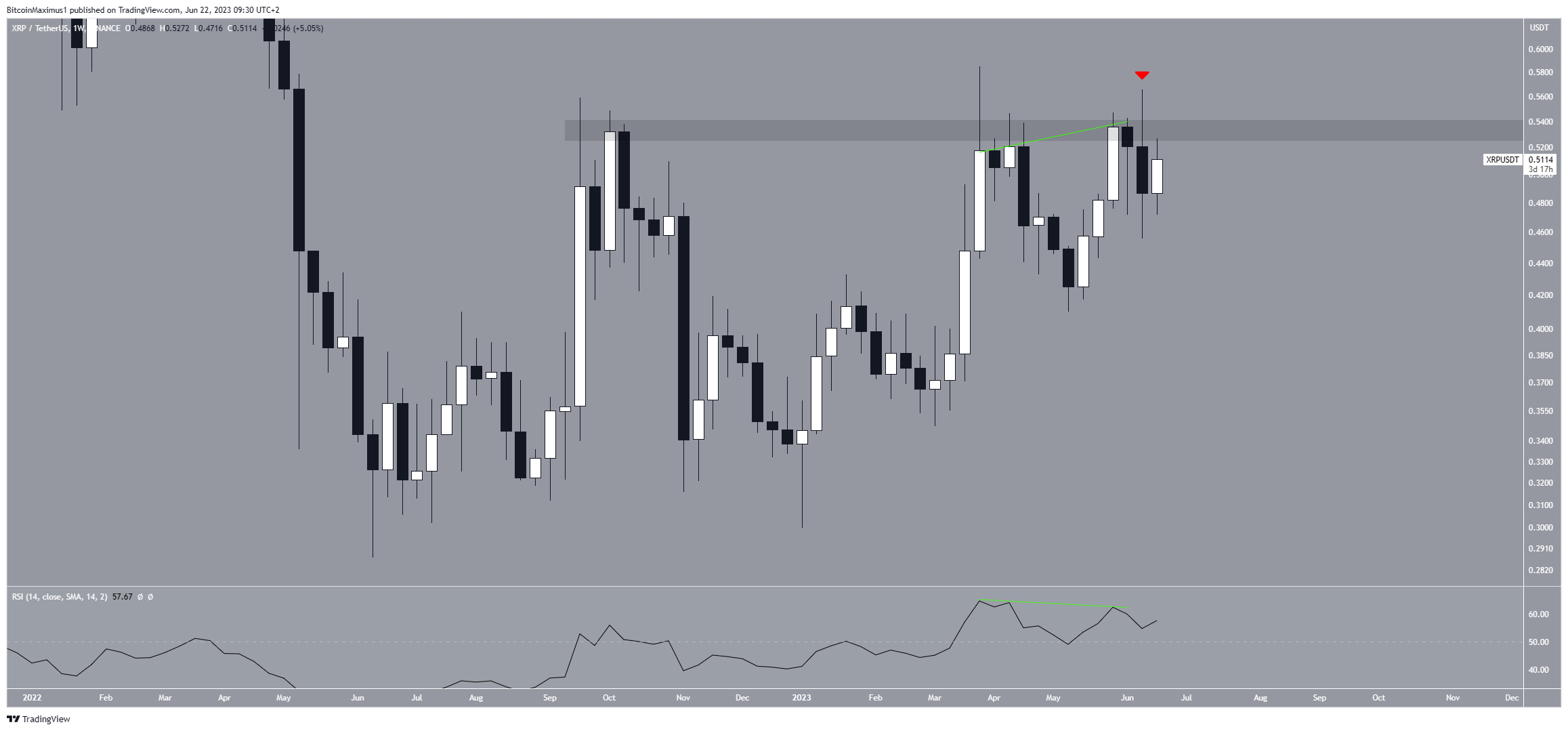

Ripple Price Struggles at Long-Term Resistance

The price of XRP has made three attempts at moving above the long-term $0.53 resistance area since the beginning of September 2022. However, all three have been unsuccessful. More recently, XRP was rejected last week, creating a long upper wick and bearish candlestick (red icon).

The long upper wick is considered a sign of selling pressure, as is the ensuing candlestick, which negated most of the increase in May.

The Relative Strength Index (RSI) indicator suggests a downward movement is on the cards. By using the RSI as a momentum indicator, traders can determine whether a market is overbought or oversold and decide whether to accumulate or sell an asset.

Bulls have an advantage if the RSI reading is above 50 and the trend is upward. But, if the reading is below 50, the opposite is true. Even though the indicator is above 50, it falls, a sign of weakness. More importantly, the RSI has generated a bearish divergence.

This is a sign of weakness and often precedes downward movements. The fact that the bearish divergence transpires inside an important resistance area and is combined with a bearish candlestick supports the possibility that a bearish trend reversal is nearby.

Read More: Top 11 Crypto Communities To Join in 2023

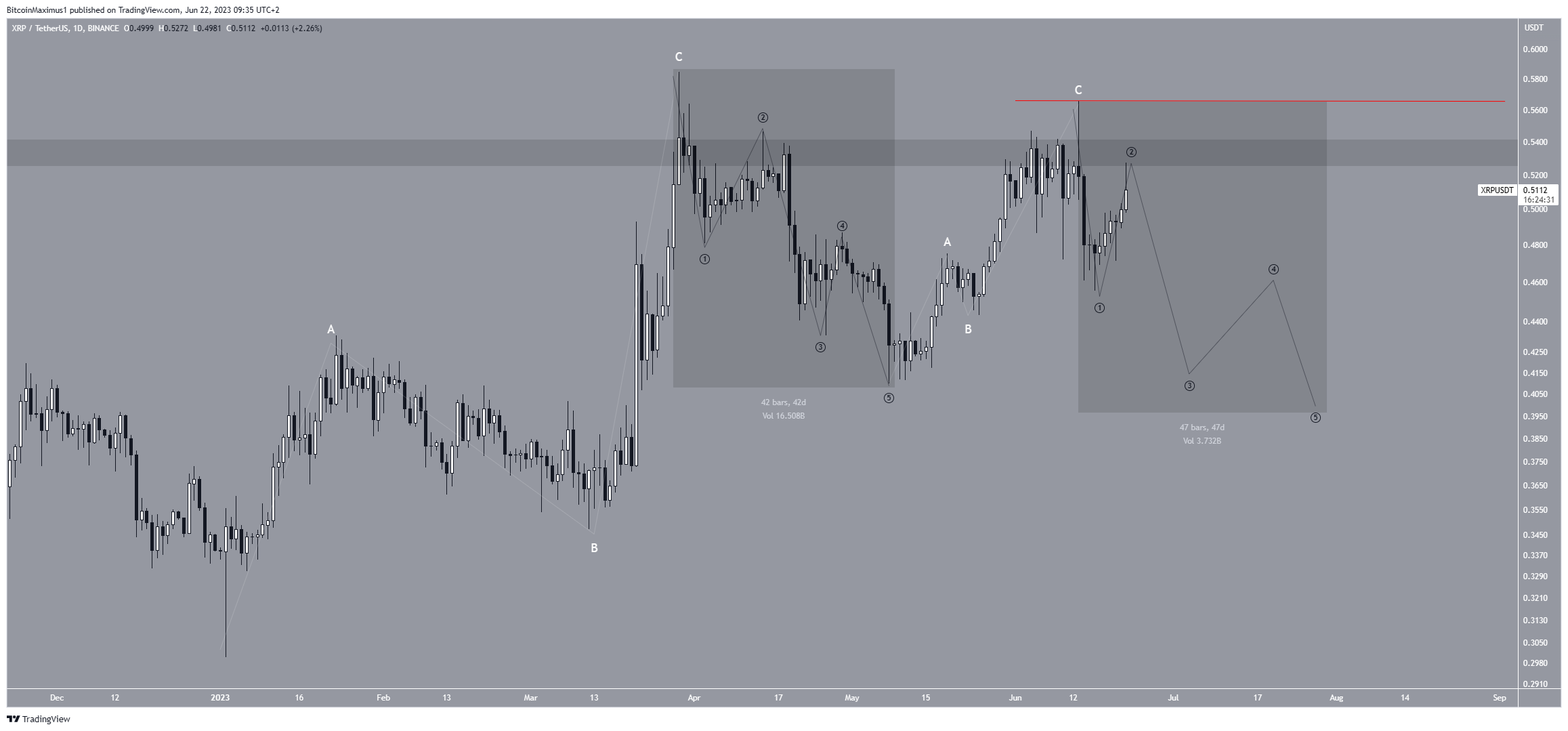

XRP Price Prediction: Wave Count Supports Descent

Based on a technical analysis of the daily time frame, the XRP price has reached its local top and will continue decreasing in June/July. The wave count is the main justification for this bearish XRP price prediction.

Technical analysts employ the Elliott Wave theory to determine the direction of trends by examining recurring long-term price patterns and investor psychology.

This year’s main characteristic of the XRP price movement is that the increases are three-wave structures. Hence, they are likely A-B-C corrections (white).

Subsequently, the decrease in April-May is a five-wave drop (black, highlighted). Thus, if the wave count is correct, the XRP price has now begun another five-wave decrease. In turn, the most likely area for the next low is at the $0.40 region.

Despite this bearish XRP price prediction, an increase above the June high of $0.56 will mean the trend is still bullish.

The XRP price could increase to the next resistance at $0.90 in that case.

For BeInCrypto’s latest crypto market analysis, click here